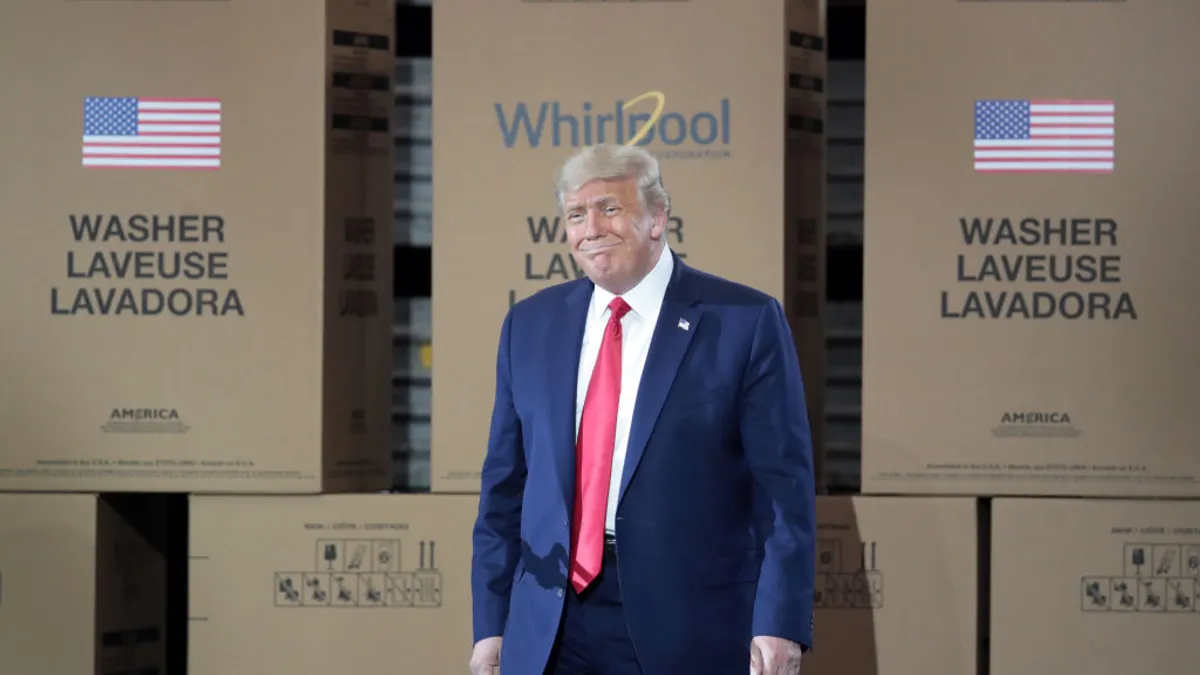

Trump's administration has been a rollercoaster ride for the food and beverage industry.

With new tariffs announced in tweets, trade agreements awaiting approval and mixed signals from the White House, the last two years have been filled with ups and downs.

From Mexico and Canada to China and Japan, President Donald Trump has focused on tackling — and instigating — trade disputes across the globe, which have rocked the food and beverage industry. Just this month, Trump has threatened to slap escalating tariffs on Mexican imports and defended his escalating tit-for-tat tariff strategy with China in the ongoing trade war.

A recent study found China has been lowering tariffs for other countries so it can increase retaliatory duties on U.S. products. These trade battles are ongoing, leaving the food industry with difficulty exporting products, which leads to financial burdens and dwindling trust.

Although the industry has cheered deals like the United States-Mexico-Canada Agreement, which still hangs in the balance awaiting congressional ratification, there is mounting concern about rising costs and challenges resulting from tariffs. Analysts and trade groups representing food and beverage told Food Dive it can be difficult to keep up with the shifts in policy as the country has become more partisan and trade has become more unpredictable.

Sean McBride, founder and principal of DSM Strategic Communications, who has observed food policy through many administrations, said trade disruption has hampered manufacturers and farmers, and Trump's policy moves are difficult to foresee.

"Like so many things during this presidency, I would say that food policy under Trump has been both pragmatic and inconsistent," he told Food Dive. "The constituents that are regulated by this administration in some ways are left guessing which way the wind is going to blow."

The end results of this unpredictable policy are being felt in the rural heartland. Farmers are facing some of the worst business conditions in decades as Trump's trade war has amplified high interest rates and low prices. From chicken to pig farmers, many in the sector originally had high expectations for how Trump would help their industries. But many of those expectations have been met with these escalating tariffs as farmers' net income has continued to drop, plummeting about 45% since 2013, according to the USDA.

Trade has seen a lot of twists and turns in the last two years that have left the food and beverage industry struggling to keep up. USMCA has been waiting to be ratified for about six months. The trade war with China has been escalating for a year — though stock futures were up on Wednesday as U.S. Treasury Secretary Steven Mnuchin told CNBC that they're about 90% to a deal and he sees a path to completion. Other trade hurdles with Japan and the European Union also snarling international trade.

Here's a look at the administration's biggest impacts to the food industry in trade during the last year.

USMCA awaiting passage

A big milestone for the Trump administration was reaching a new trade pact between U.S., Canada and Mexico. The United States-Mexico-Canada Agreement (USMCA) was proposed Sept. 30, and would replace the 1994 North American Free Trade Agreement if ratified by lawmakers in each of the three countries.

Mexico was the first country to ratify the new agreement and now it is up to Canada's parliament and the U.S. Congress to do the same. But that might not be an easy task. Democratic lawmakers have slammed aspects of the USMCA, arguing it does not go far enough to ensure protection for workers and the environment.

"The constituents that are regulated by this administration in some ways are left guessing which way the wind is going to blow."

Sean McBride

Founder and principal, DSM Strategic Communications

The food industry largely praised the agreement and has anxiously awaited its ratification, although that may take a while. As a trade agreement, USMCA needs to first pass the Democrat-controlled House of Representatives. Speaker of the House Nancy Pelosi is responsible for scheduling it for votes and has said the chamber is "on a path to yes" — but members still aren't satisfied with the agreement.

Trump has previously threatened to pull out the 25-year-old NAFTA agreement if Congress does not ratify USMCA. Although it is unclear how that would play out, it could disrupt the global economy by hurting trade relationships and putting jobs at risk, according to a study by the Peterson Institute for International Economics.

Allison Rivera, executive director of government affairs for the National Cattlemen's Association, told Food Dive getting USMCA across the finish line is a top priority. Rivera said the cattlemen's association has great trade partnerships with its counterparts in Canada and Mexico. She said keeping those relationships and maintaining an agreement is vital.

Rivera said that as long as NAFTA is still in place, cattlemen can trade the same way they have for the last 25 years. But if Trump were to pull back NAFTA before USMCA gets across the finish line, cattlemen would probably feel some negative effects, she said.

The association has had conversations with members of Congress, especially those in border states, to show them how important cross-border trade is to the industry, Rivera said.

"We continue to push the message on the Hill and we hope that a vote will happen sooner rather than later," she said.

Michael Dykes, president and CEO of the International Dairy Foods Association, said trade is extremely important to the dairy industry. He said USMCA meets all three of IDFA's priorities: preserving market access to Mexico, improving access into Canada and getting Canada to eliminate Class 7 pricing. Now Dykes said he is working closely with Congress to line up support so the lawmakers can ratify the agreement before the August recess.

In a letter sent to Congress on June 11, more than 960 groups who represent the U.S. food and agriculture at the national, state and local levels — including IDFA — called on Congress to ratify USMCA. They argue it would improve market access for U.S. farmers, ranchers and food producers.

Jim Monroe, assistant vice president of communications at the National Pork Producers Council, told Food Dive he is also optimistic USMCA will pass Congress soon. He said the agreement is good for his industry, since it preserves zero-tariff pork trade in North America for the long term — a situation U.S. pork has benefited from in North America since the early '90s and has driven a "significant amount of growth" for the sector.

"Mexico was our largest export market by volume and free trade with them has been a big part of that. So we saw it as very good news when the agreement was signed [by executive branch leaders] last year. There are some obstacles, however," Monroe said.

Trade war with China continues to escalate

The U.S. and China — the nation's biggest trade partner — continue to be entangled in a complicated trade war. Mnuchin's Wednesday interview projects optimism that things may resolve soon, but analysts say that a resolution will come down to personal chemistry at a negotiation meeting between Trump and Chinese President Xi Jinping at a meeting this weekend on the sideline of the G-20 summit in Japan.

After months of threats to impose tariffs on China for what U.S. officials call unfair trade practices, Trump followed through last March with sweeping tariffs on $60 billion worth of Chinese goods. In retaliation, China imposed duties between 15% and 25% on more than 128 U.S. imports a month later — including several food products such as soybeans, dairy and pork.

A variety of foods and industries have felt the impact of the trade war with China, and many have pushed for change.

This month, 600 companies across industries penned a letter to Trump urging him to stop the tit-for-tat tariffs on China and end the ongoing trade war to prevent damage to the U.S. economy. As the Trump administration begins the process of the trade war's latest proposed escalation, with tariffs of up to 25% on $300 billion in products, hundreds of groups are begging the administration to spare them.

Hundreds of witnesses, some in the food industry, testified over the last week at the Office of the U.S. Trade Representative's public meeting on the proposed duties.

"We believe that additional U.S. tariffs on critical inputs and confectionery items will not be effective to obtain the elimination of China’s acts, policies, and practices related to technology transfer, intellectual property, and innovation, and instead will continue to cause economic harm to U.S. interests, including small and medium-sized businesses in our sector and American consumers," Liz Clark, senior vice president for public policy at the National Confectioners Association, wrote in a public comment submitted in June.

"One day if the tariff goes one way, your business benefits and you're winning. If that tariff or retaliation goes the other way the next day, then you're losing. It's hard to plan business practices and grow businesses and make investment decisions."

Michael Dykes

President and CEO of the International Dairy Foods Association

China has the potential to be a $23 billion market for U.S. dairy, Dykes said, but tariffs have hurt business.

"One day, if the tariff goes one way, your business benefits and you're winning," Dykes said. "If that tariff or retaliation goes the other way the next day, then you're losing. It's hard to plan business practices and grow businesses and make investment decisions."

China has been especially targeting the U.S. pork industry since the country is a major export market for the U.S. since pork is a staple of the Chinese diet, Monroe said.

The U.S. pork industry had record production last year and Monroe said this year is expected to also be record-breaking. But now, he said, the industry is seeing a "major hiccup" in the availability of some of their export markets.

"We're currently facing 62% tariffs [in China], which makes us noncompetitive relative to domestic producers in China, as well as [with] international competitors who export pork to China." Monroe said. "It's really tough to compete in that market at those kinds of tariff rates."

With African swine fever impacting pork supply in other countries, the trade war is costing U.S. pork producers an opportunity to export more to China. The 62% levy on U.S. pork has made the meat too expensive for consumers in China, while competitors like Brazil and Germany are taking advantage of the market.

"We certainly want to retain as much of our business as possible [in China], but when you have a tariff that’s five times higher than the standard, that’s a significant headwind," Joe Schuele, vice president of communications of the U.S. Meat Export Federation, told Politico this month.

Aluminum and steel tariffs still hurt beer industry

Manufacturing costs for food and drinks packaged in cans made from imported aluminum or steel increased last year when the Trump administration imposed tariffs of 25% against Canadian and Mexican steel and 10% against aluminum. That caused the other countries to institute retaliatory tariffs, impacting many industries.

In May, the U.S. agreed to lift aluminum and steel tariffs on Canada and Mexico, resolving a standoff between the neighboring countries. Canada and Mexico also agreed to drop their retaliatory tariffs against different products, from metals to food. About $15 billion worth of U.S. exports had been targeted under retaliatory tariffs, according to The Wall Street Journal.

Although the three countries agreed to drop the steel and aluminum tariffs as well as the retaliatory tariffs, which were seen as barriers to the passage of USMCA, there are still complications with other policies.

The Beer Institute and National Beer Wholesalers Association's recent biennial study showed the number of U.S. jobs in the beer industry decreased 40,000 since 2016 partly as a result of metal tariffs that have increased the cost of aluminum cans.

The Beer Institute's President and CEO Jim McGreevy told Food Dive the Midwest Premium, a shipping and handling fee for the producer of the aluminum to get the metal from the facility to the beer can, has been exacerbated by the tariffs, increasing as much as 130% at certain points during 2018. The Midwest Premium more than doubled following the introduction of tariffs on imported aluminum, which caused big cost increases for beer and beverage aluminum containers. It has stayed that way, despite the cancellation of aluminum tariffs.

"The government gives with one hand and takes with the other."

Jim McGreevy

President and CEO, The Beer Institute

The Aluminum Pricing Examination Act was proposed in Congress to give the Department of Justice and Commodity Futures Trading Commission oversight for the price-setting mechanism for aluminum, including the Midwest Premium. It is still early in the legislative process and the bill hasn't gone through committee, but it could help alleviate tariffs for the beverage and beer industry, which has advocated for the legislation.

Although the exemption for Canada and Mexico on aluminum is helpful, the Midwest Premium is a "significant concern to beer brewers," McGreevy said. He said both big and small brewers have talked publicly about the negative impact of tariffs. He gave the example of Summit Brewing, a small operation in Minnesota that's been operating 30 years.

"The owner of that brewery tells me that his aluminum costs have increased by $160,000 a year. That's significant for a small brewer," he said. "We see this across the country. We understand what the president and the administration are trying to do, but it has an impact on end users like beer."

The Trump administration has brought some good news for McGreevy's industry as the Tax Cuts and Jobs Act reduced federal excise taxes on beer. But then the tariffs went into effect March 2018.

"The government gives with one hand and takes with the other," he said. "These policies affect our ability to innovate. They affect our brewers' ability to build new facilities, to improve the current facilities. They impact the business."

Many industries are hoping more trade agreements will come soon and the crippling retaliatory tariffs will subside in the process.

"We've seen a decline over the last couple of years in the value of our exports," Monroe said. "We're anxious for an end to trade disputes so we can get back to competing effectively on the global arena."

How will this play out in 2020?

With the 2020 election around the corner, a lot of these issues could impact Trump support from farmers and manufacturers.

"That trade disruption is interesting from the standpoint that it has affected growers and manufacturers in some instances, and those are constituencies that, by and large, would be favorable toward the Trump administration," McBride said.

Although some farmers feel disappointed by the trade war, many still would vote for Trump. In March, CNBC cited a CNN/Des Moines Register poll of registered Iowa Republicans, many of whom are farmers. Of those respondents, 81% approved of how Trump is handling the presidency and about two-thirds said they would vote to re-elect him.

Despite the early numbers, Trump will likely need to work to win over the agriculture sector again. McBride said tariffs and hurdles with trade agreements have hampered farmers and manufacturers, which are generally two of the president's stronger constituencies.

Monica Mills, executive director of Food Policy Action, agreed. She said she is "very, very concerned about what this administration is trying to do and what it continues to try to do" as trade policies and regulatory processes become more partisan.

"I think it is going to be a very interesting process as the election gets closer in terms of how farmers feel about how they've been treated through the trade process," Mills said.