When the furniture maker Noble House filed for bankruptcy last September, its story of financial collapse reflected the wild, wearying ride for much of the industry since the onset of the pandemic.

Sales for the sector ballooned early on during the COVID-19 pandemic. Giving the industry a boost were consumers outfitting home offices for remote work and redecorating the homes they were so often bound to as they tried to avoid contagion. To take Noble House as an example, its sales rose 48% in 2020 and 11% in 2021.

But by the end of 2021, sales for the manufacturer had begun to decline from their pandemic heights at the same time as freight costs skyrocketed amid port snarls, container shortages and congestion in ocean shipping. Inflation, long lead times and rising costs for inventory all made for a financial crisis.

Noble House wasn’t alone in filing for bankruptcy amid those challenges. Furniture maker and retailer Mitchell Gold Co. shut down in August and soon filed for bankruptcy, leaving a nightmare for customers and logistics servicers in its wake. Another furniture maker, Klaussner Home Furnishings, shut down at around the same time. The furniture retailer Z Gallerie also filed bankruptcy and liquidated its footprint last fall.

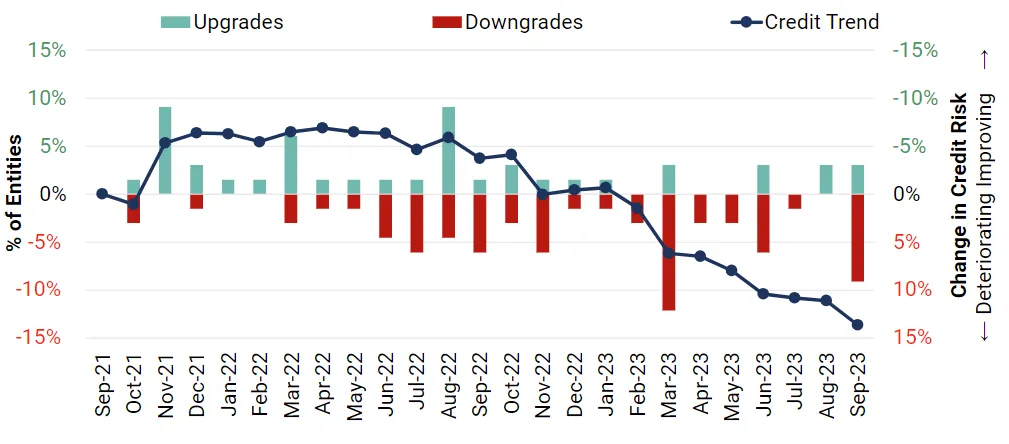

By September 2023, a credit risk index for the household goods industry deteriorated by 15% since the start of the year, according to Credit Benchmark data provided to Supply Chain Dive.

Data from analysis firm RapidRatings shows that average Core Health Scores, which measure medium-term operating strength and efficiency, fell in 2023 by 8.5% year over year across public and private companies in the furniture sector, hitting the lowest point in the past five years. Some of the largest declines came from firms in the forest product and chemical sectors within the furniture sector.

Meanwhile, RapidRatings’ Financial Health Scores, which tracks short-term default risk, fell by 3.8% YoY for private and public firms in the furniture sector in 2023 — also hitting their lowest mark in the past five years.

Evolving supply chain challenges

Furniture as an industry was hit especially hard by pandemic-era supply chain disruptions.

Bulkier, heavier items are always harder to ship. And when cargo ships filled up and ports backed up, air shipping wasn’t really an option. Mitchell Gold and Noble House both cited lead times in their supply chains as operational complications that contributed to financial crisis.

Today, many of the remaining challenges are related to managing excess inventory, following widespread sales declines.

Rick Jordon, a senior managing director in FTI Consulting’s business transformation practice, pointed to warehousing as an ongoing challenge and cost for the sector. “We're still in that great destocking of the post-COVID era, so warehouses in North America seem to be full,” Jordon said.

Supply costs are also haunting some in the industry. “We've been helping clients out that pre-bought from suppliers, because they didn't know when and how long it would take to recover” from inflation, Jordon said.

Others signed long-term contracts to try to hedge against further large price increases. “They locked in their lumber or leather goods at a higher price,” Jordon said.

And then markets shifted in 2022. Commodity prices receded from their peaks, and consumers pulled back on purchases. The combination of lingering high costs and weak demand have added pressure to what was already a tough space to compete in.

“There’s low margin in furniture at the end of the day,” Jordon said. “It’s a cut-throat business.”

When suppliers fail, disruption and opportunity arise

In that environment, there have been winners and losers. “It's a tough industry out there, and in our highly fragmented market, there's been a decent number of both manufacturers and retailers that are leaving the business,” La-Z-Boy CEO and President Melinda Whittington told analysts in November.

When furniture suppliers fail, the ramifications can be felt upstream. Big Lots faced shortages last year after the manufacturer United Furniture Industries — previously Big Lots’ largest vendor — shut down abruptly in late 2022.

While problematic for retail supply chains, those bankruptcies and liquidations can be a boon to healthier suppliers in the space. Cowen analysts in August noted that Mitchell Gold’s liquidation could benefit other sellers such as Arhaus, Crate & Barrel and Pottery Barn, among others.

La-Z-Boy’s chief acknowledged opportunities for the furniture brand created by liquidated manufacturers.

“Across some of our other smaller brands, we're making sure that we're mobilizing to help retailers that have lost some of their supply sources as manufacturers have gone out,” Whittington said. “If other channels close up, they're looking at us.”