The Red Sea crisis is driving ocean markets into a frenzy — and prompting high costs for shippers.

It’s been several months since the initial vessel attacks along the Red Sea began leading to a series of diversions for ocean carriers. Those diversions have led to longer vessel transit times, causing congestion in global ports. Influenced by high demand and reduced capacity, the congestion is also putting pressure on the ocean market.

Shippers are feeling the effects of the ongoing imbalance through higher freight costs. Rates from Asia to the U.S. West Coast reached $7,052 per forty-foot equivalent unit this week, while rate from Asia to the U.S. East Coast reached $8,253 per FEU, according to a July 2 update from Freightos.

Although not at the pandemic-level when rates were above $10,000 per FEU, the current elevated prices are reminiscent of such a time. Here's how compounding maritime issues have led to high rates, according to experts.

Ocean rates have more than doubled since January

Longer transit times add to freight costs

While the Suez Canal is typically a fast and reliable route to and from Asia, the ongoing threat of vessel attacks in the Red Sea has pushed many shipping lines to pursue other routes.

“Services have been rerouted around the Cape of Good Hope in South Africa which add 2-3 weeks [of] travel in each direction depending on the destination in Europe and Asia," Goetz Alebrand, head of ocean freight at DHL Global Forwarding in the Americas, told Supply Chain Dive in an email.

Longer transit times mean additional fuel and operating costs for ocean carriers, which are then passed on to shippers through rate increases and additional surcharges. Ocean carriers began to announce a series of surcharges soon after attacks on vessels traveling through the Red Sea started. As the crisis has extended, those costs are also piling onto typical peak season rate increases, supply dynamics and other factors.

“Today, all ships that can sail and all ships that were previously not well utilised in other parts of the world have been redeployed to try to plug holes,” A.P. Moller — Maersk CEO Vincent Clerc said in a July 2 market update.

However, while redeploying ships has alleviated part of the problem, it is not a complete solution for the industry, the CEO cautioned. With high demand and lower vessel capacity available, Maersk expects to utilize ships of varying sizes in the next month, which will reduce its ability to carry expected demand.

In a statement provided to Supply Chain Dive, the World Shipping Council acknowledged the Red Sea crisis has added transit times and millions of dollars in costs. The trade association also said spot rates are influenced by many other factors as well, such as Panama Canal capacity and global energy policy.

"Regarding spot-market rates specifically, it’s important to note that the large majority of global container traffic generally moves under rates that have been negotiated through long-term contracts," the council said in its statement.

Vessel transit surge since start of Red Sea crisis

How congestion alters rates

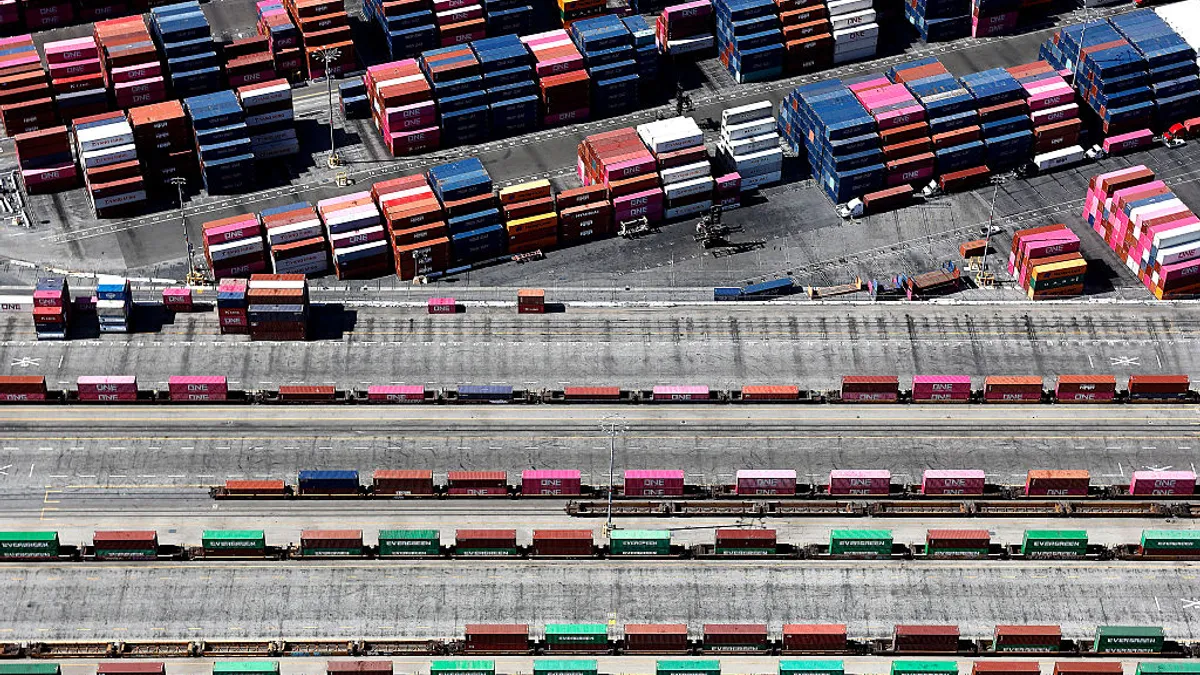

The supply and demand imbalance is creating congestion at some ports in Southeast Asia and the Mediterranean Sea, according to several sources.

“In Asia, waiting times of up to seven days have been observed in Singapore, the world's largest transhipment port, and more than three days in Manila,” Marcus Reimann, SVP of sea logistics for the Americas and Asia Pacific, at Kuehne+Nagel, said in a July email.

In the Mediterranean, he added, wait times for vessels to berth have surpassed three days at the Port of Barcelona and two days in Casablanca.

Trans-shipment ports worldwide play a pivotal role in the maritime supply chain — offering a hub for carriers to reconfigure cargo between ships for optimal use. If a vessel misses an estimated time of arrival, it can cascade into delays for other upcoming vessels as well since needed equipment may be missing or unavailable.

Dwell times rise at Singapore and other ports in Asia

The delays then have a trickle-down effect on world markets: When there isn’t enough equipment in Asia, the imbalance has a direct impact on the Transpacific, Reimann told Supply Chain Dive in May.

“We assume that five to 10% of capacity is absorbed by the longer transit times — capacity in vessels and capacity in equipment — and then of course it [has an] impact on everything else,” Reimann said at the time.

According to several maritime data analysts, some ocean carriers have recently increased their use of blank sailings — the practice of skipping a port or canceling a route — to try and manage the effects of congestion and vessel delays.

“With virtually no idle vessels, and with spot rates increasing sharply in recent weeks, this increase in blank sailings is driven by the Red Sea crisis,” Sea-Intelligence said in a May press release. “Port congestion is worsening in key hubs in both Asia and Europe. And as was clearly seen during the pandemic, port congestion soaks up supply and leads to potential capacity shortages.”

Canceled sailings over the next few weeks are concentrated in a few trade lanes, according to a June 28 analysis by Drewry Supply Chain Advisors. Of the 53 canceled sailings the advisory firm tracked in major East-West shipping lanes, more than half are occurring in Transpacific Eastbound services.

The rise in blank sailings is indicative of the tight supply conditions ocean carriers are facing. With peak season approaching in the U.S., demand for vessel space is higher than what is available for shippers, creating higher rates.

“As long as there is a strong demand that is not supported by enough capacity rates will stay elevated and further increases are expected on specific trades in relation to that supply and demand equation,” Alebrand said.

How shippers can respond

While it’s a tough market, experts emphasized shippers still have some tools and resources they can use to mitigate the effects of high costs.

Alebrand said shippers need to increase visibility and forecast to be able to plan volume and costs accordingly.

“It is prudent to budget for volatility and be ready for short-term cost increases when cargo has to ship,” Alebrand added.

Being predictable is key as well, Reimann added. If a shipper can, it should try to get a forecast for the next couple of months because the unstable market could extend past when peak season is over. Above all, shippers should avoid shipping over weekly allocations, as that will likely lead to higher rates, he said.

Meanwhile, Brian Bourke, global chief commercial officer at Seko Logistics, said shippers should communicate ocean container forecasts early and often, and make bold decisions now.

“We don’t anticipate capacity improving any better until the end of 2024 and perhaps beyond due to a number of factors," he said in an email. "This situation can be compared to trying to get an Uber at rush hour or during a holiday – riders experience a surge in pricing when demand is high.”

Edwin Lopez contributed to this story.