Shippers have less than two weeks to prepare contingency plans for if workers strike at East Coast and Gulf Coast ports in the U.S.

Composed of 85,000 members, the International Longshoremen’s Association is approaching the expiration of its master contract with the United States Maritime Alliance, or USMX, on Sept. 30.

The union’s chances of averting an Oct. 1 strike are dwindling as automation concerns and wage disagreements stall negotiations. ILA President Harold Daggett has been clear about the union’s intentions to strike and shared a strike mobilization plan earlier this month.

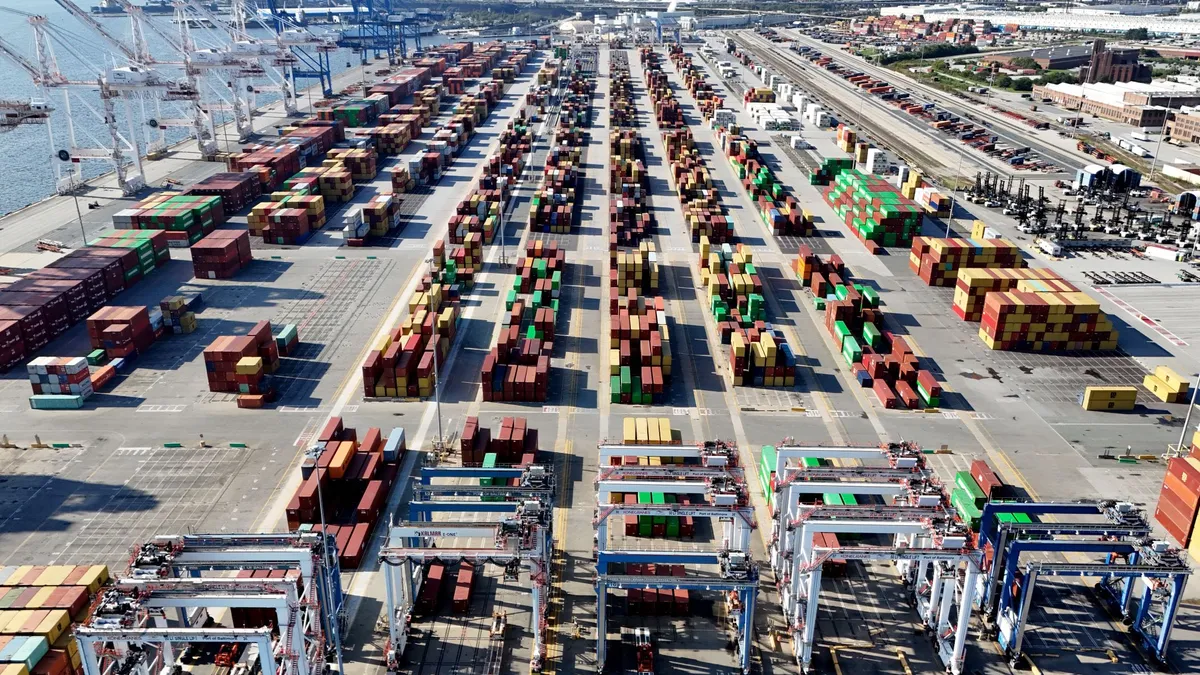

A strike would have a major impact on operations and the flow of goods at several ports. The contract between the ILA and USMX covers ports in states such as Texas, Maine, New York, New Jersey and Florida, but a strike could spur disruptions for other regions and industries.

“Shippers with freight across Europe, Oceania, and Asia bound for the U.S. will especially feel the impact, which would cascade to disrupt the flow of freight across the U.S., Canada and Mexico,” C.H. Robinson Director of North American Ocean Mia Ginter said in a blog post in August.

Supply Chain Dive spoke to shipping and logistics experts about what actions shippers can do to prepare for the event of a strike including how to reroute cargo and other considerations.

How can shippers prepare for a strike?

There are several options for shippers to minimize disruptions, such as exploring alternative shipping routes.

Importers and exporters can establish a multi-coastal transportation network in advance of a potential labor disruption, Kuehne and Nagel EVP of Sea Logistics Michael Aldwell said in an email.

“This can take the form of a transload capability or operation or an alternate coast gateway at smaller volumes that can be scaled in the event of a disruption,” Aldwell said.

Another option, familiar to shippers after years of port disruptions, is to divert cargo. Cargo can be shifted to ports along the U.S. West Coast, Canada or Mexico, Josh Jungwirth, EVP of Freight Forwarding for the Americas Region at Geodis, said.

Other ports shippers can use to divert cargo from the East and Gulf Coast

| Region | Ports | Service |

|---|---|---|

| U.S. West Coast | Los Angeles, Long Beach or Oakland | Transload and full truckload or rail and drayage |

| Canada | Vancouver, Prince Rupert or Halifax | Transload and full truckload or rail and drayage |

| Mexico | Lazaro Cardenas | Inbound rail option via CPKC to Houston and Kansas City |

SOURCE: Josh Jungwirth, Geodis EVP of Freight Forwarding in the Americas region

The choice on what alternative ports to use depends on factors like cargo origin and destination, shipping lanes and available capacity, Jungwirth said.

Is airfreight a viable alternative?

Airfreight is a transportation option shippers have for time-sensitive shipments that would be disrupted by a strike, but it comes at a higher cost and with some capacity concerns.

The average air cargo spot rate spiked 24% year over year in August to $2.68 per kilogram, according to a Xeneta report from Sept. 5.

“Shippers considering air should keep in mind that passenger flights will be reduced between the current busy summer travel season and October. Right now, air capacity is already limited due to increased demand from e-commerce from Asia and Red Sea diversions,” C.H. Robinson’s Ginter said.

Giant e-commerce retailers Temu and Shein have driven this recent surge in air cargo demand. In July, the retailers each provided carriers with about 900,000 packages daily in the U.S., according to ShipMatrix data shared with Supply Chain Dive.

Heightened airfreight booking activity from Temu and Shein is exacerbating a capacity crunch throughout the market, Kathy Liu, VP of Global Sales and Marketing at Dimerco Express Group said in an episode of The Freight Buyers' Club podcast. There are only a few freighters available on the open market, which further tightens the availability of air cargo options for other shippers, she said.

What type of cargo will be affected?

All types of cargo would be impacted if a strike were to happen, but it would have an outsized effect on commodities that rely on the just-in-time inventory model, such as automotive parts.

“Considering the challenges that could arise on the export side, chemicals and agricultural goods would become the most impacted cargo in the short term,” Joshua Bowen, global ocean leader at CEVA Logistics, said in an email. “From an import perspective, any supply chain that is heavily reliant on cargo flows from the Middle East, Europe and Africa (MEA) would have challenges, so we would expect impacts in the industrial and automotive sector specifically.”

Even seasonal items may be affected, Goetz Alebrand, SVP and head of ocean freight at DHL, said in an email. This includes items for Black Friday or the holiday season as well as temperature-controlled items that have a limited shelf life, Alebrand said.

Is it too late to take action?

Experts were mixed about whether it’s too late to enact strike contingency plans, but most agreed the longer companies wait, the more expensive adjustments can become.

“The key challenge is, if you want to make contingency plans or re-routings until a disruption occurs, it will be very difficult and expensive to find the capacity and partners needed,” Aldwell said.

It could also be too late depending on the origin of cargo, according to Freightos Head of Research Judah Levine. In a Sept. 10 update, Levine said it’s “about past the deadline” to move containers from Asia to the East Coast before a strike, while Transatlantic shippers still have a little time left to move containers. This is because it takes much longer to ship from Asia than from Europe to the U.S. East Coast.

Even moving cargo to alternate ports may not be enough for shippers to avoid major challenges if a strike occurs.

“While many shippers have already started to use these solutions, they are only ad-hoc solutions, because if there is a true slow down or stoppage, neither of these options are sufficient to handle the needed volumes,” CEVA Logistics’ Bowen said.

Lastly, even shippers re-routing cargo to the West Coast brings forward the issue of inland capacity. Without prior planning, East and Gulf Coast cargo diverted is far less likely to be prioritized for domestic intermodal truck or rail services, Ginter said.

“In addition to capacity and delay concerns, warehousing space may be necessary to store rerouted freight until inland capacity is available,” she added.