Sure, Memphis has blues, barbecue and Elvis' Graceland, but those are merely perks for logistics and distribution companies. For them, the Tennessee city’s geography and infrastructure are the big draws.

"Memphis is one of the great logistics hubs in the world," Udo Lange, COO of FedEx Logistics, told Supply Chain Dive via email. "With the No. 1 air cargo airport on this side of the globe, five class-I railroads, the Mississippi river and major trucking corridors, Memphis provides the access FedEx needs to operate our global business."

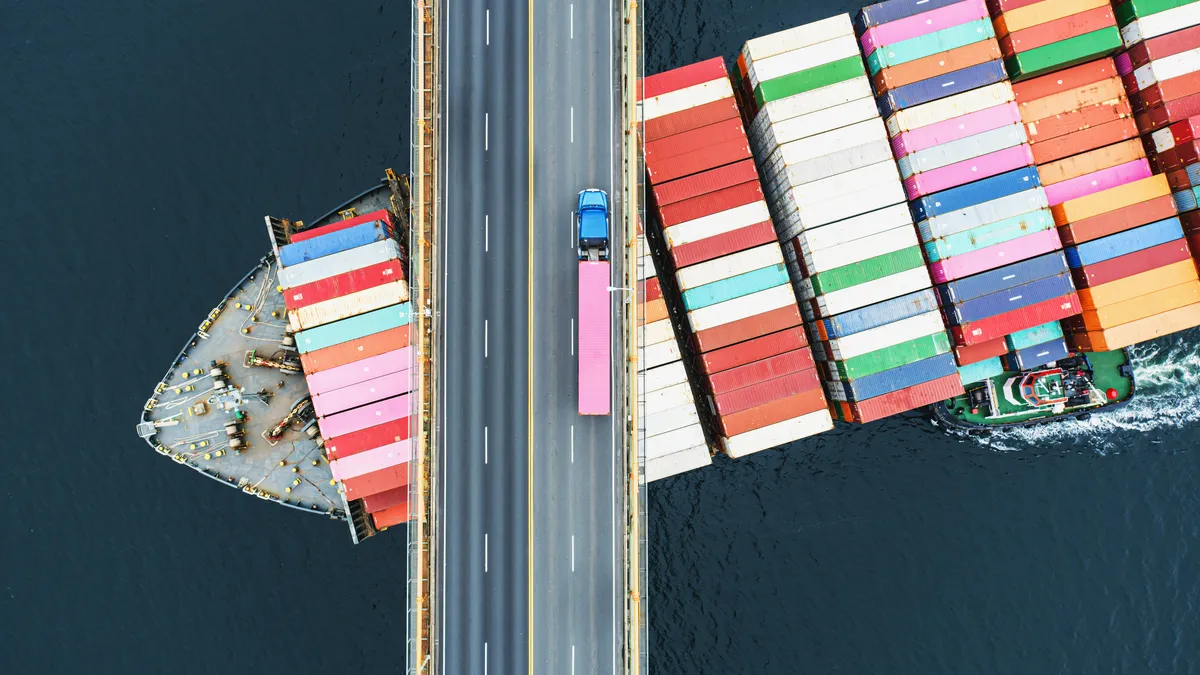

Sitting in the southwest corner of the state on the east bank of the Mississippi River, Memphis provides access to what the Greater Memphis Chamber calls the 4 Rs: runway, rail, road and river. The city has access to inland waterways and a web of interstate highway connections, but when FedEx built its SuperHub there in 1972, the city was fast-tracked to the leadership of U.S. logistics centers.

- Runway: Thanks to it being FedEx’s hub, Memphis is the world’s second busiest air cargo airport (4,336,752 metric tons in 2017), trailing only Hong Kong (5,049,898 metric tons), according to Airports Council International.

- Rail: Memphis is one of only four U.S. cities to be served by five Class I railroads. Single system shipment is available to all 48 contiguous states, Alaska, Mexico and Canada.

- Road: Trucks leaving Memphis can reach 35% of the U.S. population overnight and 68% on the second day. I-40 connects coast-to-coast; I-55 intersects Memphis and connects Chicago to Louisiana. I-69 connects Canada to Mexico, with Memphis being the halfway point of the 2,600-mile highway sometimes known as the NAFTA Superhighway.

- River: The Port of Memphis is 400 river miles from St. Louis and 600 river miles from New Orleans, where cargo can be transferred to an ocean liner. More than 11 million short tons of goods and raw materials were shipped through the port in 2017, with commodities ranging from petroleum and steel to salt and grains.

Memphis serves as the hub of a generally business-friendly state, Sean Coakley, senior vice president at Kenco Logistics, told Supply Chain Dive. "Tennessee is well known for its pro-business environment, its access to diverse talent and its generally welcoming spirit to companies from all industries," he said. "Tennessee attracts companies in part because of the many incentives and advantages offered to help promote business success."

The FedEx effect

On April 17, 1973, FedEx began flying out of Memphis International Airport with 14 aircraft and 389 team members. That night, it delivered 186 packages to 25 U.S. cities. Today, the company’s Tennessee hub covers 880 acres and 3.7 million square feet of facilities under one roof. Its 32,000 local employees launch 140 to 150 flights per night and another 100 during the day and can handle up to 475,000 shipments per hour.

The company’s Memphis hub receives 100 to 110 bulk-loaded trailers per night and each is unloaded in 45 minutes to an hour. It also receives about 80 containerized transport vehicles (CTVs) per night with about five unit load devices (ULDs — pallets or containers) per trailer. They are unloaded in about 3.5 minutes and rolled onto a dolly and delivered to one of FedEx’s regular input facilities.

In March 2018, the company announced a $1 billion investment in its Memphis hub, slated to begin this year and be completed by 2025.

Other manufacturers and 3PLs in the area include Nike, Technicolor, DHL Supply Chain, Williams-Sonoma, McKesson, Ford, Kenco Logistics Services, Barrett Distribution Centers, CEVA Logistics and Americold (just across the state line in West Memphis, Arkansas). According to the Chamber of Commerce, there are more than 400 trucking companies in the city environs.

"It’s really a symbiotic relationship," Coakley said of FedEx’s influence. "One helps the other thrive." He said Memphis has been a preferred location for Kenco in part because of the logistics provider’s Tennessee base and also because of the weather — no tornadoes or hurricanes.

"It’s really a symbiotic relationship. One helps the other thrive."

Sean Coakley

Senior VP, Kenco Logistics

Eric Miller, senior vice president of economic development at the Memphis Chamber, added via email, "it would be foolhardy, if not borderline economic development investment attraction malfeasance, for us not to seize upon the opportunity to leverage the tremendous benefit that FedEx brings to this region and any of its customers that reside within."

Of course, not everyone stays. Target and XPO Logistics recently announced plans to leave Memphis. XPO said it left because its client, Verizon Wireless, was shifting Memphis distribution to "other facilities operated by new and existing partners," FreightWaves reported. A 3PL called Radial operated Target’s fulfillment center in Memphis, and the retailer decided not to renew its contract, according to Twin Cities Business.

A wealth of talent

With the large volume of logistics and supply chain professionals already in the area, talent is abundant. In fact, said Coakley, Memphis has more logistics workers per capita than any other metropolitan area in the country. "16.6% of the metro workforce is employed in the wholesale trade and transportation sector," he said. "This volume provides access to quality talent at all levels of a logistics organization."

Nearby universities like the University of Memphis, the University of Tennessee (400 miles east in Knoxville, Tennessee) and the University of Arkansas (300 miles west in Fayetteville, Arkansas) have supply chain programs that include internships, master’s and Ph.D. programs.

"Many local school districts have secondary or high school programs as well," Coakley said, keeping the talent pipeline open.