Dive Brief:

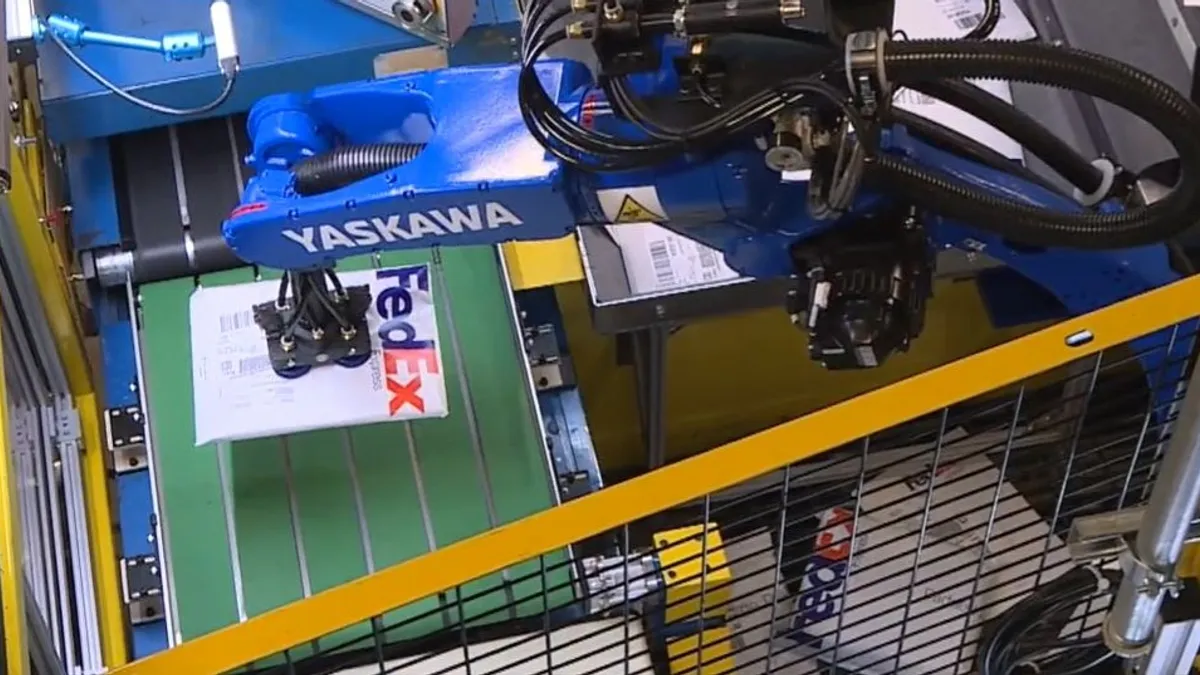

- FedEx expects that much of the e-commerce volume growth it has seen in the last six months will continue. So, the carrier said it will invest in small, automated, regional sortation facilities with the capacity to sort roughly 12,000 to 15,000 packages per hour. "They tend to be inbound only so that we can process direct loaded volume from large retailers," said Henry Maier, CEO of FedEx Ground, on a Thursday earnings call.

- The build-out of smaller, last-mile sort centers is intended to bolster overnight service within FedEx Ground and act as a "relief valve for spillover sortation at peak," Maier said.

- FedEx reported $20.6 billion in revenue for the quarter ending Nov. 30 — up 19% YoY. Chief Marketing and Communications Officer Brie Carere repeated that peak surcharges are "the new normal," and executives touted them as playing a "critical role in our revenue quality strategy."

Dive Insight:

Executives celebrated the carrier's performance in peak 2020.

"All the things I talked about in terms of investments, resources, capacity are all really driving one of the best peak seasons we've ever had, in spite of [COVID-19] and all the other challenges we’ve had in this business," Maier said.

FedEx published an open-ended surcharge on SmartPost packages Wednesday, leading some parcel experts to say the carrier was acting opportunistically in continuing to levy surcharges. But Carere said Thursday that the carrier is protecting small shippers from surcharges, as she has on past calls.

Multiple small parcel shippers and consultants have told Supply Chain Dive that they would disagree. They reported canceled pickups and denied drop-offs at hubs due to overcapacity, as carriers pick and choose the volume they want to move.

"No sense in reverting back if shippers are going to pay it," Matt Hertz, co-founder of e-commerce consultancy Second Marathon, said of surcharges. "The power of a duopoly, unfortunately, comes at the expense of small business."

Since FedEx began to insource its SmartPost service last year, the Ground network has benefited but has also been stressed. SmartPost adds delivery density to a now 7-day-per-week network, but FedEx's average daily volume was up more than 60% from Oct.15 to Nov. 30, according to Carere.

To spread out the volume, the carrier has been encouraging shippers to use weekend capacity, which Carere put in more dramatic terms.

"The incentive is, you use the weekend or you lose the capacity. And that has worked," Carere said, revealing a theme of peak season 2020, repeated by many shippers, of carriers pulling previously agreed upon capacity.

Several analysts on Thursday's call pointed out FedEx's Ground margins, still under 10% despite some increase in the last quarter, suggesting that margin improvement is a focus going forward. Technology that improves efficiency is part of that, executives said, but pricing is another.

Increased collaboration between its traditionally disparate lines of business could help too — moving more Express packages through the Ground network and FedEx Ground volume through the FedEx Freight network. But analysts are not convinced.

"Ground results were much weaker than expected," wrote Morgan Stanley analysts in a Friday research note. "It is hard to determine how much longer the sun will continue to shine on FDX but it is clear that at some point, it will set," they continued, referring to the fleeting boost to profitability in recent quarters.

To maintain profitability, the carrier can keep ahold of costs — a tough order in this environment — or continue to levy pricing power in a tight market. "Key areas of concern for investors should be around FedEx's ability to sustain recent pricing increases throughout 2021," said Third Bridge Analyst Patrick Donnelly via email.