The ocean freight market is pushing cargo owners to the limits in terms of time and price. But the timeline for when the market will cool remains uncertain as stakeholders expect demand to continue at pace through the end of the year.

Last week, Maersk acknowledged as much when it upgraded its guidance for the remainder of the year to show its expectations for EBITDA to reach $18 billion to $19.5 billion, an increase of nearly $5 billion over previous expectations. The ocean carrier specifically cited the "exceptional market situation" for its decisions, saying it is "expected to continue at least until the end of the full-year 2021."

"The strong results benefited both from the exceptional circumstances in Ocean, where congestions and bottlenecks continued to drive up rates, and from solid progress in executing on our strategic transformation where we kept a firm focus on our customers need for integrated solutions across their supply chains," Maersk CEO Søren Skou said in a statement accompanying the company's second-quarter report.

And Maersk is far from alone as other ocean carriers have reported big figures in their recent second-quarter releases.

- Matson's ocean transportation revenue grew 66% to reach nearly $683 million.

- Hapag-Lloyd increased its earnings outlook for the year and now expects EBITDA to be in the range of $9.2 billion to $11.2 billion. Its EBITDA was $1.3 billion for 2020.

- ONE's revenue more than doubled in its most recent quarter to reach nearly $5.8 billion.

"We also benefitted from better freight rates in the second quarter and are looking at a very strong first half-year overall," Hapag-Lloyd CEO Rolf Habben Jansen said in a statement.

But as carriers have profited from increased demand and the resulting rate environment, cargo owners continue to voice concern.

Columbia Sportswear is facing $40 million in incremental costs related to the higher cost of ocean shipping, CEO Tim Boyle said last week. The brand has incurred a high price tag, but it has "been successful securing allocation of containers and vessel bookings to transport our products," Boyle said.

Boyle called the rates being offered by carriers "clearly monopolistic" and said that government intervention from either European or U.S. regulators could aid in bringing down costs.

"We saw a fourfold increase in ocean freight from June 1 through ... [about] the middle part of July," Columbia CFO Jim Swanson said.

Hamilton Beach Brands CEO Greg Trepp said the brand expects disruptions to continue at least through the holiday season.

"We think that when the holiday stocking is completed later in the second half, the disruption should begin to moderate," Trepp said last week. "We are focused on importing all the inventory we can to meet the strong demand while balancing the challenges of doing so at a reasonable cost."

Dorel Industries said demand for its bicycle segment remained strong, but that issues in the ocean market were leading to in-stock issues.

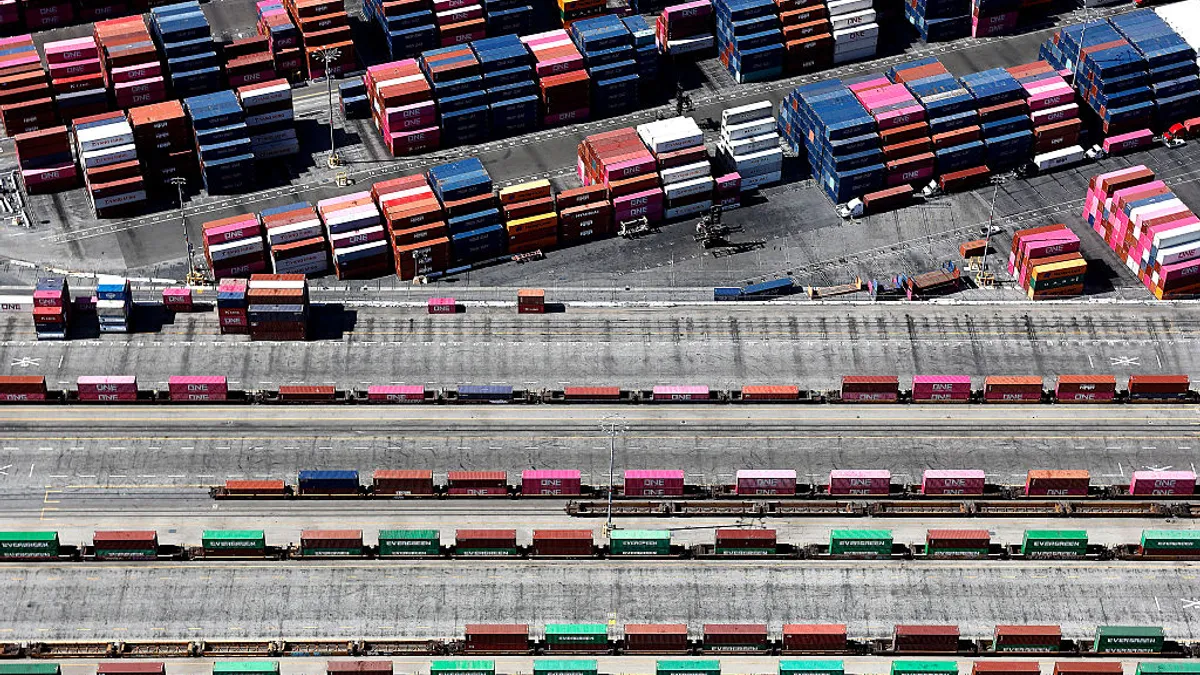

And ports, the middleman between the carriers and the cargo owners, similarly don't see any downturn coming in the last four months of the year. Last year brought a record-breaking level of volume to the Port of Long Beach and Executive Director Mario Cordero said last week the gateway expects that record to be broken again in 2021. Cordero said that the entirety of the San Pedro Bay complex expects to handle 19 million TEUs this year.

"I don't see that number diminishing in the years to come," he said. "In fact, that number is going to increase." To deal with this expectation for higher volume, the port complex will need to make changes like a move to a 24/7 operating model, he said.

All of the demand in ocean shipping is not just affecting rates, but also reliability. On-time performance has struggled since the middle of last year and the most recent figure for June shows a schedule reliability figure of 39.5%, according to Sea-Intelligence. Alan Murphy, CEO of Sea-Intelligence, said that adding capacity to ocean carriers will only make matters worse.

"The resolution has to come from solving the congestion problems on the landside," Murphy said in a press release. "This does not only imply solving the congestion in the ports, but also the hinterland infrastructure related to trucks, chassis, rail, etc."

But port operators acknowledge that this will not necessarily be easy.

"We’ve never seen this level of activity and based on the outlook we’re preparing for more," Port of Oakland Maritime Director Bryan Brandesni said in a statement about mid-year volumes last month. "Our challenge is serving customers who expect us to handle their cargo efficiently."