Before Miami-based Eden Multifamily had even begun site work on EDEN Crystal Lake in Port Orange, Florida in March 2021 (pictured above), it already had a container filled with fiberglass bathtubs ready and waiting to be installed in the apartments that would be built there.

Why did Eden decide it needed a container full of tubs before the project even started?

“There was a shortage at that time, and we were worried we wouldn't be able to get bathtubs,” Jay Jacobson, Eden’s president and CEO, told Multifamily Dive.

After two years of navigating supply chain delays, rental housing developers are now accustomed to making buying decisions they once may have found unfathomable. To make sure they have materials and appliances on site, they’re standardizing components and ordering well ahead of time. But even then, problems can arise. Some developers, like Drees Homes, are getting products at Home Depot.

Standardization

Whether a company is building a single small property or thousands of units across the country, supply chain problems are an issue.

But finding solutions can certainly be a lot easier when you’re bigger. Scottsdale, Arizona-based Alliance Residential was the No. 2 apartment developer last year, according to the NHMC. To manage supply chain issues, it can leverage its size — making bulk buys and standardizing components across its porfolio of properties.

Previously, leaders in each of Alliance’s markets would source their own building products. Now, the developer is centralizing the process.

“We’re much more cognizant of exploiting opportunities to standardize and bulk buy ... and be more technology-focused to have materials on site when we need them,” said Alliance’s President and Chief Operating Officer Jay Hiemenz.

For example, Alliance went to an appliance manufacturer and committed to bulk-buying a limited number of models to improve standardization and efficiency across its properties.

“An appliance manufacturer has maybe 20 different models,” Hiemenz said. “They’re trying to figure out how to make our process easier and smoother. If you can commit to limiting the variability and specifications and you can commit to a big quantity, it’s music to their ears.”

Early commitments

Ordering things like tubs ahead of time has become commonplace for Eden. With the potential for product shortages, Jacobson tries to secure as many products and materials as he can in advance.

“Every time I sign a construction contract with the contractors, I always tell them, ‘Buy everything you can today,’” Jacobson said. “I don't care if it's something we won't need for 18 months. I don't care. Let's get the product. We'll pay for warehousing.”

Cleveland-based The NRP Group, the country’s No. 9 developer with 3,720 units started in 2021, locks in building materials earlier in the construction process than before, according to Dan Hull, president of construction at NRP. A company its size can afford to front the money to buy products before banks are able to provide reimbursement.

NRP has also been able to lock in variable-rate agreements with its suppliers. So far, it has worked out in the company’s favor.

“I can go to some of our trade partners and say, ‘I want to pay for a place in line [for order fulfillment], but I don’t want to pay the final price yet,’” Hull said. “‘We’re going to agree to a variable rate, watch the volatility and together agree on a purchase [price] closer to delivery.’”

Retail relief

In some cases, builders and developers need to skip the supply chain and go straight to the store. Brian McGinniss, the Washington, D.C.-area manager for Drees Homes, said his company has a national account with Home Depot. The Ft. Mitchell, Kentucky-based firm builds multifamily, including Embrey Mill, an age-qualified, 264-unit project in Stafford, Virginia,

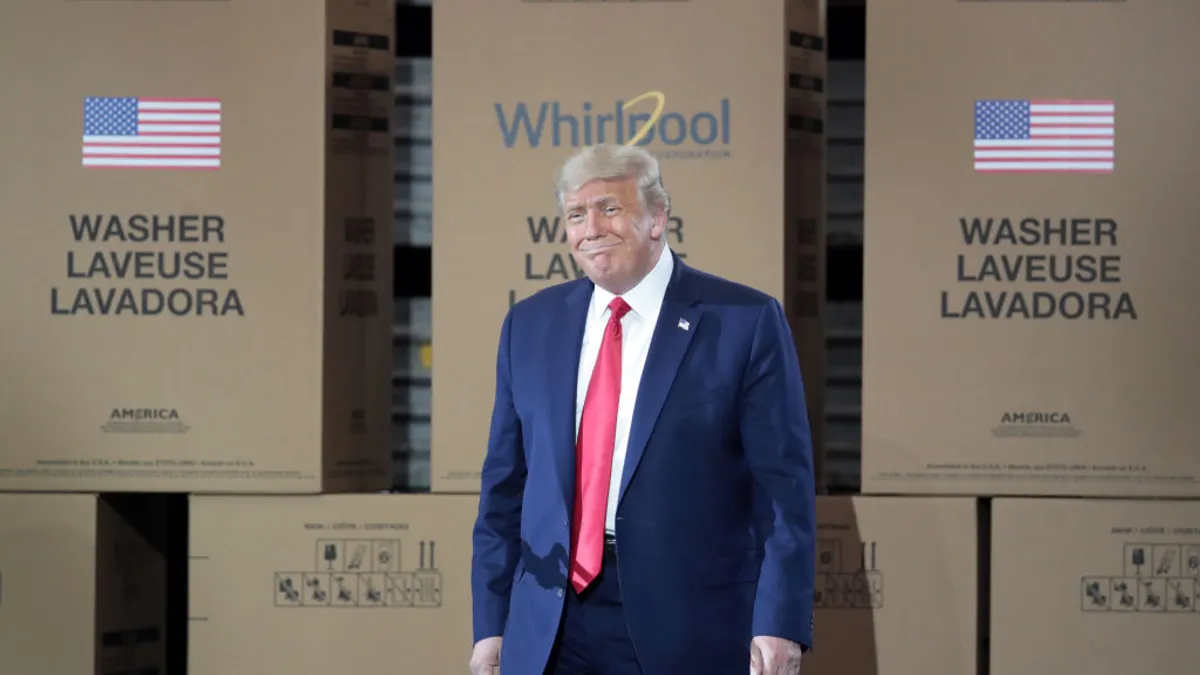

Over the past year, supply chain backlogs meant some appliances were so delayed that they couldn’t be installed by the home buyers’ move-in date. Instead of waiting, Drees’ representatives would go with the buyers to Home Depot and buy, for example, a refrigerator that was in stock. Then the company would work out the financing and credits with Whirlpool, for example.

“You would think you would go directly to the supplier, but it’s already in the supply chain somewhere, it’s just not with who we need it to be with,” McGinniss said. “It’s a matter of us getting our fingers on it.”

In other cases, Drees has found out on the day of anticipated delivery that a key component, like cabinets, has been delayed. But with more transparency from subcontractors about any anticipated material delays, the company can work around these issues.

“If cabinets are running two months behind, it doesn’t mean a delay of two months — there are a lot of other things that we can do before the cabinets actually go in,” McGinniss said. “So a lot of the trades are supplying this information, and they’re then able to share it with the sales team as well as the builders. We’re also able to share the information with our production team so that we can inform our buyers and give them the heads up.”

Even if the products simply aren’t available at all, contractors can come up with stopgap solutions. But it’s far from ideal.

“Some of our clients have had to take an appliance from one apartment and move it into another one that somebody is moving into,” said Lisa Majchrzak, an associate principal in the Oakland, California, office of TCA Architects. “They do workarounds to wait for the real thing to come in.”

Click here to sign up to receive multifamily and apartment news like this article in your inbox every weekday.