Dive Brief:

- The U.S. manufacturing sector continued its recovery, climbing from a 52.6% PMI reading in June to 54.2% in July, according to the Institute for Supply Management (ISM). A PMI reading above 50% indicates growth; below 50% indicates decline.

- June's PMI report included concerns about a potential decline in July, due to increasing coronavirus cases. However, more employees started returning to work, and consumer demand grew throughout the month, contributing to a healthy reading, said Timothy R. Fiore, chair of ISM's Manufacturing Business Survey Committee.

- Fiore said he expects continued growth in August but at a slightly lower rate of 53%. "It's an indication we're coming out of recession," he said, citing two months of recovery.

Dive Insight:

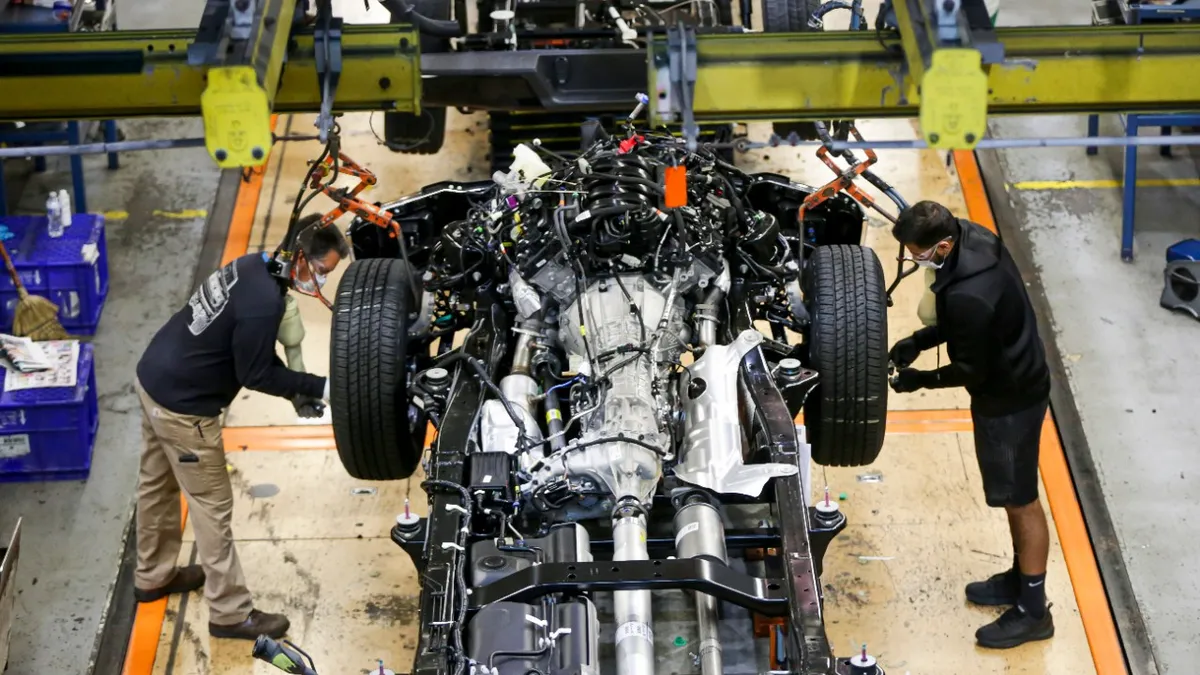

As U.S. manufacturers grapple with the "new normal," or the "pre-new normal," phase of their business during the pandemic, there are remaining issues to work through that vary significantly in severity from industry to industry, according to Fiore.

Right-sizing manufacturing workforces was a priority across the board in July, as firms coped with shifting consumer demand during the pandemic, he said. "Almost a third of the comments in my employment section were about hiring, and a third were around firing ... another 25% was around managing the workforce through attrition and no-hire policies," he said.

Cutting labor costs as production lags behind pre-pandemic levels is one way firms are working to stay afloat. And some are shifting additional cash into investments in robotics and efficiency-enhancing technologies to allow for better social distancing and/or relieve workers of more menial tasks moving forward.

Industry factors are also at play when it comes to which firms are hiring and which are laying off workers.

Computer electronics expanded hiring, Fiore said, but chemicals (which includes some pharmaceuticals), aerospace and transportation contracted. "I don't see aerospace coming back for a long time," he said as passenger flights remain significantly below 2019 and early 2020 levels.

On the other hand, the food and beverage industry continues to lead the 18 industries ISM tracks during the pandemic, though it has had to navigate worker safety, demand shifts, transportation bottlenecks and SKU cuts.

Supplier issues such as delayed deliveries and maintaining inventory levels remain challenging, Fiore said, particularly going into an uncertain peak season. However, he saw forward-looking optimism about business conditions from most of ISM's survey participants.

"Demand and consumption continued to drive expansion growth, with inputs remaining at parity with supply and demand," he said. Thirteen of the 18 industries ISM covers showed growth in July.