This is a contributed op-ed written by Joe Dunlap, managing director of supply chain advisory at CBRE. Opinions are the author's own.

The modern supply chain was a thing of wonder, delivering material from around the world to companies and customers, seemingly in mere days or even hours.

Until it didn’t. Specifically, this year and last.

As consumers, we have all experienced some recent issues relating to the supply chain — either the lack of available product, higher costs or both. At times, some common products have been unavailable for weeks and even months, creating a cycle of sustained high demand on short-supply items and perpetuating a logistics nightmare we cannot seem to escape.

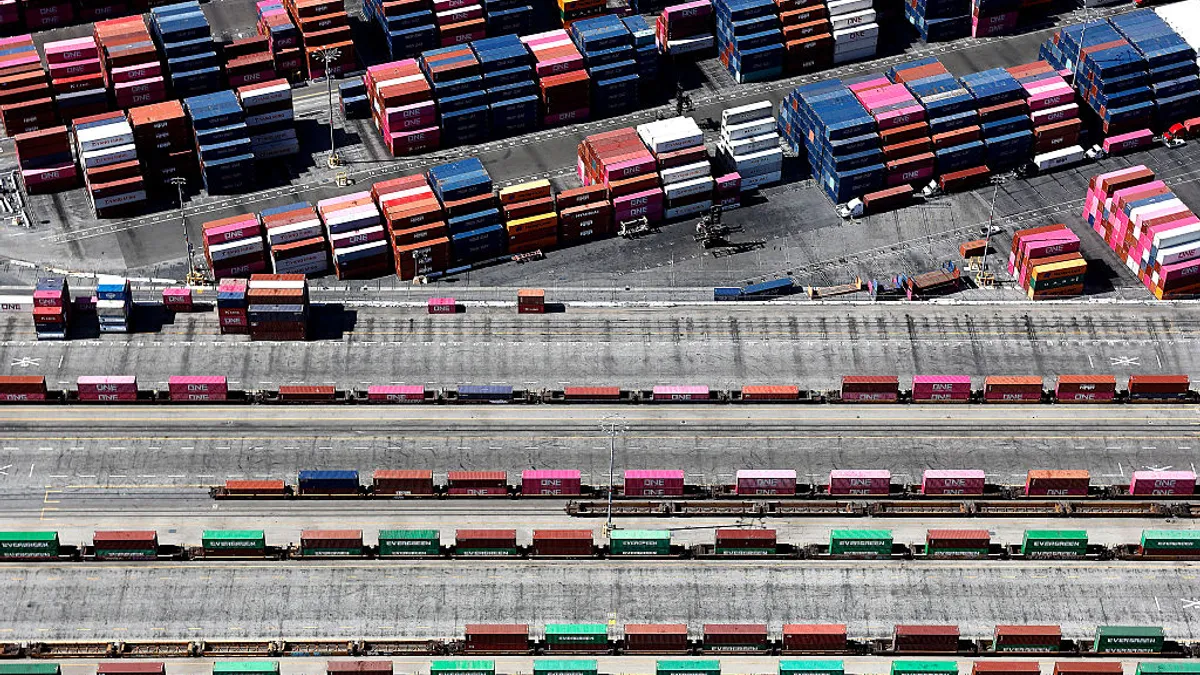

Recently, logistics costs of almost every sort have increased or performed worse. As of last Friday, there are a record-breaking 65 ships waiting to unload in the ports of Los Angeles and Long Beach, according to FreightWaves, further delaying products from reaching shelves. This is due to increased container shipments and very limited warehouse space.

Prices have escalated, too, as consumers feel the pinch from escalated shipping costs. According to the Department of Energy, fuel costs were up 37% year-over-year in mid-July, and load-to-truck costs were up more than 70% in the largest category.

There may be no returning to the pre-pandemic normal, at least not anytime soon. Consumers and businesses should prepare for continued disruption and increased costs.

Challenges in the supply chain for commercial real estate are effectively slowing down the supply chain’s capacity to fix itself.

Joe Dunlap

Managing director of supply chain advisory at CBRE

In basic terms, the supply chain links many companies together, starting with raw materials and ending with the final customer receiving the finished goods. A single retail chain with dozens of warehouses and hundreds of stores may be linked directly or indirectly to hundreds or even thousands of suppliers and end consumers.

Companies plan production and storage based upon forecasts of anticipated aggregate demand, demand by product, demand of certain products by specific region or geography, and timing or season. These sophisticated forecasts incorporate schedules throughout the supply chain, such as production lead time, ocean transport time, customs and domestic transportation.

But forecasts can be wrong, particularly when there are unknown factors. How consumers will behave in a pandemic certainly qualifies as an unknown. Ensuring the right product is stored in the right place, able to deliver to the right customer, at the right time, in the right quantity, in the right condition and at the right price becomes increasingly difficult.

We have seen countless examples of this in the past year. Computer chip shortages have hammered the auto industry, causing factory shutdowns, affecting sales and limiting the availability of new products for consumers.

The food industry has felt the pressure as well. Items such as chicken wings skyrocketed in cost as takeout orders increased from stay-at-home Americans and supply was damaged by harsh winter weather. And who would have thought there would be a national dash for toilet paper when the pandemic began? It has been volatile. Really.

What's on the horizon

It will take time for supply and demand to settle back into more predictable patterns. In the meantime, here is what we can expect to see.

Industrial Real Estate Costs Rise to Pinch Businesses and Consumers

Construction materials such as steel and lumber have been in short supply, with demand increasing steadily over the past year. In commercial real estate, no product is in more demand than industrial distribution space as retailers and e-commerce firms struggle to meet the crush of online sales activity.

Currently, according to CBRE, there is 410 million square feet of new product under construction in the U.S., a record high. However, a disturbing trend has emerged as completions have declined two quarters in a row – 54.66 million square feet in Q1 and 51.67 MSF in Q2. This is considerably below the five-year average of quarterly completions of 64.3 MSF. Projects are breaking ground and stalling out due to lack of materials at a time when more product than ever is needed. With vacancy at record lows and rental rates at record highs, a dearth of new product will continue to put pressure on costs.

CBRE projects that rental rate growth will hit double-digit percentages by year-end. This will be felt by everyone — owners, suppliers, retailers, and, eventually consumers. Challenges in the supply chain for commercial real estate are effectively slowing down the supply chain’s capacity to fix itself.

More retailers establishing a minimum order value for free shipping

Retailers have shipped directly to consumer homes for some time now. However, this activity increased dramatically during the pandemic, and retailers were not prepared. Compounding this issue, many of these items were low-cost items that consumers would typically travel to the store for themselves.

Devoting more labor to pick low-cost, one-off items degrades a retailer’s margins. The consumer used to do that work for them. Now, if consumers want to continue this practice, more retailers will establish a minimum dollar value for free shipping or increase their current threshold. They can always lower this when they need to goose sales. But if consumers show a willingness to cover more of the cost associated with picking and loading curbside or shipping to the consumer’s home, it will become more common.

Consumers Face Shrinkflation, Less Selection, Shortage of Hot Holiday Items

With volatility persisting, consumers may see some items substituted or temporarily no longer available at the shelf. Companies may decide to scale back on variety and focus on one or two core products. Another scenario that could arise may not include price increases, but instead reduced packaging volume for certain items. This is otherwise known as “shrinkflation” and is another way of passing costs on to consumers. The packaging may look the same, but the amount of product inside could be noticeably less.

Based on the current backlog of containers, it’s safe to assume the holiday shopping season will be affected.

Joe Dunlap

Managing director of supply chain advisory at CBRE

Based on the current backlog of containers, it’s safe to assume the holiday shopping season will be affected. As it takes time to work through the current backlog, we could see reverberations for months, especially when there is a large demand spike, as we typically see around the holidays. If gift givers want to assure they can get all of the hot items, our recommendation would be to have most of your holiday shopping done prior to Thanksgiving. After that, choices could be limited.

The supply chain is clearly stressed, strained, shocked, backlogged, and overwhelmed, but it’s not broken. Businesses will continue to be challenged with managing the volatility and the economics of supply and demand.

We as consumers will continue to observe delays and price swings as the supply chain recalibrates to match available supply and volatile demand. Amid varying regional and international responses to the pandemic, we will likely see aftershocks to the supply chain which drag out the supply chain recovery. But we will see it realign. As noted before, it is difficult to forecast, especially with so many unknowns. Yet companies will adapt, new strategies will emerge and a new balance will be found.