Editor’s note: The rail border crossings were officially reopened Dec. 22. See an update here.

When U.S. Customs and Border Protection announced on Dec. 17 it was closing two vital railroad bridge crossings in Texas the following day, shippers and freight brokerages immediately recognized fast action was necessary to minimize delivery disruptions.

Problems at major trade border crossings are familiar to C.H. Robinson. Shortly after customs officials announced the closure, VP for Mexico Mike Burkhart knew the brokerage giant’s customers would be inquiring about alternatives by 8 a.m. Monday.

“If you’re any kind of manufacturer that produces a high volume of goods daily, you need to keep your lines running and your product flowing even when these all-too-common disruptions happen at the border,” Burkhart said in an email to Supply Chain Dive. But C.H. Robinson was prepared and had contingency plans in place.

The brokerage assisted some of its automotive customers with larger bulky shipments by diverting freight to alternative crossings, Burkhart said. Other options also included moving loads onto trucks or planes.

Alternatives for shippers

There are things to consider when transferring a load from mode of transportation to another.

A C.H. Robinson customer has dozens of freight-filled railcars crossing the border daily, Burkhart said. Shifting a load from one railcar translates to three truckloads.

Time is another factor when weighing options to redirect freight movement, said Jason Mansur, vice president of enterprise partnerships at Valley Companies, a Hudson, Wisconsin-based third-party logistics provider.

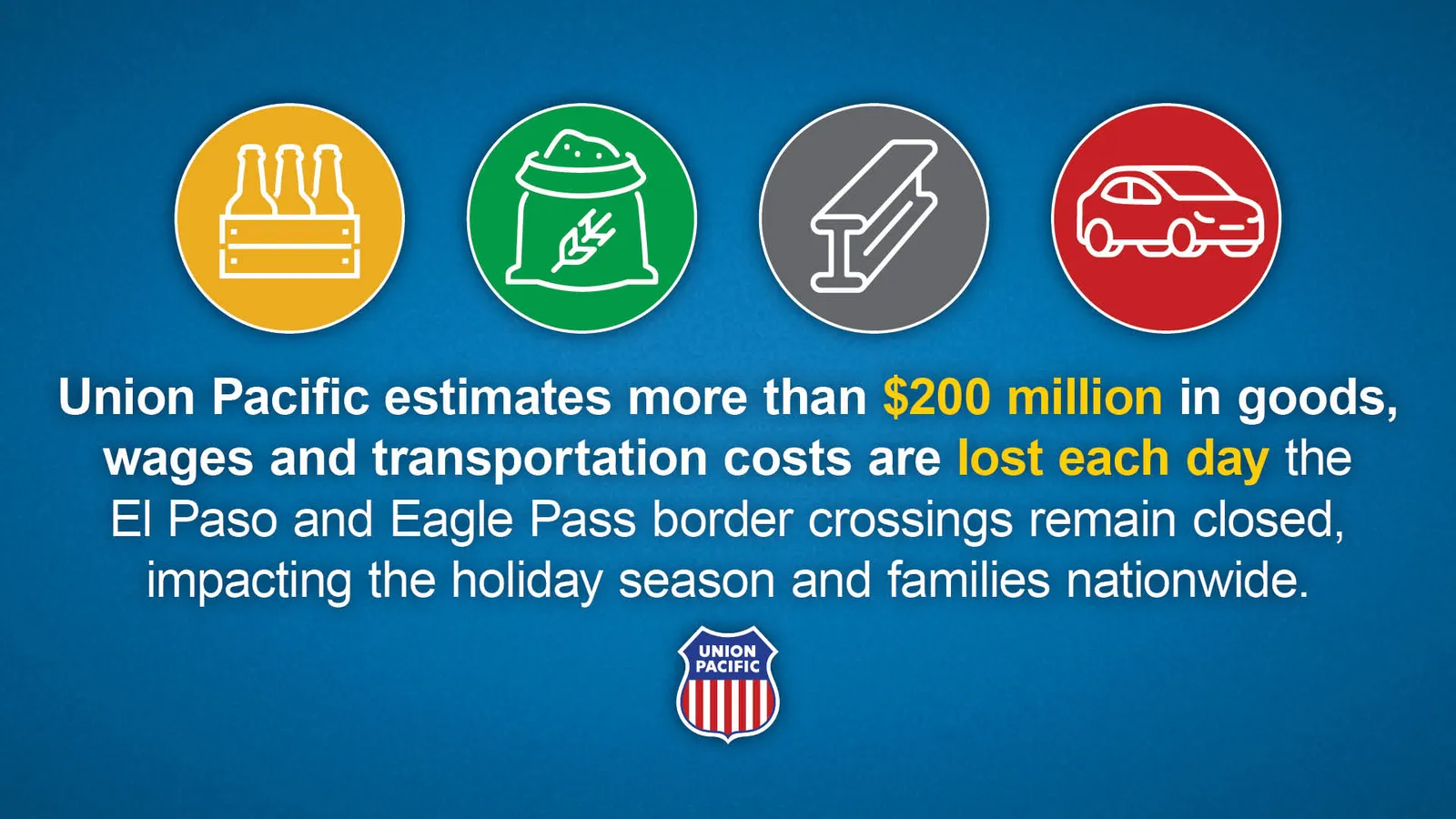

The shutdown of the border rail crossings at Eagle Pass, Texas and El Paso, Texas will have a significant impact on movement of goods, Mansur said in an email to Supply Chain Dive, noting every minute of delay can add a significant amount of costs to shippers, carriers and the broader economy.

Shippers dependent on open transit at the border should have plans in place to address closures, Mansur said.

Depending on the commodity, an option may be to create an emergency safety stock or sourcing alternative. This may include placing orders with existing suppliers to move via different modes such as over-the-road truckload or air, which provides greater flexibility for routing at the time of an order being placed.

“While the near-shoring effort to Mexico has positively impacted many organizations, a robust procurement and supply chain organization should have alternative suppliers to support any gaps,” Mansur said. It could include domestic suppliers or suppliers from other countries, depending on the customer.

Inventory management also will be critical during the closures, he said.

“Knowing that these crossings are suspended, will the existing inventory on hand and adjusted future lead-time support the current requirements,” Mansur said.

Companies who leverage just-in-time inventory would be put into a situation to react faster than companies who leverage alternative methods of inventory management, he said.

Delays can be costly

Burkhart said the closures are creating freight bottlenecks.

The four truck lanes at Eagle Pass remain open as well as the six truck lanes in El Paso but carriers are reporting wait times of between 10 and 12 hours, he said. The brokerage has rerouted some trucks to Laredo, Texas, where it recently opened a new 154-door cross-dock facility, which is designed for faster transloading activity.

“So far we’re not seeing backups at Laredo, but it’s only a matter of time if these rail crossings remain closed,” Burkhart said.

A spokesperson for U.S. Customs and Border Protection reached Tuesday morning by Supply Chain Dive provided no timetable when the rail crossings could reopen. The last rail bridge closure at Eagle Pass occurred on Sept. 20 but operations resumed on Sept. 23.

Once customs officials reopen the bridge crossings, it will take time before trains can begin rolling again, a Union Pacific spokesperson said in an email to Supply Chain Dive. About 45% of Union Pacific’s cross-border business traverses the trade gateways at Eagle Pass and El Paso.

“We’re doing everything possible to stage, but the longer this lasts the more difficult and time-consuming (it will be) to resume operations,” the Union Pacific spokesperson said.