It’s not all that often that retailers get worked up over public policy. But as first quarter earnings results are trickling in, so are concerns about the GOP's proposed 20% border adjustment tax on imports.

The provision, which is being floated as part of House Republicans' “A Better Way” tax plan, is making retail executive heads spin — and for good reason. Retailers have a lot to lose if the proposal becomes law: RBC Capital Markets analyst Scot Ciccarelli found that the earnings risk to six major U.S. retailers could result in a $13 billion blow to their balance sheets, while Best Buy alone could see its annual earnings completely wiped out by such a tax.

While the plan is still in flux, retail executives and trade groups like the National Retail Federation (NRF) and the Retail Industry Leaders Association (RILA) are pushing full-steam ahead on campaigns to inform members of Congress and consumers of the potential unintended consequences of the idea.

“In the last decade — and I can speak to it because I’ve been here for 10 years — there has been no public policy issue that has energized the retail industry like this,” Brian Dodge, senior executive vice president of public affairs at RILA, told Retail Dive. “At all levels, this would have a profound effect on the businesses, but most importantly on consumers. Companies that have not historically heavily engaged in public policy are doing so now because of the scale of this threat.”

“In the last decade — and I can speak to it because I’ve been here for 10 years — there has been no public policy issue that has energized the retail industry like this.

Brian Dodge

Senior Executive Vice President of Public Affairs, RILA

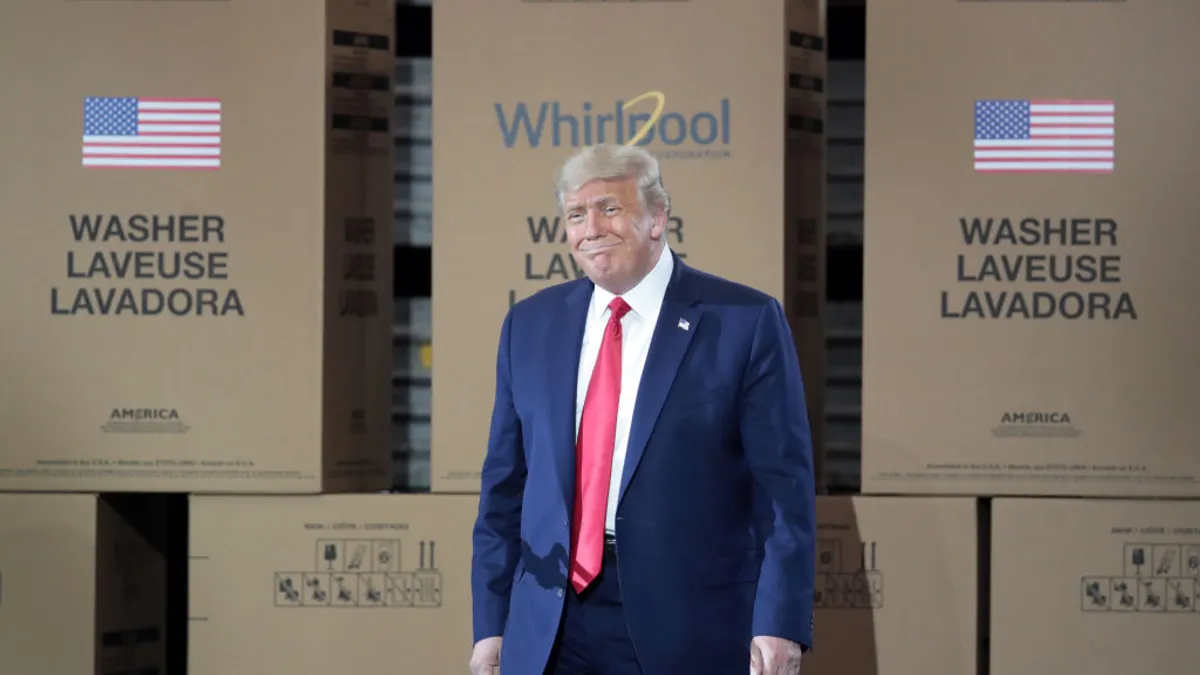

The proposed border adjustment tax (BAT) certainly has the attention of Best Buy CEO Hubert Joly, one of eight high-profile retail CEOs to sit down with President Donald Trump in February to express their concerns about the proposed tax. Joly seems to think those efforts are working.

"I think there are a growing number of people in Washington that understand [the border adjustment tax] is a risky gamble with potential devastating consequences for American families," Joly said on a recent call with reporters. "If I had to place a personal estimation, it would be that the BAT is not going to happen."

Despite assurances from Joly and others in the industry, the proposal stands a real chance at making it into the final tax reform plan, expected to be up for a vote later this year: New Treasury Secretary Steven Mnuchin has promised that tax reform will be passed by August, with Congress first prioritizing the repeal of the Affordable Care Act and the passage of a federal budget. For now, many retailers are proceeding in a state of uncertainty, anxious to figure out the proposed border adjustment tax's impact on their supply chains and bottom lines — and what they can do to stop it.

Behind the border adjustment tax

While many retailers and trade groups are just starting to voice their concerns against the BAT, the proposal has been in the works for months.

Spearheaded by Speaker Paul Ryan (R-WI), House Republicans first floated the controversial border adjustment tax as a part of tax reform last summer. The plan proposed a 20% tax on all imports, while exports were exempt, therefore creating a destination-based tax. The plan would generate roughly $1 trillion dollars over the next 10 years, according to estimates from the Tax Foundation, and partially finance the revenue lost from lowering the corporate tax rate from 35% to 20%, which is also included in the tax reform plan.

Proponents of the tax reform plan argue it will broaden the tax base, prevent profit-shifting to countries with lower corporate tax rates and bring manufacturing back to the United States. Additionally, they predict that the move would result in a stronger dollar, which could offset the effect on importers.

House Ways and Means Committee Chairman Kevin Brady (R-TX) is a strong supporter of the plan. Despite clear opposition from certain trade groups, including retailers, automakers and oil refiners, he believes that tax reform will pass with the BAT intact before the end of the year. Just this week, Chairman Brady called the BAT "a given" on CNBC's Squawk Box. "My sense is that border adjustability has become a given. That it will be part of the final tax reform plan and now the discussions are how can it be designed in transition in a very positive way for importers," he said.

Steve Bannon, President Donald Trump’s chief strategist, has given his thumbs-up to the plan, but Trump himself has not yet taken a clear stance on the tax, according to media reports. Trump previously said the tax is “too complicated” and instead spun the idea for a border tariff, which would tax importers up to 35% and lower the corporate tax rate to 15%.

“Retailers expect to pay as much as 10 times what they are paying in taxes under the border adjustment tax. So, this is bad.”

Brian Dodge

Senior Executive Vice President of Public Affairs, RILA

Opponents of the GOP-proposed provision have been vocal, however, leaving the brain behind the BAT, Alan Auerbach, director of the UC Berkeley Center for Tax Policy, to defend his idea. “People who are concerned of the health of the retail sector should look around the world at value added taxes, which are very much like the BAT,” he said in a recent interview with Bloomberg. “Retail sectors are doing just fine in these countries and that wouldn’t be the case if the projections that the opponents are coming forward with for the U.S. provision were true.”

Auerbach acknowledged that the tax would create winners and losers. But he says the losers won’t be importers — they’ll be the companies that shift their profits to countries with low corporate tax rates, such as Ireland, which has a 12.5% rate.

Retail lobby groups argue that the industry would be far from “just fine” under the proposed provision. “The border adjustable tax has the exact opposite impact on retailer tax rates. It pushes [taxes] even higher, even with the statutory rate dropping to 20%,” RILA’s Dodge said. “Retailers expect to pay as much as 10 times what they are paying in taxes under the border adjustment tax. So, this is bad.”

Retail executives clearly agree. In February, more than 120 retailers and trade organizations launched a national coalition, dubbed “Americans for Affordable Products,” to argue that the tax would unfairly hit on consumers by raising the costs of clothing, food, medicine, gas and other household items.

The NRF is also concerned about the possible negative effects of the BAT, but David French, senior vice president of government relations at the trade association, recently said the tax is “hanging on by its fingernails.” Others, such as Senate Majority Whip John Cornyn, have said the proposal remains “on life support," casting doubt on its chances.

"There are really only a couple dozen supporters of this proposal. Most members of Congress are very concerned about it. They are not going to take a public position before the legislation is drafted, but in private, most of them are telling our members that they do not like it," French told Retail Dive. "They do not like the unintended consequences. They think there are risks associated with border adjustment that are not well understood. They do not believe currencies are going to adjust easily or quickly."

But the tax is far from dead on arrival — and retailers won't be quick to dismiss its chances. Senior tax executives from major retail companies, who sit on the NRF's taxation committee, are scheduled to sit down with members of Congress on Wednesday to discuss the tax proposal. While it's still unclear how many representatives are for and against the proposal, the retail lobby is gearing up for a fight — and for good reason, too.

The impact of the border adjustment tax on retailers

The border adjustment tax has the power to punish consumer wallets and retailer bottom lines. Retailers most at risk of the BAT include importers with high domestic revenues, especially those in the footwear and apparel space, who could see earnings per share cut by at least 50%, according to a January Cowen & Co. report emailed to Retail Dive.

“We expect retailers with lower average unit retail prices to have difficulty passing cost increases to consumers and thus margins will be severely impacted in order to preserve unit volume,” according to the report. Apparel and footwear brands would have to immediately raise prices by the high-teen rates, which could spur profitability to drop by 20-70%, depending on a mix of business decisions.

Considering their dependence on imported goods, the retailers that would hit the hardest include: Target, Wal-Mart, Gap, Ascena, American Eagle Outfitters, Abercrombie & Fitch, Urban Outfitters and ELF Beauty. These companies are left with a difficult question if the proposed tax makes it into law: Can — and should — they pass the tax on to consumers?

"Millions and millions of consumers would see significantly higher prices if the bill is put through as it's currently structured."

Brian Cornell

CEO, Target

Oliver Chen, retail analyst at Cowen & Co., writes in the report that those with less commodities, strong brand equity and “newness” are better positioned to increase costs. Others could face larger challenges if consumers aren’t willing to shell out, however.

Considering that most of the products Target sells are imported from abroad, CEO Brian Cornell said at an investor day earlier this month that he expects prices to jump up between 15% and 25% under the border adjustment tax. "Millions and millions of consumers would see significantly higher prices if the bill is put through as it's currently structured," he said, via The Street.

But where there are losers, there are also winners: The report says TJX Cos., Ross Stores and Ulta are just a few of the retailers that are least at risk of the tax because they use vendors instead of direct production; therefore, they are better positioned to put pressure on merchants to incur some of the increased costs as opposed to taking them on in full themselves.

Time for retailers to act?

Even if the BAT passes along with comprehensive tax reform this year, the legislation would not go into effect until 2018 — so it’s not quite time for retailers to reach for the panic button.

But it never hurts to be prepared and have a better understanding of how individual supply chains could be affected by a border adjustment tax. Since Trump’s inauguration, Johan Gott, a principal at strategy and management consulting firm A.T. Kearney, said that retail clients have been coming to him, asking what they can do to be prepared. In response, Gott launched the Trade Wargaming initiative, a guideline that aims to help businesses react to various trade scenarios, including the BAT.

“We can’t reduce the level of uncertainty, but we can structure the alternative paths that the administration and Congress can take,” Gott told Retail Dive. “So we created five different scenarios around general archetypes and policies and then underneath that specificity around how things would turn out and what would be the impact on the company.”

“This is the time for companies to understand the impact on them, understand contingency plans to be able to quickly react and to engage with the policy makers."

Johan Gott

Principal, A.T. Kearney

The good news is that the BAT is nowhere near the point of enforcement, which gives retailers ample time to prepare. “This is the time for companies to understand the impact on them, understand contingency plans to be able to quickly react and to engage with the policy makers,” he said.

Retailers should take the BAT’s longevity seriously, but with a grain of salt, said H. David Rosenbloom, director of the International Tax Program at New York University and attorney at law firm Caplin & Drysdale.

“It’s way too early to put pen to paper on what to do. There are some aspects of it that will need to be fixed in some way, and the retail industry to the extent that the industry is dealing with imported product if it goes forward as it is now will be seriously affected, but who knows whether there will be exceptions,” Rosenbloom told Retail Dive. “We really don’t know whether it will go forward at all.”

What else is on the table?

It may not seem like it, but the BAT is not the only tax reform option on the table — and it is far from being the linchpin to the passage of tax reform this year.

In reality, some say, the proposal is too peculiar and contentious for many members of Congress to get behind. The BAT is a “radical departure from anything — not only that we have ever done but from what anybody else has ever done," Rosenbloom said.

“There’s nothing like it in the book. It’s a radical idea, and it’s got some benefits to it and that’s why it’s had as much shelf life as it has,” he said. “Let’s put it this way: It’s not totally crazy, but it’s got some real downsides and some real serious unknown aspects to it, which could create chaos and a lot of people are going to be concerned about stepping into the void on something like this.”

It has been 31 years since Congress passed major tax reform, yet there has been no shortage of ideas for how to overhaul the tax code since then, according to Rosenbloom, who served as international tax counsel and director of the Office of International Tax Affairs in the U.S. Department of the Treasury in the late 1970s. “It’s really simple,” he said. “If you want a lower rate, you’ve got to have a simpler, cleaner tax base, and then you raise the same amount of revenue.”

Raising revenue is where things get complicated. One such plan, originally introduced in 2014 by the then-Chairman of the House Ways and Means Committee Dave Camp (R-MI), aimed to lower the corporate tax rate to 25% by broadening the base, cutting some provisions and remaining deficit neutral, said the NRF’s French. But the plan had several problems of its own, receiving backlash from industry groups and ultimately stalling before a vote in committee.

French says the BAT doesn’t hinge on pro-growth tax reform, but if politicians still expect to pass tax reform this year, they don’t have much time. "The Camp draft could be a starting point and you could make some changes and probably get the rate to 23% to 25% and probably get a strong tax bill," he said. "You don’t need border adjustment to get to pro-growth tax reform. You don’t need border adjustment to make it deficit neutral. You can do it by making other choices in the way you write the bill."

It’s important to take a step back and consider that the BAT is only one piece of the House proposal, RILA’s Dodge said. “The Senate will produce a proposal — and I’m pointing to the skepticism expressed by many senators — and then the White House will have an opportunity to shape a proposal as well,” Dodge said. “There’s a lot of emphasis placed on the BAT as a component of the House proposal right now, but that’s because it’s the only one out there for us to look at. There will be more and we will be able to react to those in time.”

For now, retailers are left in the dark. But Rosenbloom says they shouldn’t lose too much sleep over the plan in question. “As of today, I would say the chances of [the BAT] getting passed are pretty low,” he said. “But who knows? I’m a tax person, but I am not necessarily a great predictor of what Congress is likely to do.”