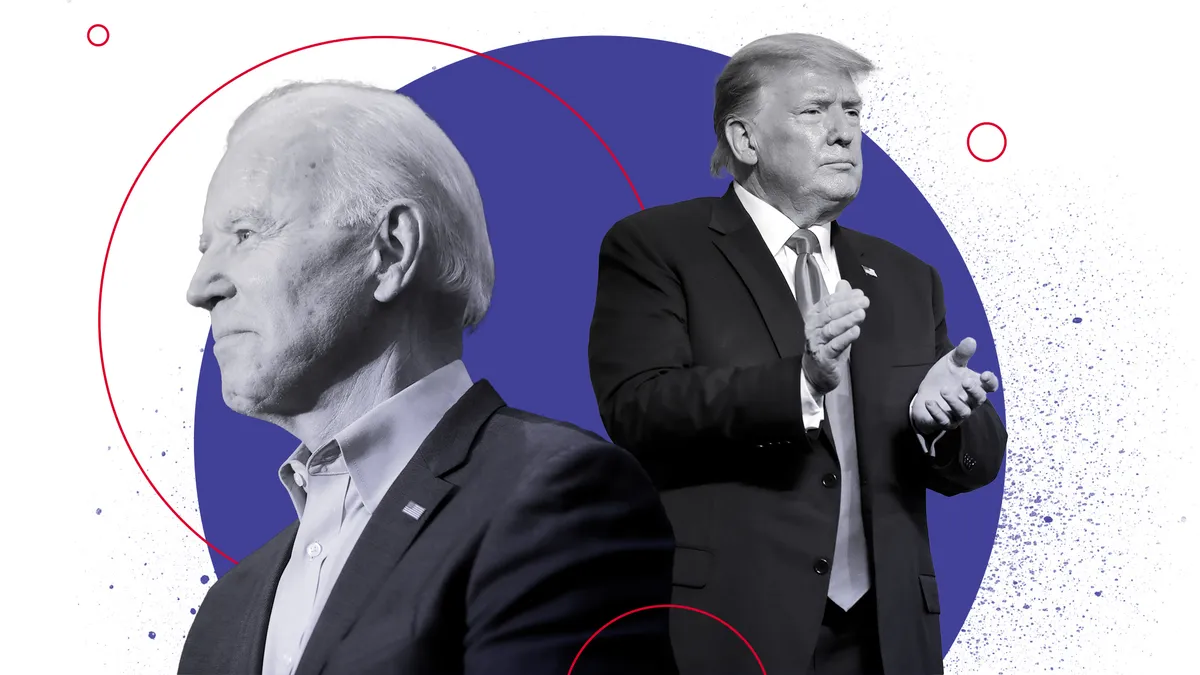

The 2020 presidential election is in the home stretch, but supply chain topics have barely graced the debate stage this cycle.

The subject of trade came up for mere seconds between the two town hall events Thursday night. The topic came up for a few moments in the first debate between President Donald Trump and former Vice President and Democratic candidate for president Joe Biden and another minute or two during the vice presidential debate a few weeks later.

Off the debate stage, the candidates have priorities within their platforms that affect supply chains. And the short story is the candidates are headed in similar directions.

"I certainly think that the rhetoric that's used is different, but I'm not sure that there's a substantial difference," said Simon Croom, professor of supply chain management at the University of San Diego. "Subtle differences, I think — really about execution and operationalization."

Reshoring and domestic sourcing

Trump and Biden want more manufacturing in the U.S., especially for medical supplies.

Trump

Trump has repeatedly called for businesses to bring manufacturing back to the U.S. while also claiming this phenomenon, known as reshoring, is already happening.

Trump has said his 2017 tax cuts stoked investment in American manufacturing. He has signed executive orders related to reshoring supply chains for minerals, reshoring of defense-related supply chains and strengthening the standards by which the federal government considers an item U.S.-made.

In August, the president issued an executive order instructing the federal government to buy and give preference to drugs and medical supplies made in the U.S. Trump's administration also loaned Eastman Kodak $765 million under the Defense Production Act to begin making vaccine components.

Biden

Biden plans to redirect $400 billion in federal procurement toward U.S.-made goods and tighten the requirements for a Made in America label on goods. His plan includes a tax-code overhaul to encourage the pharmaceutical industry to manufacture in the U.S. and plans to remove provisions that encourage outsourcing in any category.

Biden also pledged to make credit facilities available for Americans setting up manufacturing businesses, with a "clawback" provision where the government can reclaim investment or tax incentives from companies that move manufacturing jobs overseas.

How they compare

Trump's preferred method of encouraging reshoring has been through his tax cuts and executive orders — the follow-through has been mixed.

Biden's plan to turn his domestic manufacturing intentions into action would make for a different experience for supply chains.

"Pharmaceutical offshoring has been heavily driven by tax code provisions that have encouraged companies to locate pharmaceutical production in low-tax countries even where those countries have labor and other costs comparable to the U.S.," reads Biden's plan.

Changing the tax code could present opportunities for manufacturers, according to Tray Anderson, logistics and industrial lead for the Americas at Cushman & Wakefield.

"It's a game-changer because what you're doing is you're now getting the possibility of federal incentives into the decisions that people make," Anderson said. That tactic hasn't been on the table in decades — possibly as far back as World War II, he said.

The supply chain plan Biden released in July names only the pharmaceutical industry as the recipient of tax-based reshoring incentives. But Biden released another plan in September pledging similar incentives across categories — with an emphasis on revitalizing closed factories.

He also intends to use federal procurement dollars to encourage domestic manufacturing across categories by buying from American manufacturers.

"The big gap is really how do you develop domestic suppliers? What are the incentives?"

Simon Croom

Professor of supply chain management at the University of San Diego

Trump has also pledged that the federal government will "Buy American," especially when it comes to pharmaceuticals, but industry stakeholders warned in March that to do so during a pandemic could be risky.

"I've seen executive orders saying we need to make sure that medical supplies are made in the U.S. now. The big gap is really how do you develop domestic suppliers? What are the incentives?" Croom said.

Companies need financing to recruit new expertise, buy equipment and enter a new line of business. Neither plan addresses how new American manufacturers will be competitive on a global scale without the lower costs of operating elsewhere, according to Croom.

A recent PwC survey found that operations leaders in the C-suite expect manufacturing locations to diversify over the next three to five years with either administration, driven by the de-risking benefits of localization and made in country strategies.

Readiness and inventory levels

Due to the pandemic, Trump and Biden have laid out ways to keep the U.S. in stock on essential medical and personal safety supplies.

Trump

Efforts to increase the readiness of U.S. medical supply stocks center around bolstering the Strategic National Stockpile and requesting some companies and ordering others to produce essential supplies. Since the beginning of the pandemic, dozens of manufacturers have converted production lines to make personal protective equipment, ventilators and components.

Biden

Biden's supply chain plan intends to increase and maintain surge capacity in medical supply chains by compensating companies for excess capacity or inventory levels and using public-private partnerships to increase manufacturing capacity.

Supply chains spent years moving away from backstocks in pursuit of lean operations. During the pandemic, that strategy meant inventory wasn't in the right place at the right time, according to Wendy Tate, professor of supply chain management at the University of Tennessee.

"You saw what happened with PPE and the food supply chain. They broke because we didn't have that redundant inventory to buffer for these longer supply chains that we designed," Tate said.

How they compare

Buffer stock represents an additional cost to businesses, measured against the risk of a stockout. Market forces (and investors) encourage companies to run lean, Anderson said, describing a just-in-time culture among U.S. businesses.

Biden suggests that the government could compensate businesses for keeping inventories out of line with that culture. "Part of [Biden's] plan is addressing those types of backroom inventory levels that generally never get talked about in a presidential election," said Anderson.

Compensating companies for preparations could persuade supply chain managers to change their behavior around buffer stock, according to Anderson.

"It goes from something where I'm making a business decision on my balance sheet to now this is being required … and I'm being paid for by the federal government," he said. "That's why it's such a sweeping change."

"You're now getting the possibility of federal incentives into the decisions that people make."

Tray Anderson

Logistics and industrial lead for the Americas at Cushman & Wakefield

Still, executives likely won't change their inventory strategies simply based on the results of the election, according to PwC U.S. Chair Tim Ryan.

"There is a lot of work going on right now around what is the right inventory level going forward if you have another disruption in supply chain," Ryan said on a call with reporters Tuesday. "We have not seen companies say, ‘We will change the inventory policy or practices that we've had depending on who is sitting in the White House.'"

Trade with China and beyond

Trump and Biden are largely aligned on what the end goal of U.S. trade policy should be, but Trump prefers a more unilateral approach while Biden wants to work with allies to exert more pressure on rivals.

Trump

U.S. trading relationships have been a source of great uncertainty in President Trump’s first term due to his focus on the U.S. trade deficit with other countries, most frequently China. He levied tariffs on hundreds of billions of Chinese imports and left them in place through the pandemic, with some exceptions for critical supplies.

Tensions with France, centering around the rivalry between Airbus and Boeing, are ongoing. Tariffs on Canadian steel and aluminum are frequently in flux. And this month, the administration opened a Section 301 investigation into Vietnam’s trade practices — a possible precursor to tariffs.

Despite back and forth with Canada on tariffs, Trump renegotiated the North American Free Trade Agreement, replacing it with the United States, Mexico and Canada Agreement. USMCA is similar in structure to NAFTA, but updates the agreement with provisions for e-commerce and greater intellectual property protections. USMCA is also somewhat more complex when it comes rules of origin requirements.

Biden

Biden similarly pits China as the United States' number one competitive threat. But Biden’s rhetoric around building relationships with U.S. allies offers a stark contrast to Trump. His plan to revamp U.S. manufacturing includes language about working with allies to move away from China using collective purchasing power.

Biden has expressed support for the USMCA and is expected to uphold the deal, although possibly with different enforcement priorities. Biden praised the deal for gaining support from labor unions in its final form and criticized it for leaving out environmental concerns — which could be indications of future trading priorities in a Biden administration.

How they compare

Decoupling from China is no easy task. And it is unclear supply chains have a strong desire to do so. A survey from the American Chamber of Commerce in Shanghai and PwC released in September but conducted in July, reported 71% of responding businesses do not intend to leave China. Just 4% had plans to move some manufacturing back to the U.S.

"The idea of being soft on China is something that is fraught with political risk."

Scott McCandless

Principal in the Tax Policy Services group of PwC's Washington National Tax Services

Biden and Trump have plans to encourage more domestic manufacturing, but bringing some operations home won't necessarily reduce exposure to China. The trade war and supply disruptions during the pandemic pushed many supply chains to diversify sourcing and manufacturing locations — in addition to and not necessarily instead of China. Plus, China still a major supplier of raw materials in many industries, meaning even if tier 1 suppliers are not directly exposed, other tiers may be.

Executives think Trump will move more quickly to decouple from China — though it is the goal of both candidates. Biden may take a slightly softer approach, according to analysts, but politics may constrain any desire for wholesale policy changes.

"The idea of being soft on China is something that is fraught with political risk and will likely mean that even a new Biden administration would probably avoid completely repealing or withdrawing the 301 tariffs that currently exist with regard to China," said Scott McCandless, principal in the Tax Policy Services group of PwC's Washington National Tax Services on a Tuesday call.

But McCandless added that a less hard-nosed approach may result in easing "at the margins" of China policy, such as in the form of an expanded tariff exemption process.

However, due to a break down in the dispute resolution process at the World Trade Organization, tariffs and trade barriers may become more common globally — adding weight to the balancing act required by U.S.-based international companies to keep all parties happy.

"I think that they're walking a careful line. On the one hand, CEOs do see the opportunity for growth and for increased market access in China and that is something that is very valuable. So they don't want to disrupt any relationships that they might have there, either with customers or with the powers that be. But at the same time, they're just trying to make sure that they're more diversified," McCandless said.

Politicians speak passionately about the threat of reliance on China, but that talk is often divorced from the reality of individual businesses. Biden’s plan, in mentioning the need to work with allies, suggests an understanding that competitive alternatives to China sourcing will need to exist before "decoupling" can occur.

Even if the destinations are similar, the journey takes up most of the time of any presidency. Supply chains won’t be in for a sea change under the next administration. But a continuation or change in administration will inform long-term supply chain planning and strategy.