The International Longshoremen’s Association suspended negotiations with the United States Maritime Alliance scheduled for Tuesday, according to a June 10 statement from the ILA.

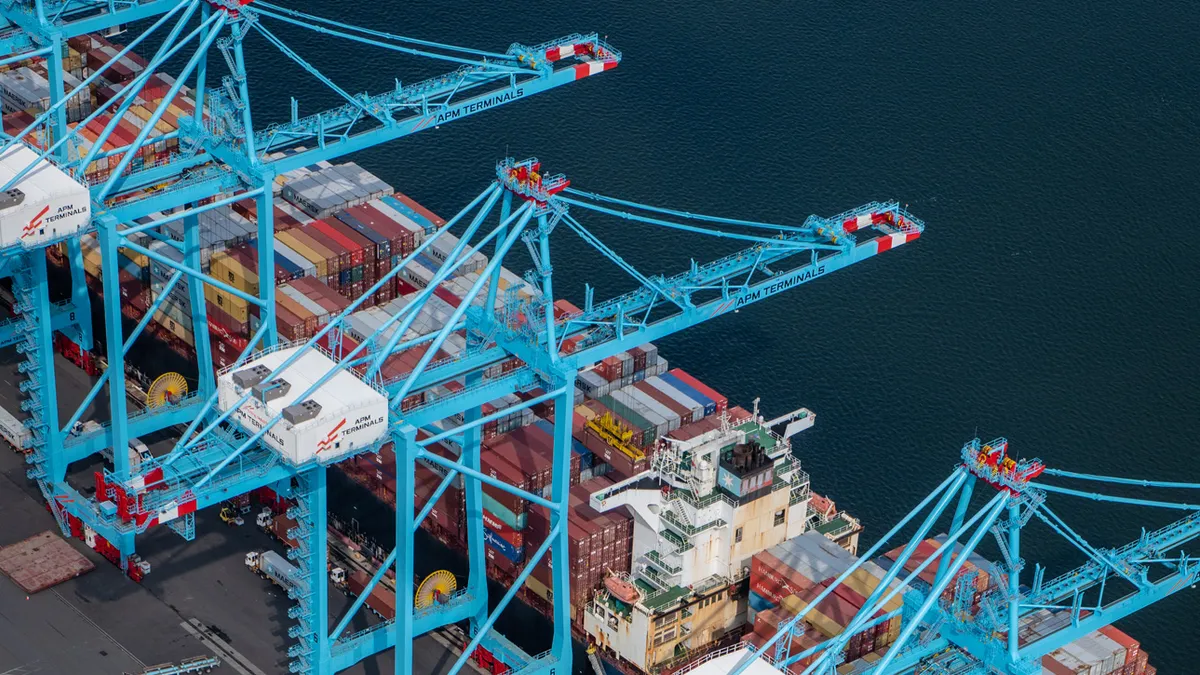

The labor union said it discovered that APM Terminals and Maersk Line, which are both owned by A. P. Moller - Maersk Group, are utilizing an auto gate system that autonomously processes trucks at multiple ports, including the Port of Mobile, Alabama.

“There’s no point trying to negotiate a new agreement with USMX when one of its major companies continues to violate our current agreement with the sole aim of eliminating ILA jobs through automation,” said ILA International President Harold Daggett, who also serves as chief negotiator for the union.

In the letter, the ILA said it will not meet with USMX until the auto gate issue is resolved. USMX did not respond to a request for comment at the time of publication.

A Maersk spokesperson told Supply Chain Dive that APM Terminals is committed to upholding its agreements while fostering a safe and efficient working environment. “We remain in full compliance with the ILA/USMX Master Contract. We are disappointed that the ILA has chosen to make selected details of ongoing negotiations public in an effort to create additional leverage for their other demands.”

The Maersk spokesperson also said the company will continue to engage with all stakeholders, including the ILA, to address their concerns. “APM Terminals, through the representation of the USMX, looks forward to resuming constructive negotiations with the ILA to find mutually beneficial solutions that support the future of our industry,” the spokesperson said.

Optimism for a speedy and conflict-free contract renewal process is not so high anymore after the ILA and USMX said they expected similar success compared with previous negotiations in 2012 and 2018, which yielded no disruption or delays in shipment of cargo.

The ocean market is already in a volatile environment with rising ocean spot rates and the ongoing Red Sea conflict. With an expiration deadline of Sept. 30 for the current six-year contract between the ILA and USMX, shippers may face another ocean disruption later this year. In preparation, some shippers have already shifted cargo to the West Coast.

Shippers don’t want “to be the last to make sure that they have vessel allocation and empty containers ready for their imports to the U.S. before it’s too late down the line into peak season,” Port of Los Angeles Executive Director Gene Seroka said in a media briefing on May 20