Dive Brief:

-

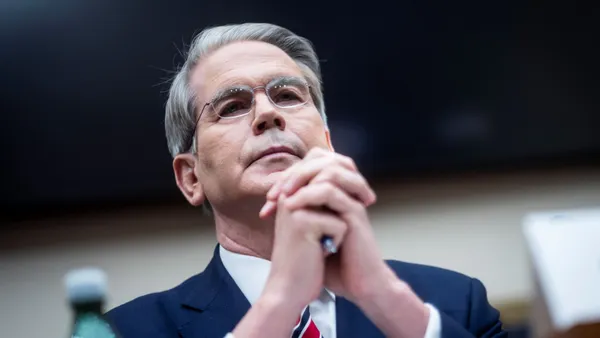

FedEx said Tuesday that its CFO, Michael Lenz, plans to retire from the package delivery giant effective July 31.

-

The company has begun a search for a new finance chief who combines “deep financial expertise with strong operational capabilities,” according to a press release.

-

Lenz, an 18-year veteran of FedEx who was named its CFO in March 2020, will serve as a senior advisor at the company until Dec. 31 to help ensure a smooth transition, the release said.

Dive Insight:

The news coincided with a weak quarterly earnings report from FedEx. The company generated $21.9 billion in revenues in the fourth quarter of its fiscal 2023, a 10% decline year over year, according to results released Tuesday.

The quarter’s results were negatively impacted by continued demand weakness and cost inflation, according to company executives.

“While we expect these pressures to persist, we do expect moderation throughout the fiscal year,” FedEx CEO Raj Subramaniam said during a Tuesday earnings call.

Subramaniam opened his remarks by praising Lenz for his work as CFO over the last three years, noting that it came during a global pandemic and a time of significant change for the company. “Due to his tireless work, FedEx is on solid footing as we execute the next phase of our strategy,” the CEO said.

Lenz began his career at the company in 2005 as vice president of finance at FedEx Office, or FedEx Kinko's, as it was known at the time, according to his LinkedIn profile. He became staff vice president of strategic finance at FedEx in 2010, which was followed by a promotion to corporate vice president and treasurer in 2012. Prior to joining FedEx, he worked at American Airlines and Boeing.

Meanwhile, Global insurance firm American International Group said Tuesday that Sabra Purtill, who was named its interim CFO in January, has been appointed to serve in the role on a permanent basis, effective immediately. She succeeds Shane Fitzsimons who is stepping down after a medical leave of absence, AIG said.

The appointment follows AIG’s Jan. 30 disclosure that Mark Lyons, an initial interim replacement for Purtill, was fired after it discovered that he breached confidentiality obligations to the company.