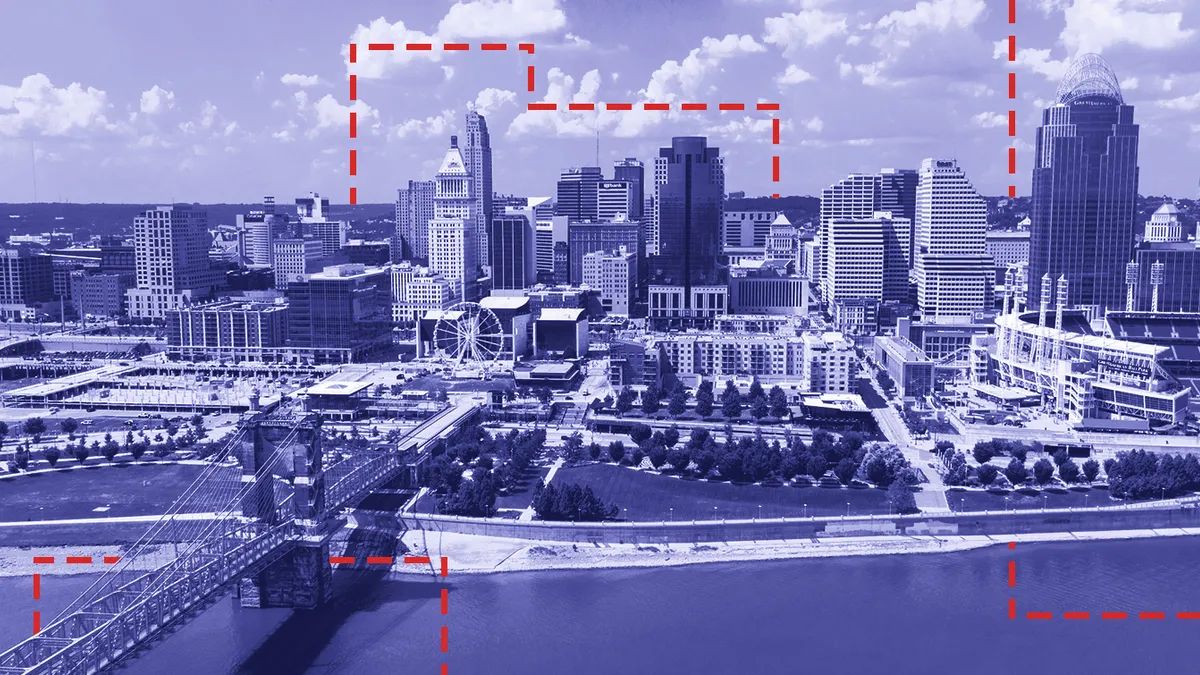

Cincinnati’s supply chain infrastructure is growing to new heights with Amazon Air’s $1.5 billion hub, set to open next year. Amazon has operated flights out of the Cincinnati/Northern Kentucky International Airport, known as CVG, since 2017. But in spring 2019, the e-tailer broke ground on its Air Hub in line with Amazon's "commitment to ensure fast, free shipping," according to a company blog post.

The project includes construction of a new ramp for aircraft parking, vehicle parking lots and a sortation building, as well as local roadway improvements, comprising the $1.5 billion investment.

The e-commerce giant's revved-up presence in the area has spurred other developments that are expanding infrastructure and logistical resources and growing the local supply chain network. Big players like P&G, Kroger and Cintas have dominated the city's scene, but now the little guys are getting in on the action too.

A growing list of small businesses and developers are swarming to the Cincinnati region, making use of the expanding industrial infrastructure, business-friendly policies and initiatives, and an educated workforce enticed by a relatively low cost of living. It's all buttressed by what first put Cincinnati on the map: its location.

Growing infrastructure and development

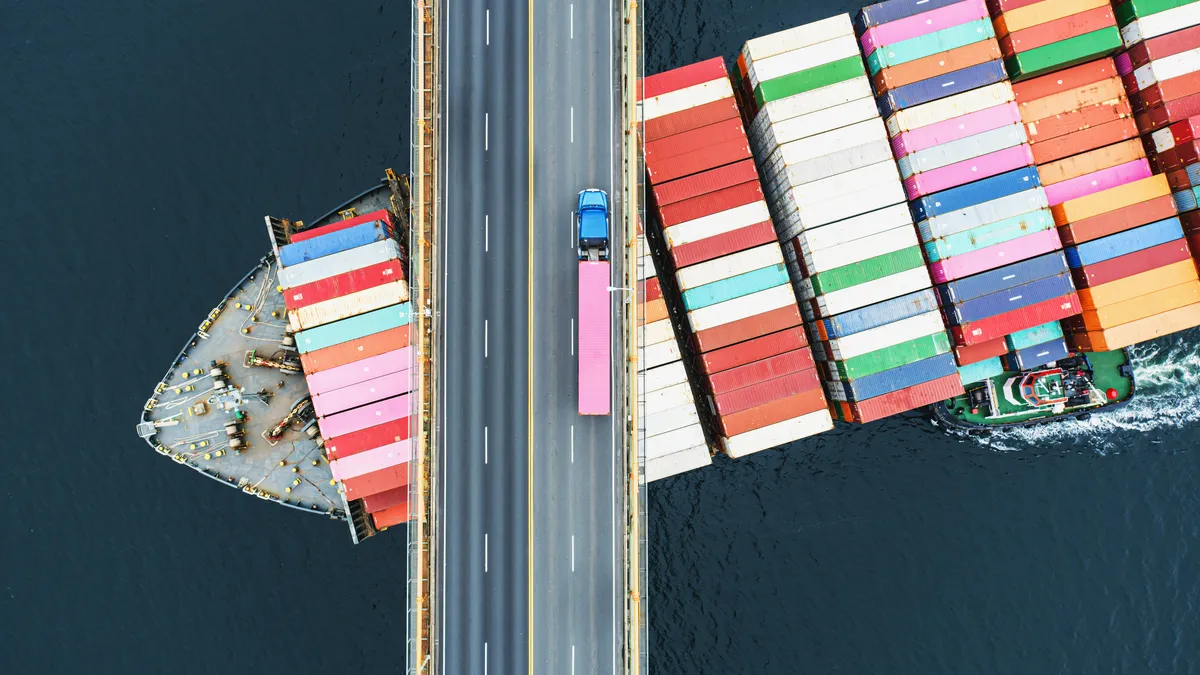

Cincinnati has the benefit of being at the heart of the Ohio-Kentucky-Indiana region — it was estimated in 2009 that more than 323 million tons of freight flowed through annually, according to the OKI Regional Transportation Plan website. The region's multi-modal infrastructure network of trucks, trains, barges and planes provides businesses big and small with ample shipping options.

Norfolk Southern and CSX link Cincinnati to the eastern U.S. and the rest of the Midwest, along with three intermodal terminals and three train classification yards, with area railroads operating on average 100 trains per day.

"Cincinnati can be a great logistics command center."

Rod Robinson

Vice President of Business Acceleration, Supplier Inclusion & Sustainability at Coupa Software

Interstate 75, one of the heaviest truck lanes in the U.S., and the region's major highway system, allow for 80% of the region's freight to move by truck. Companies like Total Quality Logistics (the second largest freight brokerage firm in the country) and family-run Verst Logistics are headquartered in the area, giving businesses of all sizes access to TL, LTL and intermodal offerings to transport a variety of goods.

The Port of Greater Cincinnati situated along the Ohio River is ranked as the busiest inland port in the U.S. by the U.S. Army Corps of Engineers. And CVG has emerged to be the fastest-growing cargo airport for the last three years in the U.S., according to industry experts.

The city is teeming with options for shippers, and the Amazon Air Hub announcement accelerated the pace of expansion in the Greater Cincinnati area, according to Mike Lowe, a senior vice president in CBRE’s Cincinnati office.

"We averaged 3.25 million [square feet] per year in industrial development in the previous four years leading up to 2017, and then have averaged 6 million [square feet] per year in the last four years," Lowe said in an email. He noted that the uptick has pushed development 10 to 20 miles in every direction outside of the core zone.

Michael Meyers, vice president and market officer of Prologis Cincinnati, said the steady increase of new, modern bulk Class A products has spilled development even farther out into the vicinity.

"Since 2017, a total of 18 million square feet of new product has come online and extended the map for logistics real estate as a whole ... as far south as 18 miles from [CVG] and approximately 45 miles north," Meyers wrote in an email, pointing to Prologis' build-to-suit 755,000-square-foot project for Bed Bath & Beyond in Monroe, Ohio, as an example. He puts the current investment amount for Boone County, Kentucky, where CVG is located, above $230 million.

Infrastructure improvements in the county are underway in anticipation of new traffic patterns driven by Amazon Air's facility.

A new interchange west of the airport along Interstate 275, two interchanges being converted into high volume interchanges south of the airport along Interstate 75 and road widenings are all designed to alleviate truck traffic and congestion for new areas of industrial development near the airport, Lowe said.

Along with Amazon Air, DHL also has a presence in the area with its International Americas Hub established at CVG in 2009.

New players come to town

The bevy of activity around CVG has caught the eye of smaller businesses looking to get in on some of the action.

Amify, a company focused on managing and boosting brands that operate on Amazon, opened up a second headquarters in Cincinnati — the other in Arlington, Virginia — to be close to the e-tailer's new air hub. The fact that other big names are a part of the local ecosystem made the decision to open up shop that much easier, said an Amify executive earlier this year.

Satco, a family-owned manufacturer of upper- and lower-deck containers and air cargo equipment for commercial cargo and passenger aircraft, established a presence in the area last year to expand services to its customers in the Cincinnati region.

"Satco’s investment reinforces the Cincinnati region as a national leader in logistics and distribution," said Kimm Lauterbach, president and CEO of REDI Cincinnati, per the organization's website. She added that the region continues to see the ripple effect of Amazon as other companies move to the area.

Amazon Air's volume has surged this year, while others have had to scale down due to global air cargo rates falling. The company has announced plans to increase its aircraft fleet to 82 by the end of 2021. Some are hoping that this boom in business will translate to more companies moving to the area, making Cincinnati a leader in technology-based logistics.

"I think the proximity to the Prime Air Hub is a true testament to what type of companies are going to be attracted to really support the entire Amazon ecosystem," Amify Chief Marketing Officer Sean Lee said, on Cincinnati Public Radio in 2019.

E-commerce has been the lifeline for many during this year's pandemic, and while growth was accelerated this year, many see the trend as here to stay, creating new possibilities for small businesses to cash in.

Incentives support growth

Recent economic encouragements by leaders suggest Cincinnati is banking on e-commerce growth projections to bring more companies there for the long run. Capital, infrastructure, research and development and tax credit incentives are all designed to get companies up and running as part of the local economy.

Ohio tax credits will allow Amify to add 90 new jobs over the next two years to keep pace as Amazon and its brand partners continue to grow in the area, Lee said in a video interview on YouTube. As it expands in size and operations, Amify will be able to provide a swath of services to Amazon sellers, including marketing, generating content and even storage of goods in its warehouse close to the air hub.

Centrifuse — a local company dedicated to supporting startups — hopes to make Greater Cincinnati the top startup hub and innovation center in the Midwest and U.S. respectively. Its strategy involves connecting startups with larger companies to drive innovation, while also encouraging entrepreneurs to start new businesses. Centrifuse sees the growth plans of local companies, like Amify, as an opportunity for smaller businesses to grow as well.

"When companies say that they're going to make a major shift, that means a lot of money is on the line. If we can get organized and build an ecosystem that supports that, that is a really big opportunity," Pete Blackshaw, CEO of Centrifuse, told Supply Chain Dive in an interview. Centrifuse has more than $90 million in venture capital investments and over 600 startups in its pipeline to create an ecosystem where innovaters want "to invest, grow and live," according to its website.

Blackshaw said Cincinnati needs to better tell its story so that businesses across the nation will know what the city has to offer. The story is that the region is the great supply way for the country. And with DHL and Amazon Air (if it ever flies internationally) it very well could be the great supply way for even more in the future.

"I don't have the precise scientific advantage, but we know that there are real cost efficiencies of being closer to the plane. No question. And a lot of other companies are going to reap the benefits of that supply cain center of gravity," Blackshaw said.

Opportunities in education and business development may prove pivotal in positioning the region to benefit from new economic and supply chain opportunities.

The University of Cincinnati has partnered with Kao USA, a manufacturer of premium beauty care brands, to provide the company direct access to the school's talent pool through the Cincinnati Innovation District — a collaboration to retain and attract talent by accelerating the creation of 15,000+ STEM graduates and $2 billion in research for the region. The public-private partnership was announced in March.

The following month, Northern Kentucky University announced a Global Supply Chain Management program to meet the needs of local employers, as the only accredited four-year program in the region. It started in August with 16 students enrolled.

"When companies say that they're going to make a major shift, that means a lot of money is on the line. If we can get organized and build an ecosystem that supports that, that is a really big opportunity."

Pete Blackshaw

CEO of Centrifuse

The Cincinnati Minority Business Accelerator won the Ewing Marion Kauffman Foundation Grant for $450,000 last year. The grant will be used to expand the accelerator's business pipeline and develop a strategy playbook for the entire area.

Rod Robinson, a vice president at Coupa Software, thinks this type of local investment and commitment to success, for the entire community, puts Cincinnati in a great place to seize the economic opportunities Amazon and others are creating.

"Cincinnati has the right to win," and is a great place for small business, Robinson said. And as small and large businesses are connected, precisely what Centrifuse is aiming to do, the benefit of the area's location, growing infrastructure and workforce may become more apparent. At least, that's the goal. "Cincinnati can be a great logistics command center," he said.

If there is a possible downside to all the growth, it could be too much of a good thing. Excitement swirling around Amazon's new facility and businesses securing property close to the hub can cause a challenge for others still wanting to get in.

"Developers’ interest in our market has been a constant for the last decade, but it is very difficult to find, acquire, go through entitlement, and build in our market, especially in Northern Kentucky around our airport," Lowe said.