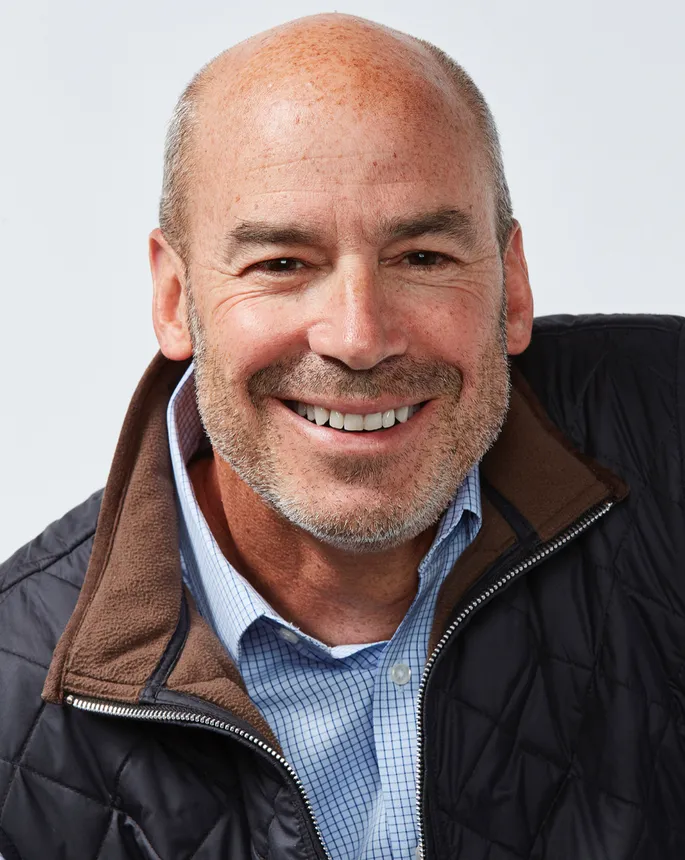

For Destination XL CEO Harvey Kanter, too much inventory is “the kiss of death.”

That fear comes from Kanter’s experience on the merchandising side of the retail industry. “You’re chasing your tail when you get over-inventoried and you can’t bring in fresh receipts,” he told Supply Chain Dive in a late-April interview. “Fresh goods are the lifeblood of retail.”

Plenty of retailers might agree, in principle, especially after the inventory flood of 2022. But executing isn’t always easy. In the minds of many, inventory is not seen as a cost or a drag but as a future sale.

Destination XL ended fiscal 2022 with its inventories at $93 million, up 13.7% over the past year. While in the double digits, that growth was substantially lower than the apparel sector on the whole. A Telsey Advisory Group analysis found inventory growth at 53.8% at the end of Q4 for the companies they covered in the apparel sector.

DXL noted that levels were up over the inventory-strained year of 2021, and by the end of 2022 inventory was 9.2% lower than the pre-pandemic year of 2019. Inventory turnover has increased 30% in that time.

To do that, DXL looks at inventory from across the supply chain, from the source to the store. “Every store in every market has some unique peculiarity,” Kanter said. “It may be a brand that sells better, it may be a size they sell better, it may be a color they sell better.”

Kanter said that DXL has “put in place the best AI, [machine learning] and inventory management practice that allows us to most efficiently create unique, relevant sorting in our stores.”

Chasing inventory

The effort to keep inventory under control starts with procurement and purchasing. “We have a philosophical point of view where we'd rather be chasing goods than chasing cancellations,” Kanter said.

In other words, DXL errs on the side of buying too little to stock its stores. Getting the numbers right is even more important, given how many different sizes the retailer stocks. CFO Peter Stratton said that DXL has a low unit-to-SKU count compared to other apparel retailers.

“They might be four or five units deep per size but, because we have two, three, four times the number of sizes, it's a lot fewer units that are in that stack of shirts on the on the shelf,” Stratton said. “Because our business is all about fit.”

Compared to pre-pandemic, “we are turning goods faster, we have less inventory, and we have not experienced some of the challenges that other retailers are which is they're really heavy on inventory and being promotional to get inventories back in line,” Kanter said.

To be more nimble about chasing inventory when the company needs it, DXL’s sourcing team lays the groundwork upstream.

The company procures materials in a pre-finished state and materials that are dyed but uncut. Even if the materials aren’t used the way DXL originally intended, they can still be made into other products for the company, meaning the supplier isn’t stuck with unpurchased finished products. Kanter says this reduces risk for both the company and its suppliers.

“We don’t have a lot of on-order in the warehouse. We don’t even necessarily have a lot of on-order with suppliers,” he said. “Because of all of the elements of procuring some part of the production process, they can produce much quicker.”

And while most of DXL’s come in on a boat, the company opts to send by air if it needs inventory shipped quickly.

Looking west to source apparel

Also helping to speed up shipping times is DXL’s increased sourcing from the Western hemisphere.

Some production programs have been moved to Western countries including Mexico and Nicaragua, according to the company’s most recent 10-K. Kanter couldn’t disclose exact figures but said Western hemisphere sourcing was in the double digits as a proportion of the total. The company is also eyeing possible sourcing opportunities in Guatemala and Peru, Kanter noted.

When deciding where to source, “quality trumps everything,” Kanter said. “But then it’s a balancing act between speed-to-market and cost.”

A significant chunk of sourcing comes from southeast Asian countries including Vietnam, Bangladesh, Cambodia and India. Less than 10% of products for DXL’s owned brands are sourced from China, a reduction process that has been ongoing over recent years.

“We’re basically not in China anymore,” Kanter said, pointing to the forced labor of the Uyghur people in the Xinjiang region as the primary risk prompting DXL to avoid in sourcing from the country.

Being specialists in big-and-tall apparel for men, DXL typically relies on specialized suppliers. In the clothing factories that make its products, equipment and production runs often are unique to the category given the complexity of the sizing and manufacturing. Even cutting tables need to be twice as large for shirts that are twice as large as standard sizes.

In all, DXL sourcing network includes just over 20 suppliers, in eight countries, with about 34 factories among them, and DXL sources a majority of its products directly.

“We have a pretty finite supplier base,” Kanter said. “It’s not like we have 100 [suppliers].” Ultimately that means deeper relationships with manufacturers, who, in Kanter’s view, benefit from the retailer’s growing market share and expertise in the big-and-tall sector.

“Where our suppliers can see through the day-to-day and look at the future, they're making a bet on us.” Kanter said.