Dive Brief:

- FedEx is reconfiguring its air network to optimize the use of its assets as it looks to drive savings and boost profits, according to a Dec. 19 earnings call.

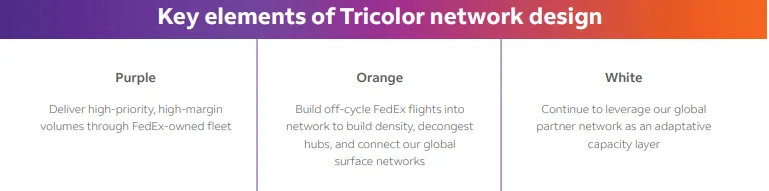

- The redesign, called “Tricolor,” divides FedEx’s network into three sections, or colors, to support the targeted $4 billion in the company’s DRIVE savings program in fiscal year 2025.

- “With the rapid growth of e-commerce and as volume mix continues to shift to deferred, we recognize the need to reconfigure our network to focus on both speed and density,” CEO and President Raj Subramaniam said during the call.

Dive Insight:

The parcel carrer’s Express unit faced headwinds this year as revenue declined 6% year-over-year last quarter due to volume and yield pressures, according to Subramaniam.

Weakened demand due to a slowdown of industrial production, product mix shift from priority to economy traffic, lower fuel and demand surcharges also contributed to the carrier’s hardships, the CEO added.

Historically, FedEx’s air network was primarily based on a hub-and-spoke model, Subramaniam noted. With Tricolor, FedEx aims to better size the overall capacity to current demand, and is confident that the redesign and other DRIVE initiatives will “make us more resilient in future periods of demand weakness,” EVP and CFO John Dietrich told analysts.

FedEx’s Purple network will be the “backbone” of its International Priority parcel business, while flights for its Orange network will operate off-cycle, Subramaniam explained. Meanwhile, imbalanced trade lanes will benefit from FedEx’s Global Partner Network, or White network.

“In fact, we’ve taken out a lot of flight hours in the last 12 months accordingly,” the CEO said. “So, the one part of it is sizing the capacity to demand. But within that capacity, now there is a fundamental restructuring that allows us to really improve our service on our core IP business, improve density across all of our networks, and then essentially bring to a lower cost point and access some of our Ground networks that are really unparalleled.”

FedEx has been working to right-size and restructure its air network throughout the year as volume and demand continue to plummet. Earlier this year, the parcel carrier announced plans to lean more on third-party carriers for less urgent shipments. In March, FedEx combined its Ground and Express units to advance its $6 billion cost-savings goal.

Later in June, FedEx retired 18 freighters as part of its cost-cutting initiative in addition to reducing Transpacific and Transatlantic flying to match demand.