Dive Brief:

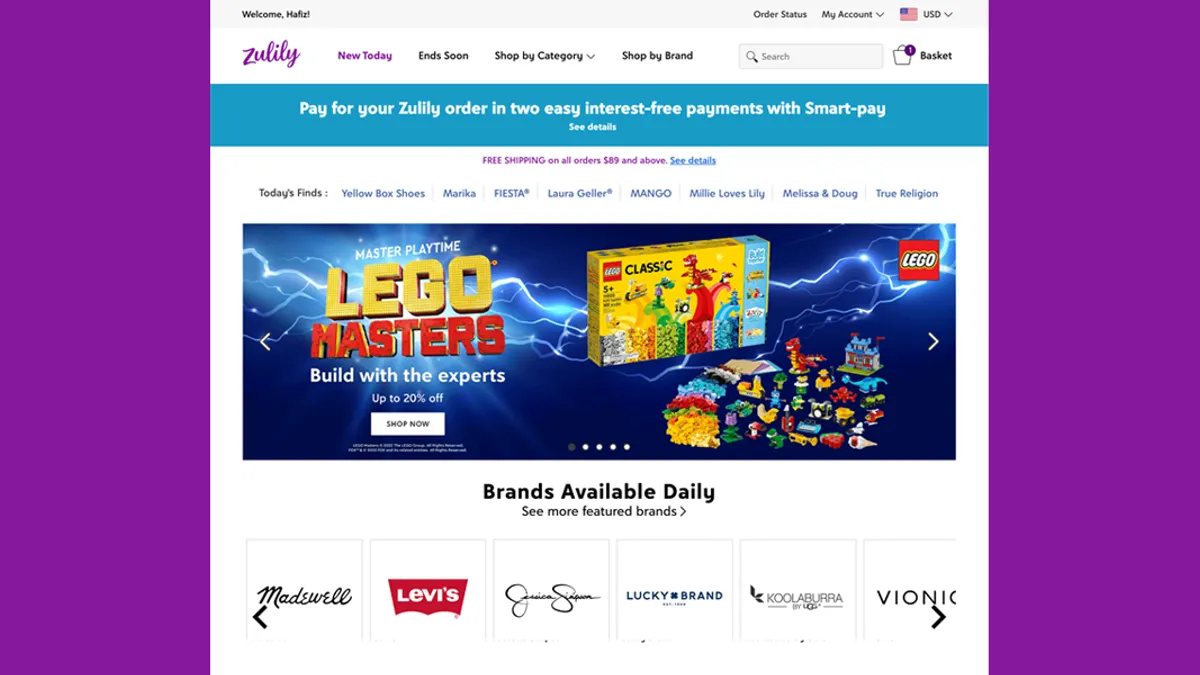

- As the online retailer Zulily winds down its business, $85 million in inventory is up for grabs.

- Gordon Brothers, which is handling the liquidation, is marketing the inventory to firms looking to procure “a wide selection of well-known nationally branded fashion and home products inventory,” Ulos Anderson, senior managing director of Commercial & Industrial at Gordon Brothers, said in a Jan. 30 press release.

- Along with the retail inventory, Zulily is selling assets from its fulfillment centers in Ohio and Nevada, including conveyors, pick towers, scanners, handling equipment and IT equipment.

Dive Insight:

When Zulily’s website abruptly went down for “maintenance” in December, the retailer’s future came into question. Days later, the company moved to liquidate entirely.

It told stakeholders at the time that “[d]espite the Company’s recent efforts to position the business for future growth, Zulily made the difficult decision to conduct an orderly wind-down of the business” through what is known as an assignment for the benefit of creditors. (In such cases, companies hand over their assets to creditors outside of a bankruptcy process.)

For creditors, Zulily’s inventory is an asset to turn into cash for repayment. For buyers, it is a potential sourcing opportunity.

On a listing page, Gordon Brothers describes Zulily’s remaining items as as branded consumer products, including apparel, footwear, small appliances, beauty and housewares. The liquidator said it would be selling the inventory through private treaty, meaning it will negotiate prices with buyers, as opposed to a liquidation auction.

The entire process of winding down Zulily could take 12 to 18 months, according to a fact sheet. Former suppliers to Zulily that haven’t been paid for goods shipped have until June to file claims through the assignment process.

Zulily struggled with sales declines and operating losses in the years leading up to its demise. When under its former parent Qurate Retail Group, it suffered in part from an over-inventoried retail sector that was stuck in a heavy discount cycle. Zulily suffered operational woes prior to that as well as it contended with product scarcity and rising supply chain costs.

Qurate sold Zulily to investment firm Regent last year. Now, less than a year later, all that is left of the retailer is the inventory and warehouse equipment being sold off.