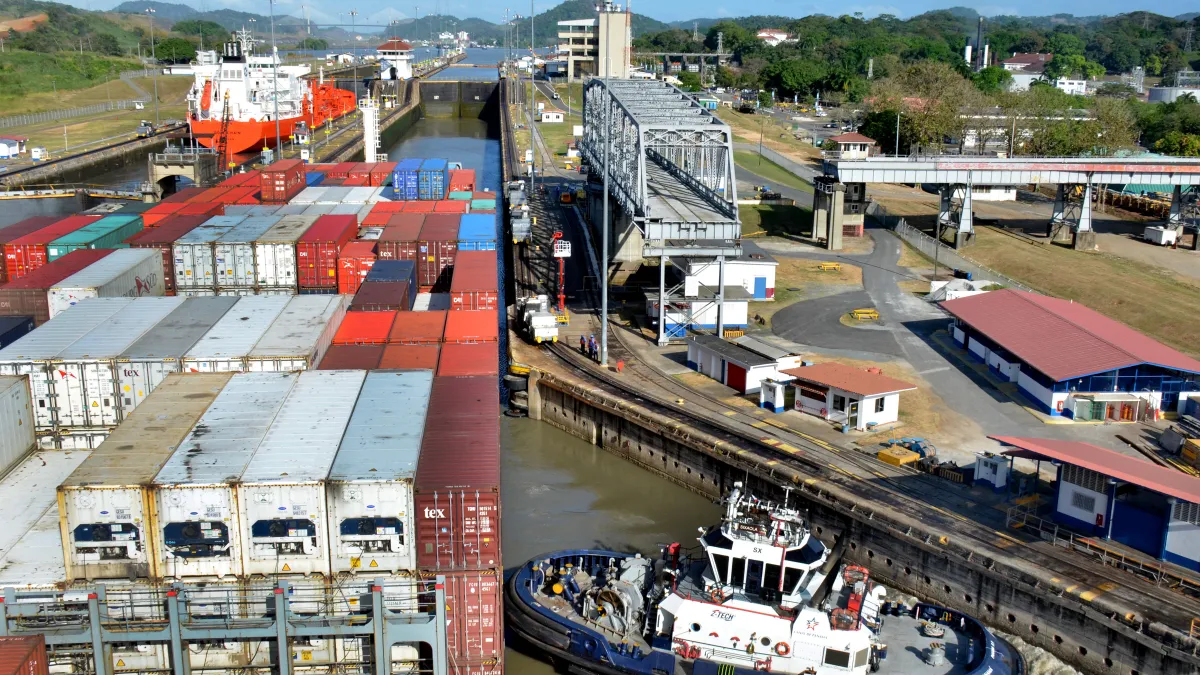

The Panama Canal announced another set of restrictions to reduce transit capacity as a result of continued low-water level at Gatun Lake.

Last week, booking slots were reduced to 25, down 30% from August, and will go down to 24 on Wednesday. Slots will continue to gradually decline in the new year.

| Dates | Number of reservation slots |

|---|---|

| November 3 to 7 | 25 |

| November 8 to 30 | 24 |

| December 1 to 31 | 22 |

| January 1 to January 31, 2024 | 20 |

| As of February 1, 2024 | 18 |

SOURCE: Panama Canal

The restrictions mark a significant escalation from earlier this summer, where June averaged 33 vessel arrivals per day, with a high of 49 vessels that month, according to the canal’s operations summary.

Since the shipping channel began to pose draft restrictions in July, shippers have had to look for alternative routes and leverage freight diversions to move their cargo. Trade between China, Japan, South Korea, and certain regions of the U.S. continue to be impacted as 46% of container movement from northeastern Asia to the U.S. is facilitated by the canal.

But some analysts say the impact to cargo moving through the canal may not be as severe due to existing market conditions.

Higher blank sailings

Blank sailings are a typical response from ocean carriers to specific market conditions, and softening demand has been one of the main reasons for the use of skipping a port of voyage.

"In recent weeks, carriers have announced a host of blank sailings," Sea-Intelligence CEO Alan Murphy said in a press release. "Even then, there has been significant [year-over-year] growth in the capacity being offered in the market."

Still, with restrictions placed at the major waterway, capacity from Asia to the U.S. has decreased about 2% to 10% per week as carriers adjust to the weight restrictions, with lighter containers taking priority, C.H. Robinson VP of global ocean services Matthew Burgess told Supply Chain Dive.

"Nonetheless, the restrictions to date have not caused significant disruption to container transport, in part due to containers being prioritized at the canal and the fact that there are still a significant number of blank sailings across the industry," Burgess said.

The new restrictions are still being analyzed and it could cause delays of up to two to three days for vessels and containers, Burgess added.

Early peak season and holiday orders

There is no doubt that the ocean freight market has experienced a volatile year. Even Maersk's CEO Vincent Clerc made a comment about worsening market conditions during a Q3 earnings call.

Between labor negotiations in the West Coast that led shippers to divert cargo to avoid possible labor disruptions, retailers dealing with higher inventory levels or shippers navigating the aftermath of higher freight rates, the ocean market has lost its sense of predictability.

This uncertainty has also changed how shippers view peak season.

“We probably hit expected peak already for this year and we’ll probably see gradual slowing as we get into the rest of the year,” National Retail Federation President and CEO Matthew Shay said in a media briefing at the Port of Los Angeles last month.

Retailers typically ship holiday orders via ocean between August and October to ensure ample time to distribute goods throughout their networks, project44’s Senior Data Analyst Jenna Slagle told Supply Chain Dive. This includes distribution centers, fulfillment centers, and stores, she added.

"As we are now in November, it is safe to assume most holiday freight has already been delivered to ports. We also see this reflected in a decrease of volume throughout October,” Slagle said.

With most freight shipped before the Panama Canal restriction was placed this summer, volumes in the next few months should cyclically decrease, project44 said in a Nov. 6 report. Remaining volume, however, will experience additional delays until the congestion clears.