Recent announcements about Pfizer/BioNTech, Moderna and AstraZeneca’s COVID-19 vaccine positive results brought the logistics issues to the forefront. Each movement along the supply chain is important, and freight forwarders are the linchpins, ensuring vaccines go door-to-door while maintaining their temperature. That means staying cold. In the case of Pfizer’s vaccine candidate, very, very cold.

"We refer to this as the biggest product launch in the history of mankind," said Neel Jones Shah, Flexport's head of airfreight, referring to coronavirus vaccines. "This is the top end of complexity of anything we've ever done before."

But with billions of people to inoculate globally, freight forwarders don’t feel ready for this challenge.

"The industry as a whole is not prepared or doesn’t feel comfortable with the type of requirements thrust upon them," said Jones Shah.

A September survey from The International Air Cargo Association (TIACA) and Pharma.Aero showed only 28% of companies involved in supply chain logistics felt well prepared to handle these vaccines.

Part of that is because pharmaceutical companies are keeping some requirements close to the vest, said Jones Shah, a TIACA board member. But a lot of information is still unknown: exact temperatures for each vaccine’s transit, manufacturing sites, needed transportation modes, vaccine destination, and numbers of doses/pallets to ship at any given time.

"As we get new pieces of information, we're able to add more specificity to the plan about how it will get moved from A to B," Jones Shah said.

"This is the top end of complexity of anything we’ve ever done before."

Neel Jones Shah

Flexport's head of airfreight carrier relationships

Pfizer, the first company to announce its positive interim results, will use DHL, FedEx and UPS to deliver its vaccines via truck and plane, in reusable containers topped off with dry ice, that can maintain the temperature at minus 70 degrees Celsius.

Pfizer said the vaccines will be shipped directly from the manufacturing site to the vaccination site. The company is bypassing distribution by McKesson, the government’s appointed distributor for Operation Warp Speed.

The devil is in the details

Vaccine transport is nothing new to freight forwarders who work with pharma — the difference is the high volume of vaccines to distribute, and the low temperatures of COVID-19 vaccines like Pfizer’s.

"Freight forwarders coordinate the entire move. There’s not one company that typically controls all access to do that," Jones Shah said. "Freight forwarders are the glue that connects all the asset owners together." Pharmaceutical companies can then focus on what they do best: manufacture therapeutics, not manage logistics.

Pfizer is not using the typical distribution route, in that it is taking control itself. The company does not plan on building inventory, and figures it can get vaccines to their destinations faster by working directly. In avoiding additional loads and unloads at distribution sites, it can better maintain the temperature of the frozen product.

"The colder the storage requirement, the more complicated the logistics."

David Goldberg

CEO of DHL Global Forwarding USA

Pfizer’s most recent projections are to produce 50 million vaccines by end of 2020, and up to 1.3 billion in 2021. That’s one manufacturer. By comparison, 175 million flu vaccine doses were distributed in the U.S. during the 2019-2020 flu season, according to the Centers for Disease Control and Prevention.

The equipment needed to transport vaccines globally varies widely depending on the numbers used in forecasting dosages in each vial and inoculations per person (one versus two).

A model developed by Seabury/Accenture and Kuehne + Nagel estimates needing fewer than 1,000 full 747 freighters, if the vaccines are transported at 2-8 degrees Celsius, with multiple doses per vial, said Robert Coyle, SVP of Kuehne + Nagel’s pharma and healthcare vertical.

The International Air Transport Association estimates 8,000 full 747 flights for a single dose vaccine for 7.8 billion people.

A DHL analysis estimates up to 200,000 pallets, 15 million deliveries in cooling boxes, and 15,000 flights for 10 billion doses.

The cold chain is a big challenge. Moderna’s solution can remain stable at 2-8 degrees Celsius, the temperature of a standard refrigerator, for up to 30 days and can be stored for six months at minus 20 degrees Celsius, standard freezer temperature. Pharmaceutical distribution companies have this capability now.

Conversely, Pfizer’s product must be transported and stored at minus 70 degrees Celsius. That’s so cold that there is not ample deep freezer capacity.

Few air carriers are able to ship at temperatures of -80 degrees Celsius or lower

"The colder the storage requirement, the more complicated the logistics," said David Goldberg CEO of DHL Global Forwarding USA.

Pfizer designed its own packaging, which will use dry ice to maintain storage without needing specialized appliances.

The U.S. is experiencing dry ice shortages as well. Why? Blame the decrease in ethanol production, with fewer cars on the road. Dry ice is a byproduct of that process.

"You can’t stockpile [dry ice] because it evaporates. We’re working with manufacturers to make sure we have sufficient capacity," Goldberg said.

UPS announced Tuesday it is expanding dry ice production capacity to 1,200 pounds per hour in the U.S. and Canada.

Keeping vaccines cold during flights

Airplanes have limitations for how much dry ice can go on an airplane. "It turns into carbon dioxide when it sublimates. You can’t pack an airplane full of dry ice — it’s harmful for the crew," said Jones Shah.

Vaccines in a 2-8 degree Celsius temperature range, like Moderna’s and AstraZeneca’s, don’t need dry ice. The vials may be sent in a temperature-controlled container that holds a battery charge and keeps the contents at a consistent temperature. The container’s battery is then recharged on arrival.

| Manufacturer | Temperature requirement |

|---|---|

| AstraZeneca | 2-8 degrees Celsius |

| Moderna | 2-8 degrees Celsius short term, minus 20 degrees Celsus long term |

| Pfizer | minus 70 degrees Celsius |

Source: AstraZeneca, Moderna, Pfizer

The containers are not new for the COVID-19 vaccine and are already used to move other vaccines and temperature-sensitive products. However, with a greater number of vaccines to transport, more containers may be needed at any one time.

Not all airports have enough plugs to recharge them, said Christos Spyrou, CEO and founder of Neutral Air Partner, and a TIACA board member. That means ensuring the airports have the appropriate support, or the freight forwarder has nearby storage capacity. Kuehne + Nagel identified 32 pharmaceutical hubs globally with airside solutions, Coyle said.

Shippers and freight forwarders are also using sensors and sometimes GPS trackers to monitor products throughout the journey and ensure they remain within the temperature spectrum. "We have people on the ground working with baggage handlers making sure the temperature range doesn’t get out of control," Coyle said.

The airports and airplanes are a concern, as a majority of pharmaceutical damage occurs via temperature changes while in their possession, according to IATA. The association estimates a $34.1 billion annual loss as a result.

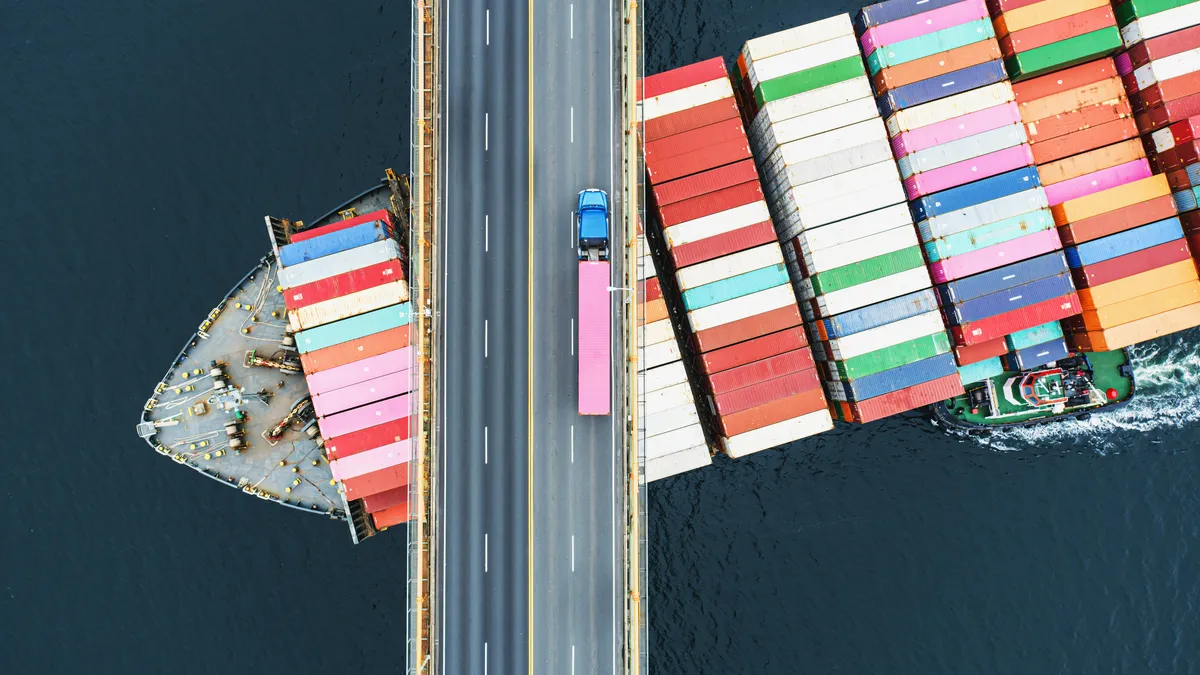

Airfreight is the fastest way to move the vaccines, but it’s not the only solution.

Multimodal service involving air, ocean and truck, is an option, said Goldberg. The freight forwarder needs to ensure the vaccines get to their destination using approved carriers and with temperature guidelines followed, no matter how many segments and transport modes are used to move them to the final destination. While not common, some manufacturers make reefer containers able to store contents at the low temperatures required.

Similar to the personal protective equipment import issues early in the pandemic, the first round of vaccine movement will likely be airfreight, and the second round might include ocean freight, he said.

Warehousing and the last mile

Freight forwarders and carriers need solutions to keep vaccines cold en route to the airport and while waiting for transit.

UPS is building freezer farms near air hubs in the U.S. and the Netherlands, adding 600 freezers that can hold 48,000 vaccine vials at minus 80 degrees Celsius.

DHL Global Forwarding opened a 20,000-square-foot life sciences and healthcare logistics cold chain facility in Indianapolis, with three temperature-controlled chambers, the lowest at minus 20 degrees Celsius. Goldberg said DHL has four other cold chain facilities in the U.S.

Kuehne + Nagel is building key hubs with temperature flexible capacity, like ones that recently opened in Brussels and Johannesburg, which can be used for airfreight and distribution.

"Freight forwarders are the glue that connects all the asset owners together"

Neel Jones Shah

Flexport's head of airfreight carrier relationships

Moving the cargo to emerging markets by plane might be easy, but the final mile is not, said Spyrou. Many freight forwarders are buying or considering the purchase of freezer or temperature-controlled boxes to create a final mile vaccine solution. However, "you can't invest unless you know the country would receive a certain type of vaccine," he said.

In the U.S., the recipient will need enough storage capability at the temperature required. Pfizer's vaccines may be sent to larger facilities where clinicians can vaccinate more people in a shorter timeframe, to decrease waste.

In the short term, none of the vaccines will likely sit in a distributor’s warehouse for any length of time, given the demand. The deliveries will need to be coordinated to ensure storage availability at the inoculation sites.

Not all freight forwarders are equal

There's another aspect to the freight forwarder story, and that's how COVID-19 will affect freight forwarder businesses when the vaccines start shipping.

General freight forwarders with no specific niche, those who don’t move temperature-controlled products, are worried that their cargo won't be a priority and might be rolled. Their rates may also rise high enough that clients can't afford to ship.

"Pharma is always a priority. When it’s vaccine season, other cargo gets bumped," Spyrou said.

The second type of freight forwarder ships some smaller amounts of pharmaceuticals, maybe vaccines for clinical trials, or associated materials like the packaging. They have freezer warehouse space and some access to the pharmaceutical companies, but not enough information about whether they’ll be used for COVID-19 vaccine shipments. They have the technical know-how, but not necessarily the large volume capacity. These freight forwarders are unsure whether they will be called on for vaccine distribution.

"When it’s vaccine season, other cargo gets bumped."

Christos Spyrou

CEO and founder of Neutral Air Partner

Freight forwarders in the 3PL space distributing PPE cannot necessarily adequately support vaccines. "Pharmaceutical capabilities are not acquired overnight," said Jones Shah.

Companies have to be vetted and audited by pharmaceutical companies and regulatory bodies overseeing the vaccine supply chain, getting certifications. "You need processes in place and recurring training. [Pharma is] not an industry you can enter lightly," said Jones Shah. Only a small fraction of freight forwarders are capable of moving the highest end pharma products, he said.

Freight forwarders and everyone along the supply chain will gain experience and confidence as the first batches of vaccines are distributed domestically and internationally.

"We’ll redo the TIACA survey mid-December and see if we’ve done our job educating the stakeholders," said Jones Shah.

Correction: A previous version misstated the location of Kuehne + Nagel's distribution hubs.