If you visit a foreign country but don't take time to learn even basic phrases, getting around can be difficult. It's the same thing when operations managers visit the land of finance. Without some basic knowledge of the language, it's going to be hard to get things done.

Many operations managers don't get a deep understanding of finance during their education and early careers, so they may lack the background when they reach higher levels of management.

However it's vital to know at least enough of the language to ask where the bathrooms are and understand the answer. Financial concepts such as budgets, cash flow and depreciation are basic vocabulary that every operations manager should know.

Why financial knowledge matters now

Operations managers must be able to speak and understand enough finance to contribute to the success of their organization. Otherwise, they may not be able to influence the company's strategic investments and may find themselves without a seat at the table when strategic decisions are made.

"If they're unaware of the financial picture often they'll end up frustrated because they can't move forward the projects that need to move forward," Stephen McCaskill, controller for the Institute for Supply Management and a member of Financial Executives International, told Supply Chain Dive. "By understanding the budget and the cash flow of an organization, they can bring a lot of extra value by helping with strategic planning, especially for major investments."

In some cases, companies make operations decisions for economic reasons. Tesla located its Gigafactory for batteries in Nevada "not because it's the best place in the world to build batteries, but because of the tax incentives," Dale Rogers, professor of logistics and supply chain management at Arizona State University’s W. P. Carey School of Business, told Supply Chain Dive.

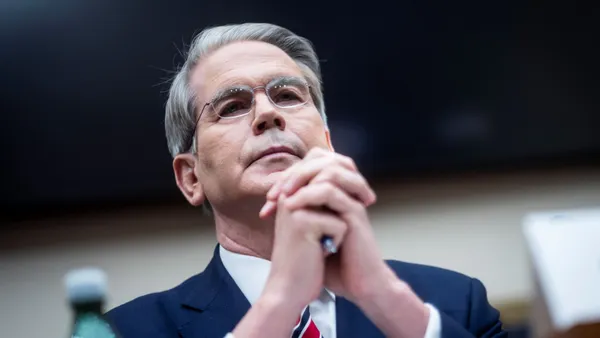

"The information finance is giving you may not make sense, so work together to boil it down."

Stephen McCaskill

Controller, Institute for Supply Management

Rogers said the big picture cost savings, such as supplier pricing and tax incentives, are as important as reducing internal costs. "Operations managers really need to understand those macro issues; otherwise they're going to be left out of the decisions, and they're only going to be executors, not deciders," he said.

Managing overhead costs like inventory and supplier payments are more important than ever as companies look for ways to fund expansions or enter new markets. Stretching payment terms to 120 days is not unheard of, and shifting to just-in-time inventories helps cut storage costs.

Jones says operating capital is becoming supply chain capital, in which companies use savings generated from their supply chain to fund the organization. "Operations managers must look upstream in the supply chain to see how they can use suppliers to help finance things," Jones said.

"They're going to be left out of the decisions, and they're only going to be executors, not deciders."

Dale Rogers

Professor of Logistics and Supply Chain Management, Arizona State University’s W. P. Carey School of Business

Supply chain managers can track the financial health and stability of critical vendors to manage risks. "If you're single sourced from one supplier and they're not financially stable and suddenly are out of business, you're in trouble," McCaskill said.

Trade wars are contributing to supplier uncertainty, and companies are looking for suppliers in Vietnam and other countries to replace those in China subject to tariffs.

"The operations and supply chain folks have to understand what the options are and what are the financial consequences of moving sourcing and they have to be more creative," Jones said.

Learning the ABCs

While no one expects an operations manager to become a full financial expert, there is basic information they should understand about their company.

Overhead costs

What it means: Fixed overhead includes the costs of running the business, such as utilities, real estate, taxes, insurance and other costs that don't vary with production levels.

How it helps: Knowing the elements of overhead help an ops manager "understand where money is going and what tradeoffs might be needed to improve efficiency, productivity and customer service," Bob Collins, senior director of learning and development at the Association for Supply Chain Management, told Supply Chain Dive.

Inventory turns

What it means: A measure of the number of times inventory is sold or used over a period time, usually a year.

How it helps: Tracking inventory turns can help an operations manager understand inventory levels to reduce costs and maintain or improve customer service. The company can then identify fast- and slow-selling products and adjust the pace of manufacturing. Otherwise, slow-selling inventory can build up over time, leading to higher costs that reduce profitability

Profit margins

What it means: The amount a company earns after paying the expenses of operations. In addition to tracking it at the organizational level, operations managers can track it by product or line of business level as well.

How it helps: Tracking profit margins at the product level helps the Ops Manager know how Ops is contributing to the bottom line and reveals areas of possible improvement, or whether a product or service is worth focusing on or dropping.

"Gross profit by product can be beneficial because if you have products that are hot sellers but are low profit, those are the ones that you want to focus on," McCaskill said. "You need to find ways to streamline procurement, manufacturing or shipping of that product, which can save a product line and help a company financially."

Operations managers can tap a variety of resources to learn the language of finance. An internal mentor is one way to start. Associations offer training courses, sometimes as part of certification classes, such as the Institute for Supply Management's Certified Professional in Supply Management designation. Online training courses are available, as well as programs at the university level.

The problems with financial reporting – and how to solve them

Financial reporting usually focuses on results geared toward senior management and external audiences. Standard tools such as profit & loss statements don't always provide the right level of detail operations managers need.

"Twenty years ago, it was not uncommon for finance to not be collaborative. Today they're looking to bring value, they're looking to increase the performance of the organization," McCaskill said.

Operations managers should ask for reports or information that reflects the decisions they make.

"The information finance is giving you may not make sense, so work together to boil it down so either I can understand your report, or we can build a report that works better for me," McCaskill said.

This story was first published in our weekly newsletter, Supply Chain Dive: Operations. Sign up here.