Dive Brief:

- Companies seeking to create more resiliency in their supply chains are helping fuel strong logistics real estate demand, Prologis CFO Tom Olinger said on the company's Q4 earnings call.

- "The inventory to sales ratios are more than 10% below pre-pandemic levels," Olinger said. "Our customers not only need to restock at this 10% shortfall, but build additional safety stock of 10% or greater. This combination has the potential to produce 800 million square feet or more of future demand in the U.S. alone."

- Companies repositioning their supply chains for e-commerce orders and "overall consumption and demographic growth" are also aiding high demand, according to Olinger. Prologis expects vacancy rates will remain at record lows in its U.S. and international markets this year.

Dive Insight:

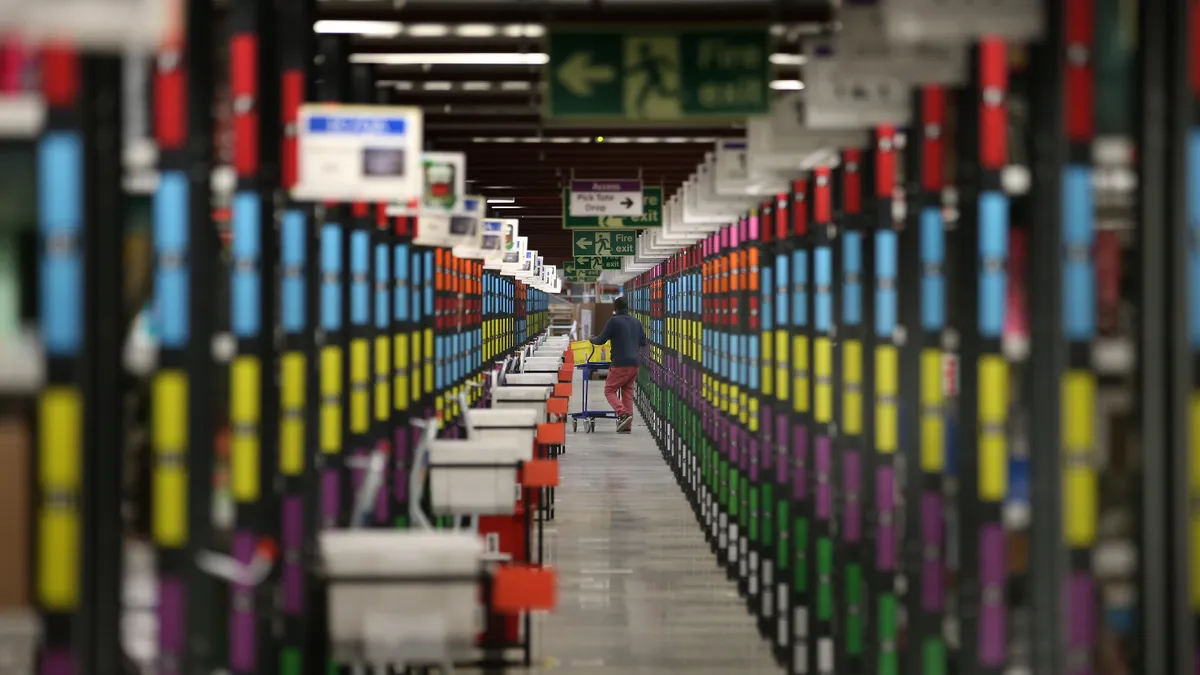

Companies are bolstering their inventories to insulate themselves from future supply chain shocks or to simply keep pace with consumer demand, which requires more storage space. But it will take some time for real estate supply to address the heightened need.

The U.S. industrial real estate vacancy rate dropped below 4% for the first time ever in Q4, according to Cushman & Wakefield. Demand is outpacing supply by nearly 50%, Carolyn Salzer, Cushman & Wakefield's head of logistics and industrial research for the Americas, said in a statement.

"Developers are setting new records on the pipeline yet falling short of meeting demand for space when it comes to deliveries due to pandemic related issues, particularly for warehousing and e-commerce facilities," Salzer said. "Until significant new supply is able to be delivered at the rate of demand, we expect tenants to continue to struggle finding the space they need."

The market is also seeing new tenants compete for real estate, especially in the e-commerce space. Amazon remains Prologis' top customer, with more than double the square footage than its second-largest customer, Geodis. But the company's tenant mix is diversifying. Prologis signed 357 new leases with 265 e-commerce customers last year, which Olinger said "are high watermarks."

Rents are climbing as this mix of companies battles for limited space. With supply tight, rental rates reached a new record of $7.39 per square foot last quarter, Salzer said. (Rents were $6.75 in Q4 2020.) But rising costs elsewhere in companies' supply chains means higher rents aren't a top concern, according to Olinger.

"Cost of drivers, cost of fuel, cost of transportation, all of those things are much bigger factors in terms of our customer's cost structure," Olinger said. "So, there is not as much sensitivity to the real estate cost."