After years of relentless expansion, Amazon’s fulfillment network has encountered a series of stumbling blocks in 2022. Overstaffed warehouses. Higher transportation costs. A glut of capacity.

Turbulence has now hit the e-commerce giant’s facility buildout for Amazon Air, which focuses on moving inventory by airplane among its parent company’s sprawling network of warehouses. Plans for an Amazon Air hub at the Newark Liberty International Airport have dissipated, the Port Authority of New York and New Jersey announced last week.

The authority entered into negotiations with Amazon in August 2021 for a 20-year lease to redevelop and expand air cargo facilities at the Newark, New Jersey, airport. The project would have created an Amazon-run air cargo campus and more than 1,000 jobs, but it came under fire from elected officials and local activists over issues such as workplace safety and environmental impact.

“Unfortunately, the Port Authority and Amazon have been unable to reach an agreement on final lease terms and mutually concluded that further negotiations will not resolve the outstanding issues,” said Huntley Lawrence, COO of the port authority, in a statement. “The growth of air cargo and the redevelopment of airport facilities in a manner that benefits the region as well as the local community remain a top priority of the Port Authority.”

Despite the outcome, Amazon looks forward to continued investment in New Jersey, spokesperson Maria Boschetti said in an emailed statement. The situation exemplifies the crossroads Amazon finds itself at: The company needs to invest to accelerate fulfillment times, while also trimming the fat from its pandemic buildout.

Why Amazon sought to build a hub in Newark

In terms of facilities, Amazon has pivoted its Air network facility buildout in recent years from hubs well outside large cities to airports in densely populated areas, Joseph Schwieterman, director of the Chaddick Institute for Metropolitan Development at DePaul University, said in an interview.

“[Newark is] almost ideally located because it’s near container yards, it’s so close to downtown New York, it actually is surrounded by areas that are zoned for industrial,” Schwieterman said. “There’s a lot of potential there for Amazon.”

While the Newark hub plan has been shelved, Amazon can continue to lean on the multiple gateways it has in the New York area, including John F. Kennedy International Airport. But none of those have the upside of an air cargo facility at Newark, Schwieterman added.

The lack of a Newark hub limits the company’s ability to move inventory to major northeast markets faster — making the ramp-up of its one-day delivery service for Prime members a trickier endeavor. It also hinders Amazon’s push to build the transportation infrastructure necessary to directly compete with UPS and FedEx, Dean Maciuba, managing partner USA at Crossroads Parcel Consulting, wrote on LinkedIn.

“The proposed regional hub at Newark’s Liberty airport was key to Amazon’s ability to efficiently serve the metro NYC/NJ markets with domestic express overnight delivery services,” Maciuba said.

But some Newark community members wanted the company to steer clear of the airport. Chloe Desir, environmental justice organizer at the Newark-based Ironbound Community Corporation, said in a statement that Amazon is unwilling “to comply with basic standards of safe, well paying jobs without added pollution or injury rates set by the community.” A state senator, Joe Cryan, said he was “thankful to the Port Authority of NY/NJ for siding with the workers.”

It’s not the first time Amazon has seen resistance for an Air-related project.

Amazon Air’s planned expansion in Lakeland, Florida, has been met with pushback from noise pollution-wary residents after the local airport experienced a surge in cargo activity. Lakeland Linder International, at which Amazon established an air cargo complex in July 2020, saw landed cargo weight grow 263% from 2020 to 2021, according to preliminary Federal Aviation Administration data.

Amazon Air’s San Bernardino, California, airport expansion has also encountered legal resistance from state Attorney General Rob Bonta, who cited pollution concerns in his request in January for the Ninth Circuit to review its ruling that allowed the project to move forward.

“The brand is golden, yet the dominance and arrogance of the online retail giant continues to drive challenges from special interest groups across America,” Maciuba wrote of Amazon.

Despite setback, Amazon Air slated to continue its expansion

The cancellation of the Newark cargo hub negotiations adds to a rocky 2022 for Amazon’s fulfillment network. The company has delayed or canceled plans for at least 13 warehouses as it grapples with excess fulfillment and transportation capacity, which contributed to $6 billion in added Q1 costs.

Smarter inventory positioning will be critical for Amazon to minimize fulfillment costs as it expands one-day delivery offerings for Prime members. That would allow Amazon to reduce the amount of freight it’s forced to fly, a transport mode which comes with a higher price tag, Jason Murray, Shipium co-founder and CEO and a former vice president of supply chain and retail services at Amazon, said in an interview earlier this year.

“Where costs go up is when you’re wrong [on inventory placement] and you have to fly stuff — that’s what drives your costs up,” said Murray. “If you get it right 80% of the time, it’s going to cost you this certain amount. And if you get it right 81% of the time, it’s going to significantly reduce your cost structure.”

It’s one reason Amazon Air is set to keep playing a prominent role in its parent company’s supply chain.

Amazon's flight activity more than doubled in less than two years

When Amazon is caught flat-footed by an order for an item not sitting in a nearby warehouse, Amazon Air can bring the goods in quickly without needing to use an outside air cargo carrier, another added expense. That reduces the financial sting in instances when the company “misses” on inventory placement, said Murray.

Amazon Air’s network has steadily grown to fulfill this critical need. The subsidiary expanded its fleet from 73 planes in late August 2021 to 88 planes in mid-March, according to a March brief from the Chaddick Institute. It also increased its flight activity and grew its airport network to be within 100 miles of 73% of the U.S. population.

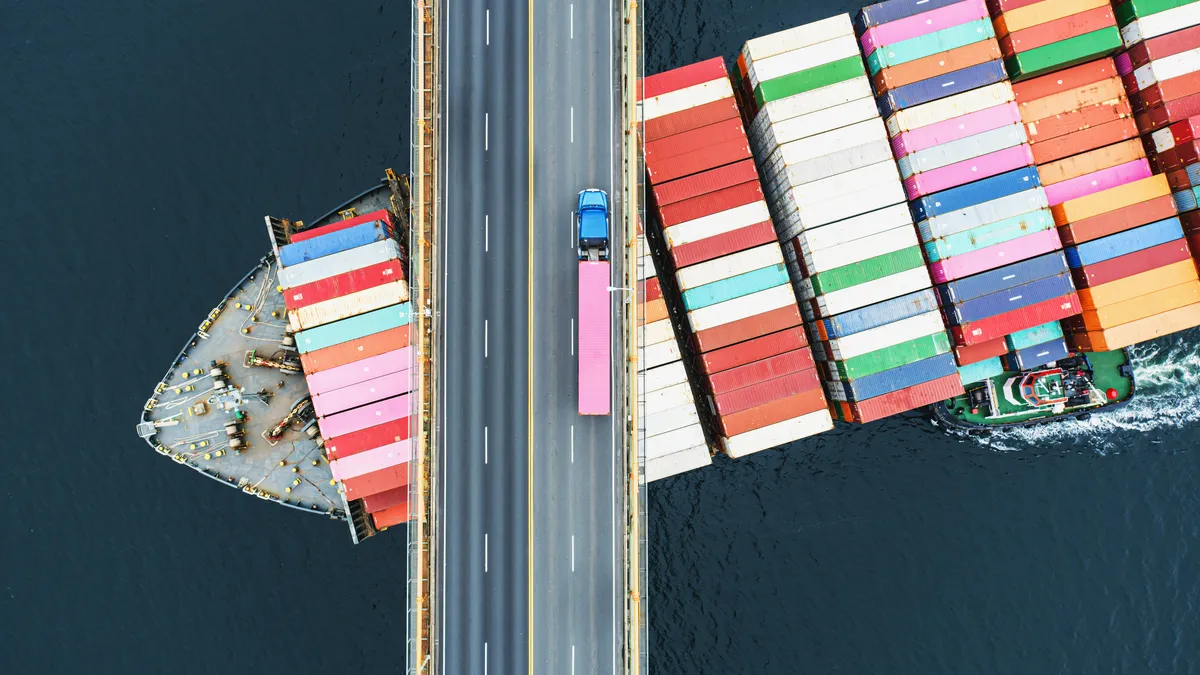

And going forward, Amazon may lean more on its air cargo operations to keep its international supply chain running smoothly in a time of frequent ocean congestion, according to the Chaddick Institute’s report.

“We believe the airline will move slowly into transoceanic flying over the next two years, likely with a dozen or fewer planes, but the longer term could bring a much more robust expansion,” the report said.

Additionally, there are U.S. regions still ripe for Amazon Air service expansion as the company looks to fulfill customers’ speedy delivery expectations countrywide — introducing new projects and potential opposition in more cities.

“There’s still some big holes in the network, particularly in the mountain states and northern Great Plains where the population is thin,” Schwieterman said.

Editor's note: This story was first published in our Logistics Weekly newsletter. Sign up here.