MEMPHIS, Tenn. — FedEx will consolidate portions of its network and promote more collaboration between its shipping segments under a new long-term strategy unveiled Wednesday.

The logistics giant’s plan, known as “Network 2.0,” is meant to optimize the resources of FedEx Express, Ground and Freight. The company will invest $2 billion to carry out the initiative, President and CEO Raj Subramaniam said in an investors meeting.

"Network 2.0 fundamentally changes how we look at our networks and moves beyond discrete collaboration to more of an end-to-end optimization," Subramaniam said.

By fiscal year 2027, FedEx expects to operate 100 fewer stations, eliminate more than 10% of pickup and delivery routes overall and reduce millions of linehaul miles driven. FedEx expects the more efficient use of its separate networks will provide it with a $2 billion financial benefit each year.

FedEx Express, Ground and Freight currently fill different roles at FedEx. Express delivers time-definite packages globally using its own employees, while Ground delivers day-definite packages in the U.S. and Canada via independent contractors. Freight is FedEx's LTL arm. They've historically operated their networks independently of each other.

"They were designed to deliver different products to support different customer needs in an effort to find the optimal balance between economies of scale and economies of focus," said Richard Smith, President and CEO-elect of FedEx Express. "Operating them independently also allowed us to be nimble and flexible and to build capabilities very fast."

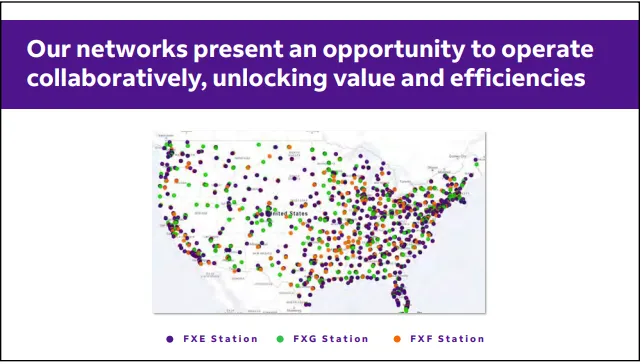

But FedEx's networks have expanded and overlapped with each other through the years, with those inefficiencies exacerbated by a surge in e-commerce volume. More than 95% of FedEx's revenue comes from customers using more than one operating company, according to Smith, adding further incentive for the company to streamline cross-company operations.

FedEx began its network opitimization effort in 2020 when it announced FedEx Express would hand off some packages to Ground for final-mile delivery, which executives referred to as the Last Mile Optimization program. This program pushed FedEx to develop the technology and systems necessary for its different companies to communicate and operate together effectively.

"Rather than duplicate last mile routing footprints across these two parcel networks, LMO created the insight and processes to effectively handoff packages between networks and remove redundant routes," Smith said. Since the program's launch, Ground has delivered more than 70 million Express shipments and "that is only the beginning," he added.

Through Network 2.0, FedEx will be able to consolidate its facility footprint in more rural markets to a single station across operating companies, Smith said. In heavily populated markets, distinct Express and Ground operations will be co-located under one roof to better facilitate package transfers between companies. This will primarily occur in Ground facilities because they're generally larger and more automated, Smith added.

Through these co-located stations, Ground can more easily absorb Express volume that can be delivered in the afternoon and evening, improving its route density. FedEx will also be able to send packages based on the most effective route rather than Ground or Express network affiliation, Smith said.

How FedEx's different operating companies compare

| FedEx Express | FedEx Ground | FedEx Freight | |

|---|---|---|---|

| Focus | Time-definite delivery | Day-definite delivery | LTL shipping |

| Average daily volume | 6.2 million packages | 10 million packages | 110,000 shipments |

| Service area | More than 220 countries and territories | U.S. and Canada | U.S., Canada, Mexico, Puerto Rico and U.S. Virgin Islands |

| Operating facilities | 1,950 stations (650 in the U.S.), 13 express hubs | Nearly 690 sortation and distribution facilities | Approximately 400 service centers |

Note: Average daily volume numbers are from fiscal year 2022.

Three Ground facilities currently house Express operations as well, and FedEx plans to do the same in several more markets, said FedEx Ground President and CEO John Smith. Executives did not provide specifics on how the changes will affect employment levels.

FedEx Freight, meanwhile, has identified opportunities to reduce drayage costs between both itself and Ground. Both companies' intermodal activities were previously being looked at separately, FedEx Freight President and CEO Lance Moll said. FedEx Dataworks built a dashboard providing visibility to all of the intermodal containers at Ground and Freight, reducing the amount of miles a Freight tractor drives without a trailer attached to it.

"We had visibility to where, 'Okay, instead of going back to the freight hub with just a tractor, there's a Ground trailer over there. We'll pick it up and bring it back then to [a FedEx Ground] station,'" Moll said.

FedEx can cut roughly 8 million miles in which a tractor drives without a trailer through better Ground and Freight collaboration on intermodal containers, Moll said.

FedEx is also in the process of building a model across its companies that identifies opportunities to reduce empty miles by day of week, according to John Smith. Eight test lanes are in place right now using this model, with 18 more to come in the next couple of months.

"As you can tell, this is a great opportunity for us from an enterprise to unlock the power of our networks," Smith said.

Editor's note: This story was first published in our Logistics Weekly newsletter. Sign up here.