Highlights

Fundrasising to date:

$258 million

Headquarters:

Chicago

Outlook:

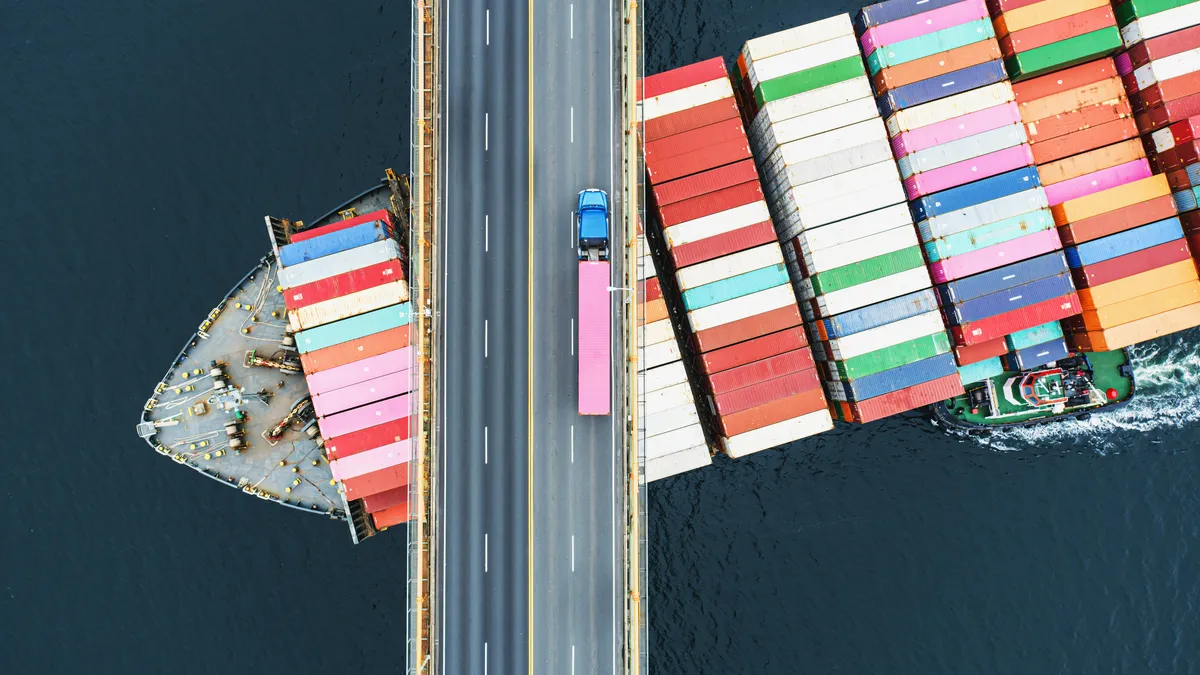

To increase supply chain efficiency using data to keep machines and vehicles running without unexpected downtime.

Supply chain managers today are not looking to put out fires. They’re looking to prevent them.

Uptake is a Chicago-based startup looking to do just that. The four-year-old company applies artificial intelligence and machine learning-backed data analytics to one of the most basic forms of data on moving vehicles: telematics.

The company's main value proposition is reducing downtime across machinery and freight modes. Trucks, railcars, locomotives, manufacturing machinery, combines, wind power stations, oil and gas machinery and planes all go out of service for one reason or another — and Uptake’s promise is that it can tell you when and why with plenty of time to adjust operations, fix the problem or prevent it in the first place.

"At the core of what we do is making sure that machines don’t break — or predicting failure of assets before they break," Hoyoung Pak, senior vice president of transportation, logistics, and supply chain, told Supply Chain Dive.

Over the last four years, Uptake has worked with its industry clients to create data platforms that not only provide the traditional offerings of existing asset performance management systems, but also add on Internet of Things (IoT) data analysis capabilities. More recently, Uptake developed a database of what could go wrong — allowing the software to recognize problems sooner than any human or machine alert system.

Keeping the trains on time

Rail is where Uptake started and remains its strongest customer segment, but due to the long life of rail car, is not an easy business to spread an IoT solution.

The inherent tech on rail cars varies greatly based on their age. Brand new cars come equipped with up to 500 sensors whereas the oldest cars still in use may have none. In the case of newer cars, Uptake has more than enough data to work with to predict maintenance and downtime, but in the older cars, the company must use service data and fluid samples from the shop.

Still, the dramatic underutilization of data in the rail sector meant that impact was not too difficult to achieve quickly.

Timothy Thompson, senior manager of rail solutions for the startup, told Supply Chain Dive that even the railways with high-tech cars "were collecting data just for the sake of collecting it."

The company is now monitoring more than 12,000 locomotives and many more rail cars. After working with all major Class I railroads, Thompson said that rail clients are able to reduce road failures by 25% across most fleets saving $160,000 per locomotive per year.

"The number one value-driver lies around being able to reduce road failures across locomotives deployed in service on trains," said Thompson, who came to Uptake form the hardware side of the rail industry.

Reducing maintenance time and increasing reliability is what got Uptake in the door with railroads, but the company is looking to expand its value proposition going forward.

"Now we’re working with a lot of these same customers to increase productivity across the rail space, where you’re understanding which locomotive in fleet have the mission competence to be assigned to your most high-profile trains and avoid delays," said Thompson.

Efficiency for the long haul

Trucking is another field with vast amounts of unused or underutilized data, making it a prime target for Uptake.

"Even as we look at some of the major trucking companies — they don’t do anything with the 300+ sensor data that are available in trucks, so they welcome working with us because they know that we can do something with that data," said Pak.

Though trucking is a relatively new business for the company (just over a year old) Uptake already has 30,000 units installed, targeting medium-to-large truck fleets, monitoring things like idle time and fuel efficiency, which has been a major draw for clients, Pak said.

"Some of our major clients have said that there is no way for them to understand if a particular asset is degrading in terms of miles per gallon efficiency by 5 to 10% because every truck gets driven differently. You can’t just look at the miles per gallon consumption and say that asset A is more productive than asset B," explained Pak.

Uptake uses artificial intelligence and machine learning to "take on all the noise in the system and do an apples-to-apples comparison."

In an effort to create a one-stop solution, the company has also integrated Hours of Service (HOS) compliance, as well as International Fuel Tax Agreement (IFTA) regulations and Driver Vehicle Inspection Reporting (DVIR) compliance.

Data-driven ambition

In recent years, Uptake has grown to what may be a critical point.

The company has raised $258 million in its history, and $117 million in the last year alone from notable investors like Revolution Growth and Bailie Giifford. It acquired Asset Performance Technologies (APT) — a firm reported to have the world’s largest database of industrial machine failure data. Uptake signed a $1 million contract with the Department of Defense to use sensors and data to analyze the indicators of vehicle failures and avoid them in combat zones. And it is starting to compete with major corporate players in both its technology and talent.

In 2018, Uptake hired four former GE executives from GE Digital and GE Power and Water. GE’s Predix software is a competitor, but as the company reportedly hired a banker to sell its digital component, Uptake is overtly pursuing that business.

"At the core of what we do is making sure that machines don’t break — or predicting failure of assets before they break."

Hoyoung Pak

Retail and supply chain leader, Uptake

The wide breadth of Uptake’s applications across the supply chain strongly suggest that the company’s footprint will likely expand. Pak said that as the company evolves past its core competency of eliminating equipment downtime, it intends to take a more holistic view of the supply chain, leveraging AI to determine optimal pickup and delivery times of assets and connecting freight modes to the last mile.

In the last year, the startup has made clear moves to compete with tent pole names within its sphere and serious progress beyond its bread and butter if railroads in attempt to impact every freight mode. In naming Uptake 2018 Innovator of the year, Supply Chain Dive recognizes that the company is offering supply chains the exact opposite of what so many startups chase: disruption.

Read More

-

The art of modernizing machinery

By Craig Guillot • Aug. 28, 2018 -

How data is changing the nature of maintenance and repair

By Carig Guillot • June 12, 2018 -

How do supply chains use Big Data?

By Edwin Lopez • Feb. 13, 2017

Correction: In a previous version of this article, Uptake's fundraising total to-date was misstated.