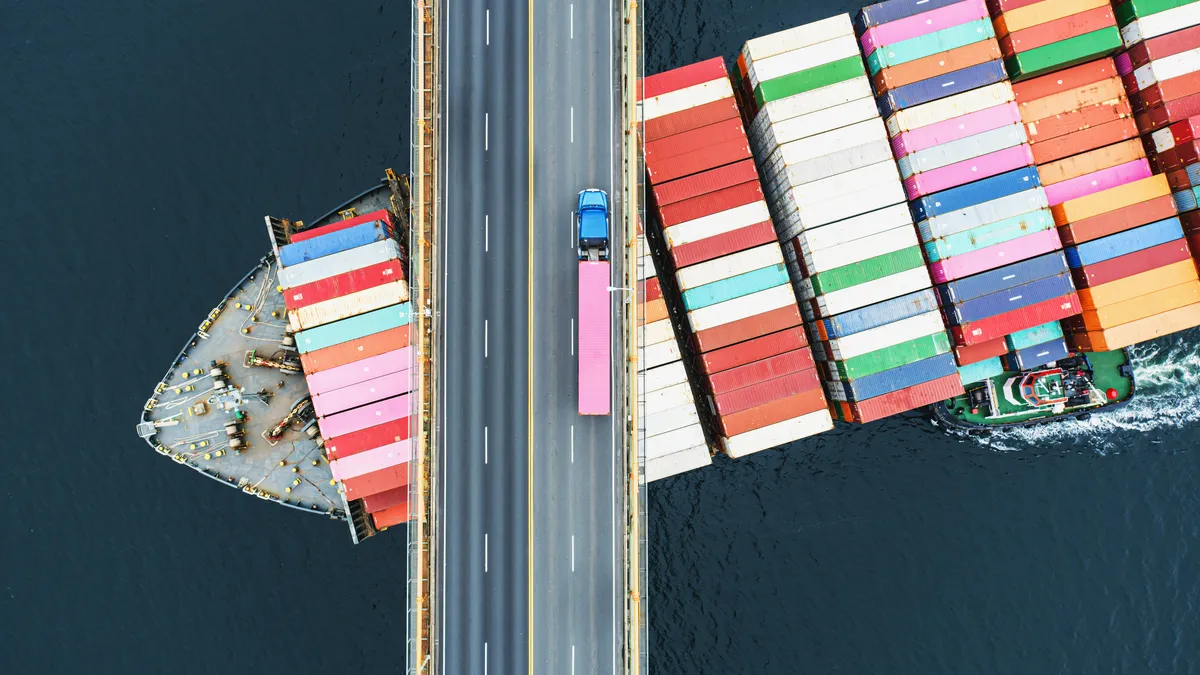

Tracking a truck across the country is easy for a shipper. Easier, at least, than tracking an intermodal container.

Making it easier to determine when an intermodal shipment will arrive will require carriers — ocean and rail — to get better at data sharing, industry experts said during a Thursday webinar hoasted by the Intermodal Association of North America.

It shouldn't be a surprise that intermodal shippers want more visibility, Scott Friesen, senior vice president of strategic analytics at Echo Global Logistics, said during the event. They can order a pizza and see it every step of the way, but they can't find out where their $30,000 container is located.

This is a sign that the expectations of B2C business are "drifting over and translating in the B2B space," Friesen said. The demands for visibility have also evolved over the years. It's no longer good enough to know a container is in a particular city.

Changing visibility demands

"Today we want to know the precise location within a marine terminal," Eric Klein, the CEO and co-founder of Crux Systems, said during the event. "We don't want to just know that it's at Long Beach Container Terminals in LA. It's that fidelity that has evolved over time."

The spread of predictive analytics tools in supply chains has added another layer of expectation to the concept of visibility. It's not just about where — it's also about using data to provide estimates on a potential arrival time, according to Al Tama, vice president and general manager of container and port solutions at Orbcomm.

But the current state of the intermodal data-sharing environment has not yet matured to the point where carriers or other logistics partners are providing the necessary information to make this kind of visibility a reality, the panelists said. And recent research suggests there's still work to do in digitally connecting the intermodal supply chain.

"It becomes this black hole of planning information."

Eric Klein

CEO and Co-Founder of Crux Systems

"In recent years, freight transport research on [estimated time of arrival] predictions has focused on single modes of transport, especially on road transport executed via trucks," reads a paper published by German researchers in Business & Information Systems Engineering in May. "As a result, much of the data generated by today’s [intermodal freight transport networks] remains unused."

The authors of the paper, from Kühne Logistics University, attempted to create an appropriate model for ETA that allows for the prediction of containers in intermodal transport chains. The effort relied on data from railway operators, railway transport companies, inland terminal operators and weather services.

In the paper, the researchers were upfront: This is not easy. The flow of intermodal cargo is not linear and relies on scheduled (rail and ocean) and unscheduled (truck) transportation. This was an issue panelists in Thursday's webinar also highlighted.

Klein noted that the ocean and rail carriers have a lot of control in deciding if they actually load a shipment on a particular ship or train. The ocean carrier could roll the container, and the rail company could similarly hold it for another train, Klein said.

"It becomes this black hole of planning information," he said, noting that a train could leave for Chicago tomorrow or next week.

Then there's the question of missing a train, which can dramatically throw off an ETA for a container, according to the KLU researchers. To create an ETA, the researchers had to consider the wide range of potential arrival and departure times for each leg in the intermodal journey and how these distributions would change if a connection is missed.

The KLU model started out with 20 different predictors. But through the process of variable selection, the researchers whittled it down to the most important predictors for arrival time.

"It becomes clear that train properties and terminal properties such as capacity utilization and departure frequencies are much more important than environmental influences such as wind speed and container properties such as their weight or dangerous goods status," the paper notes.

Need for more data sharing

The KLU researchers noted that their model could be helpful for understanding and estimating the downstream impacts of delays at specific intermodal nodes. But their experience shows the importance of data availability and quality in the process of creating ETA predictions in the intermodal space.

Tama said he hears from customers that companies have more data than they're typically sharing with their partners, which can leave those partners in the dark in terms of intermodal visibility.

"Historically, there has been some reticence to share too much data, because it might expose maybe, let's say, some dirty laundry," Tama said.

But the beneficial cargo owner misses out on the ability to better understand their network when carriers hold back this data, he said. Some links in the supply chain might not even have good data to share, though, further compounding the issue.

"I mean, chassis is, to me, a perfect example," Klein said. "If you're managing your chassis fleet, I think even that party will say they struggle with understanding where their assets really are."

"Historically, there has been some reticence to share too much data, because it might expose maybe, let's say, some dirty laundry."

Al Tama

Vice President and General Manager of Container Port Solutions at Orbcomm

But there is reason to be optimistic. Information sharing has improved in recent years.

"When I started out six years ago ... your only option was to screen scrape data off of websites, and the access through API's has improved dramatically," Klein said.

Tama also noted that there are multiple efforts currently underway to tackle issues of data standards and quality in this space. He specifically highlighted work by the Digital Container Shipping Association and the International Maritime Organization.

And carriers have provided new options to customers in recent months to provide more of this data. Union Pacific launched a developer portal earlier this year to provide access to information on inbound and outbound rail shipments through three different APIs.

"On the API side ... we're working with our largest international carriers, so that we can have visibility to when they come in and instill confidence and trust in our service," Union Pacific Executive Vice President of Marketing and Sales Kenny Rocker said on the company's earnings call Thursday.

Building on these foundations of APIs and data standards to create an intermodal environment with greater visibility will help to alleviate some of the anxiety shippers experience in the information void that is intermodal shipping, Klein said.

"Visibility gives you that comfort of being able to communicate with the various service providers," he said.