Dive Brief:

- The hold-up of components shipping out of China as a result of the COVID-19 outbreak will impact Trimble, a major producer of industrial software and technology hardware, within just a few weeks, executives said on an earnings call last week.

- Trimble keeps about two weeks of inventory on hand for customers at any given time, meaning a three-week delay of freight out of China or continued factory delays would affect sales in the near term. The company expects a 3% hit to Q1 revenue as a result of the supplier disruptions.

- The company, which depends on agricultural customers for a significant portion of revenue, does not expect any substantive impact from phase one trade deal between the U.S. and China. "Our agricultural business plans for this year reflect the continuation of the market conditions we have seen since the beginning of the implementation of tariffs," said CFO David Barnes.

Dive Insight:

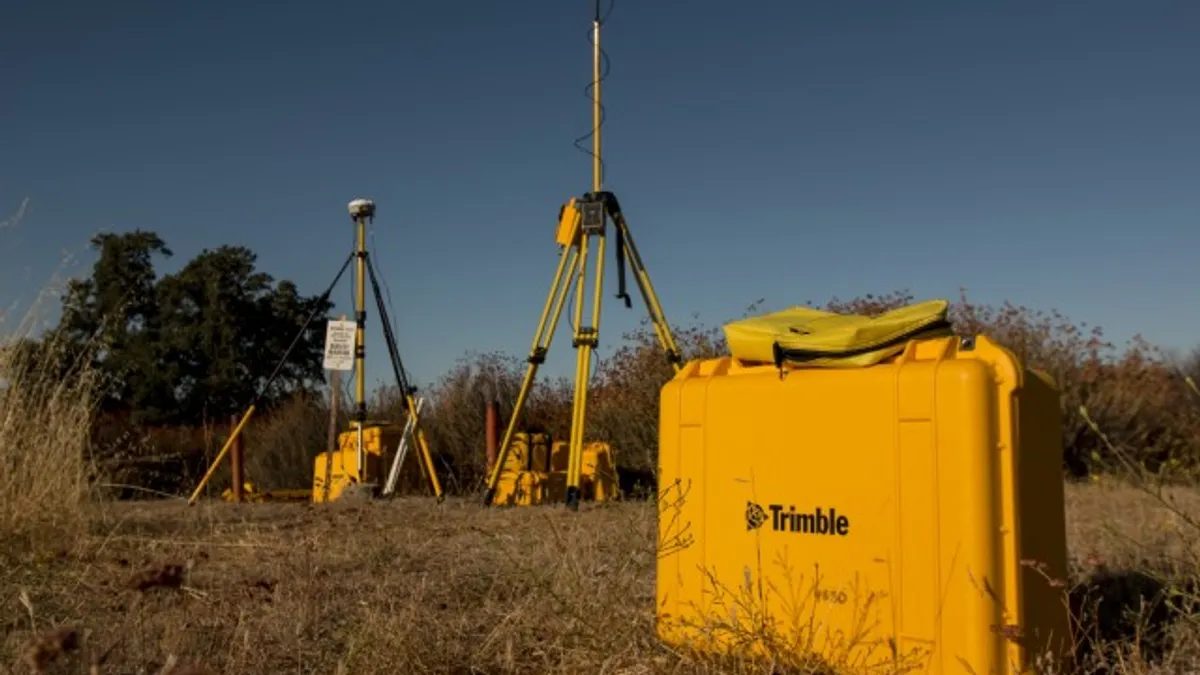

Trimble customers are OEMs who depend on economic optimism to make a relatively large equipment purchase seem like a good idea. The company has products addressing agriculture, construction, transportation, geospatial services, mining, oil and gas, transportation and more.

The mood of companies like Trimble, stakeholders in the currently tentative industrial economy, are particularly illustrative of the level of uncertainty in the global economy. Trimble forecasts a -3% to 1% change in revenue in Q1 2020 and 1% to 4% growth for the full year.

Trimble relies on China for components, as do many electronics supply chains. Even as factories reopen, they are unlikely to be fully staffed, according to the American Chamber of Commerce in Shanghai. Road and port congestion persists.

Managing multiple sources of uncertainty has driven many businesses toward just-in-time manufacturing strategies, attempting to tailor inventory in hand as close to expected sales as possible. Trimble's two weeks of inventory on hand are an example. Disruptions like trade wars and the outbreak of COVID-19, an illness caused by a member of the coronavirus family, call into question this strategy, which is viewed as a best practice in normal times.

Trimble is far from alone in this quandary. Hyundai stopped production at one of its South Korea plants after the supply of parts from China stopped. Suppliers of the automaker are attempting to move production of these parts outside of China. Trimble made no mention of similar moves on the call.

China sales contribute only 2% of Trimble's revenue, but agricultural and utility products represent roughly one-fifth of the company's adjusted net revenue — exposing it to trade tensions and the COVID-19 outbreak.