Dive Brief:

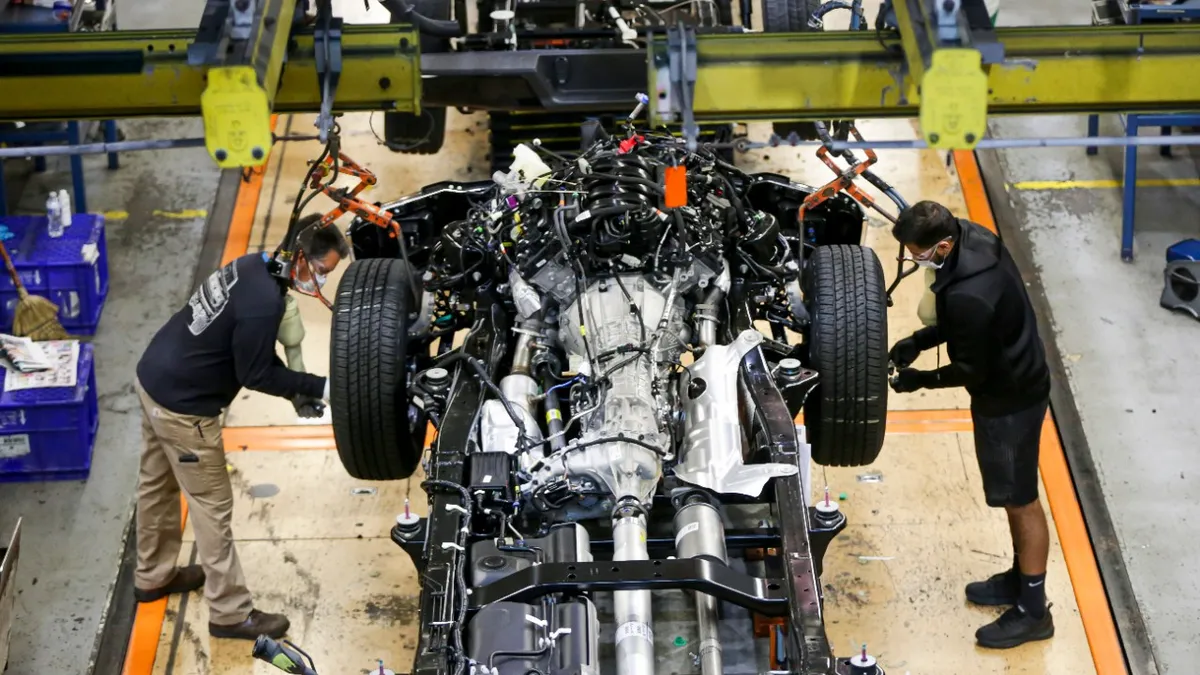

- Automotive suppliers have reopened and are prepared to meet demand that is expected to "improve sharply through 2021," according to a research note from Moody's, which changed its outlook for the industry to stable from negative.

- The automotive suppliers have "proved fairly resilient, aided by aggressive cost-reduction and restructuring moves, leaner inventory levels, and cash-preservation strategies," the note reads. "Instead of encountering major issues, production restarts were largely smooth, and disruptions in the supply chain were no worse than expected."

- One challenge for the industry will be matching production output with the consumer demand and current inventory in dealership networks, the note said.

Dive Insight:

Moody's expected the restart of the automotive supply chain to be bumpy.

A continuous, lean supply chain is the hallmark of the automotive industry. Turning off production, as the industry did in late March, was seen as a blow to the its cherished efficiency. But as production resumed, analysts saw efficiency rising, Moody's said.

The latest Automotive Supplier Barometer Index from the Original Equipment Suppliers Association showed a positive reading of 53 for Q3, just above the neutral reading of 50. The index was at 15 for Q2. But OESA's survey showed optimism is not evenly spread, with 47% saying they have an improved outlook for the industry and 36% saying their expectations worsened.

One issue for suppliers is knowing the number of people required to build cars, given the uncertainty of demand in the car market. As a result, automotive suppliers are seeing more pressure to automate operations, according to an analysis of OESA's Index by the consulting firm RSM. More automation means companies can scale production up and down with less change to labor cost, RSM said.

Automotive suppliers have highlighted cost-cutting measures in recent earnings calls, saying the moves were necessary in the face of production stoppages.

Goodyear's Q2 cuts included a reduction in $65 million worth of salaried employees, according to slides presented this month at the Morgan Stanley Virtual 8th Annual Laguna Conference.

"Despite the unanticipated severe drop in production volumes, [American Axle and Manufacturing] performed well in the first half of the year, and made the necessary adjustments to the business to reduce costs, and conserve cash," American Axle and Manufacturing CEO David Dauch said on the company's earning's call in July.

The financial impact of shutting down and the decreased demand due to the pandemic hit American Axle and Manufacturing to the tune of $947 million in Q2. The firm is working directly with the OEMs as they roll out production schedules, Dauch said.

"Right now, from an overall standpoint, we have got very few supplier issues," he said. "We definitely have a couple that we are managing, but nothing that we see jeopardizing production."

Michelin CEO Florent Menegaux said his company had a leg up when it came to getting U.S. production running again, because it also had facilities in China that went through the process earlier. Menegaux later added that properly managing production levels is one of the most important considerations for the business right now.

"You certainly noticed that our inventory level at end of June has been very low," he told analysts in July. "We have been very, very clear with all our teams that in this type of crisis, cash was king. And therefore, we have tightly managed our production level to make sure that we would not take any risk."