Dive Brief:

- Panasonic Energy wracked another critical mineral supply deal last week, this time with natural graphite producer Nouveau Monde Graphite.

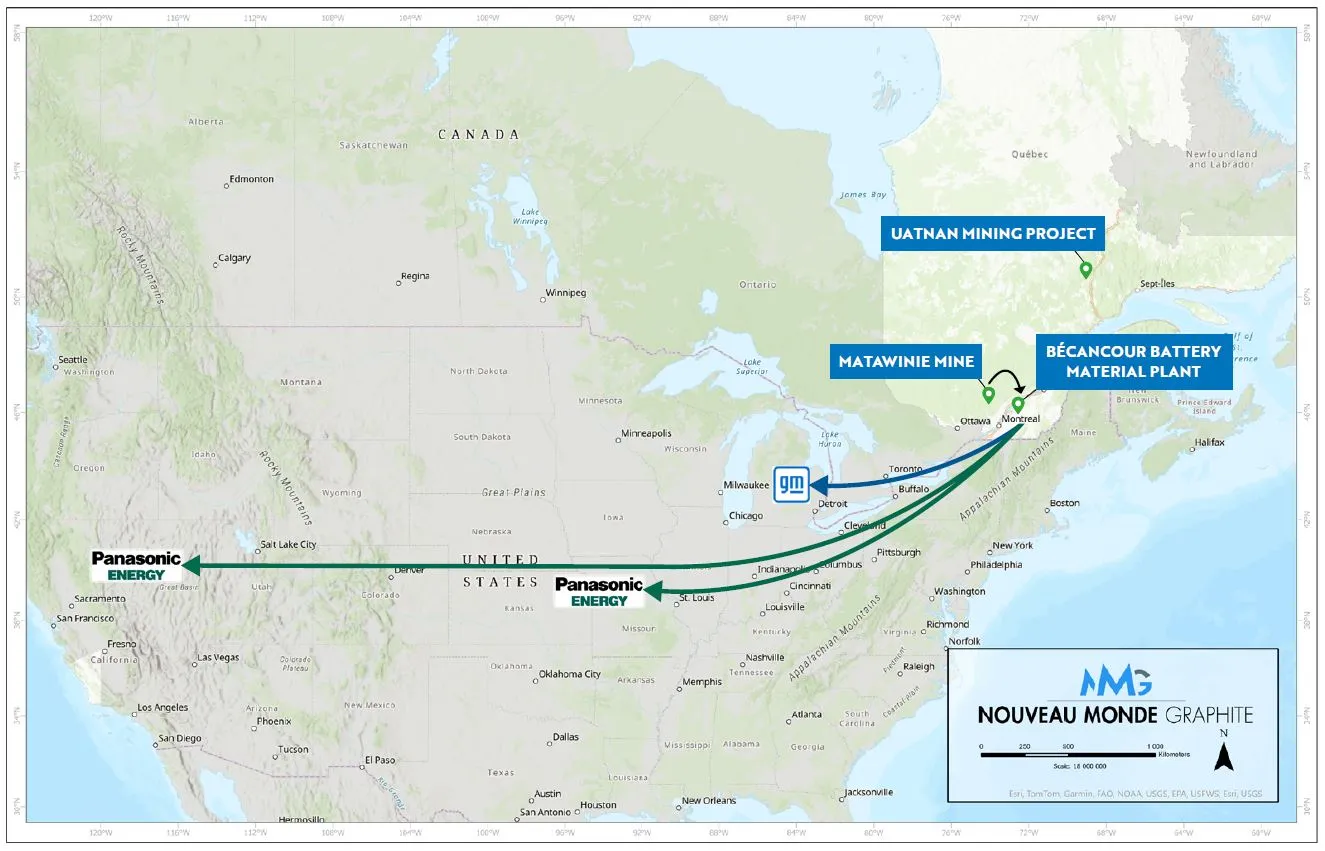

- The Canada-based graphite company will supply Panasonic Energy's North American facilities with 18,000 tons of graphite annually over seven years. The mineral will be mined at NMG's project in Quebec and processed into anode active materials at its nearby battery material plant.

- The battery maker will also invest at least $25 million into NMG as it looks to increase its stake in the critical mineral market. NMG will use the money to fund the development of its mine and battery material plant.

Dive Insight:

Panasonic Energy has been busy this month signing multiple supply deals to support its upcoming battery plant in De Soto, Kansas, as well as its current factory in Nevada.

The company announced a four-year deal for synthetic graphite with battery materials company Novonix less than three weeks ago.

Both the NMG and Novonix deals build on previous talks between Panasonic Energy and the suppliers. The agreements are now reaching their next stages as the battery maker prepares its Kansas factory to begin production as early as next year.

Panasonic Energy is readying its supply of natural graphite thanks to NMG. The graphite producer plans to leverage a vertical "mine to battery material" model, extracting and processing the mineral in-house before shipping it to Panasonic Energy.

The deal will take effect once NMG starts production at the new mine and processing sites in Canada, expected to begin around mid-2027, said Julie Paquet, VP of communications and ESG strategy at NMG.

NMG is growing its own capacity and demand as more battery and automakers secure additional suppliers for their North American supply chains. The graphite producer announced a supply deal with General Motors the same day as its agreement with Panasonic Energy.

NMG will supply GM with 18,000 tons annually of active anode material using a similar vertical model as with Panasonic Energy, extracting and processing graphite ore into battery-ready material. Like the Panasonic Energy deal, GM will also invest in the graphite company, offering $150 million to support the company's development plans.

The two deals, which make up roughly 85% of reserved volume at the graphite producer's upcoming sites, are part of NMG's plan to grow its supply chain capacity, Paquet said.

The start of commercial production at the Quebec sites is part of a three-phased plan to build out processing capacity both in North America and elsewhere to meet EV battery demand. The Canada-based supplier is also leveraging the Inflation Reduction Act, offering automakers and battery manufacturers graphite that can comply with the law’s stipulations.

"The IRA came into effect recently [and] there's this added notion now that if you can't find [materials] in the U.S., you need to find sources that are responsible and comply with the requirements of the IRA," Paquet said. "So we're checking all of these boxes in terms of what the market is looking for as we develop this North American industry.”