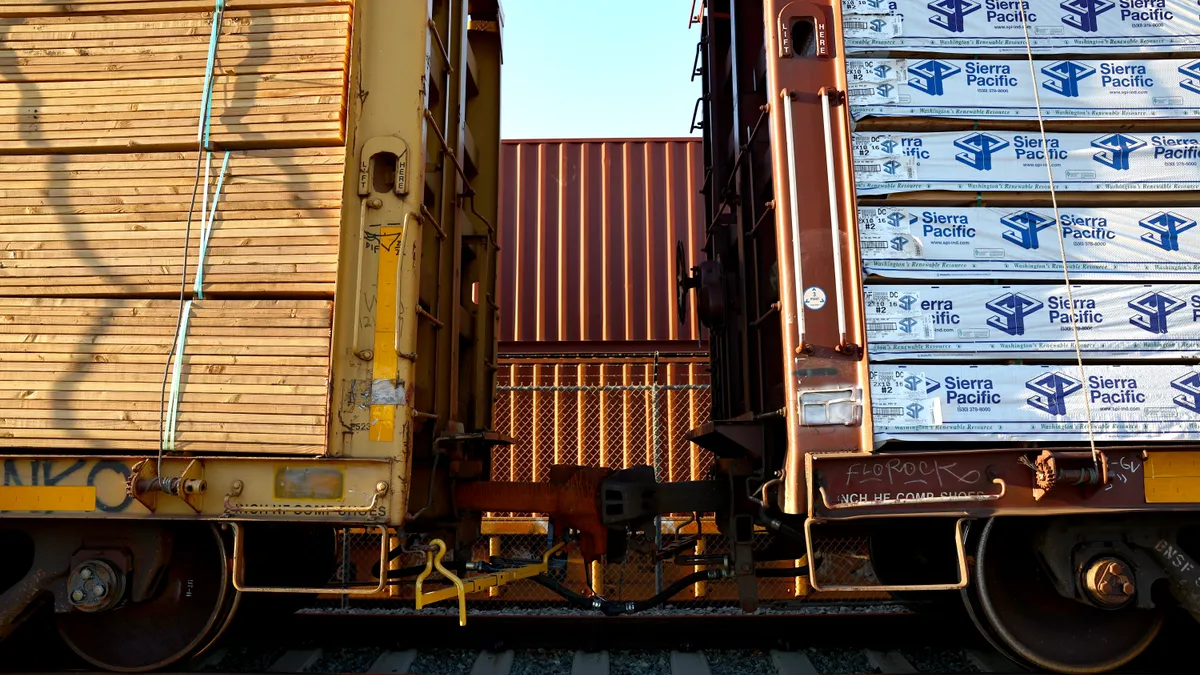

President Donald Trump’s promised tariffs on some of the U.S.’ largest trading partners could be implemented as soon as Saturday, but questions linger about what importers and supply chain managers should expect.

During his first week back in office, Trump said Feb. 1 was “the date we’re looking at” for implementing a 10% tariff on China-based imports and 25% tariffs on those from Canada and Mexico.

The comments came after the Trump administration set an April 1 deadline for a federal agency-led trade review. The memorandum initiating the review called on agencies to evaluate U.S. trade policy and provide recommendations about tariffs and other actions.

With Trump’s long-expected import duties seemingly imminent, international trade experts shared what we know right now.

1. How can a president issue tariffs?

There are a slew of levers the U.S. can pull to enact tariffs. Several require Congressional action trade reviews by the U.S. Trade Representative, such as with recent Section 301 duties on China-made goods under former President Joe Biden.

However, through the International Emergency Economic Powers Act, the president has the authority to immediately implement import duties to address a national emergency or to remedy a threat to national security or domestic industry, experts told Supply Chain Dive.

Trump has previously stated his intention to use this executive power to levy tariffs on China, Canada and Mexico, after engaging in similar tactics during his first term. He has laid the groundwork to enact such tariffs based on national emergencies his administration has declared related to immigration and the importation of fentanyl into the U.S., said John Brew, former chair of the international trade group at law firm Crowell & Moring.

2. How quickly would tariffs go into effect?

If Trump does sign an executive order implementing tariffs, U.S. Customs and Border Protection would be able to start collecting duties rapidly, according to Alexander Schaefer, a partner in the international trade group at Crowell & Moring.

“I don't think it actually takes a lot for CBP to implement, whether it's on a country basis or a product basis or a regional basis,” Schaefer said. “I think they can turn that around fairly quickly within a couple of days.”

“I think they can turn that around fairly quickly within it, within a couple of days.”

Alexander Schaefer

Partner, Crowell & Morning

The order could call for implementation to begin on a specific date, perhaps 15 or 30 days from when the order is signed. There could also be some exemptions made for goods already in transport or because of contract terms, Schaefer added.

For example, the first Trump administration gave importers three weeks of advanced notice before imposing 25% duties on $34 billion worth of Chinese imports in July 2018.

3. Would the executive order be subject to legislative or judicial challenges?

An executive order can be overturned by Congress, per the American Bar Association. Tariffs implemented by an order could also face legal challenges, most likely from affected U.S. importers, said Jonathan Todd, vice-chair of the transportation and logistics practice group at law firm Benesch Friedlander Coplan & Aronoff. However, companies that seek relief via judicial means would face an uphill battle.

“The burden on the plaintiffs or the importers to get temporary relief or restraining order … is much higher than just in a normal case,” Brew said, adding that successful lawsuits would need to show something was “egregiously wrong” in how the tariffs were being imposed.

The domestic steel industry learned that lesson the hard way during Trump’s first term. After the U.S. slapped increased duties on steel imports in 2018, the Supreme Court refused to hear a suit brought by a contingent that included the American Institute for International Steel.

“The burden on the plaintiffs or the importers to get temporary relief or restraining order … is much higher than just in a normal case."

John Brew

Former Chair, Crowell & Moring’s International Trade Group

Even if they are heard, such cases could take multiple years to resolve, according to Schaefer. Plus, companies likely won’t be able to gain a suspension of the collection of duties until a decision is made, leaving them on the hook for tariff fees they are challenging in court.

“The batting average historically on that is not good,” Schaefer said.

4. Will there be an exemption process?

Both Trump and former President Joe Biden showed a willingness to offer exemptions for certain products and industries to tariffs enacted over the last eight years. The first Trump administration allowed for exemptions for specific tariff lines and products, according to Schaefer, including medical devices and personal protective equipment.

Without new tariffs officially enacted, it’s unclear what any exclusion process might look like. However, should one be offered, importers will need to demonstrate why the additional fees would be harmful to U.S. production or supply chains, Todd said.

For instance, when Trump imposed steel tariffs in 2018, companies had to show that some steel or aluminum products were not available domestically, according to Schaefer.

“Even if an exclusion process were allowed and an importer were to seek exclusion, that would still take time. And if they have high volumes of active imports during that period of time, they're still paying those duties.”

Jonathan Todd

Vice-chair of the transportation and logistics practice group, Benesch Friedlander Coplan & Aronoff

If tariffs begin being collected immediately, exemptions may still be offered, although shippers would still need to go through the process of applying for such relief.

“Even if an exclusion process were allowed and an importer were to seek exclusion, that would still take time,” Todd said. “And if they have high volumes of active imports during that period of time, they're still paying those duties.”

However, if an exemption is granted, it would likely be retroactive to the date of entry of historic goods or create some other means for importers to recover monies paid, according to Todd.

5. How does Trump’s trade review fit into the equation?

There is a degree of conflict between what Trump outlined in his trade policy review memo and what he has said about implementing tariffs on Feb. 1, according to Todd. However, the disparate timelines derive from the purpose behind the trade review.

That procedure is more about determining whether the U.S. should consider blanket tariffs on countries beyond the entities Trump has said he may levy tariffs against by Feb. 1, according to Schaefer.

In the past weeks, Trump has also threatened tariffs on the European Union and Colombia.

“For instance, you know if you're going to put tariffs on herring from Denmark, you've got to have a little bit more in the record about why that's a sensible thing to do, whether in response to economic emergency or security issues or what have you,” Schaefer said.

This story was first published in our Procurement Weekly newsletter. Sign up here.