Dive Brief:

- A rise in omicron cases constrained railroad operations in Q4 and helped drive a decline in volume, executives said on earnings calls this month.

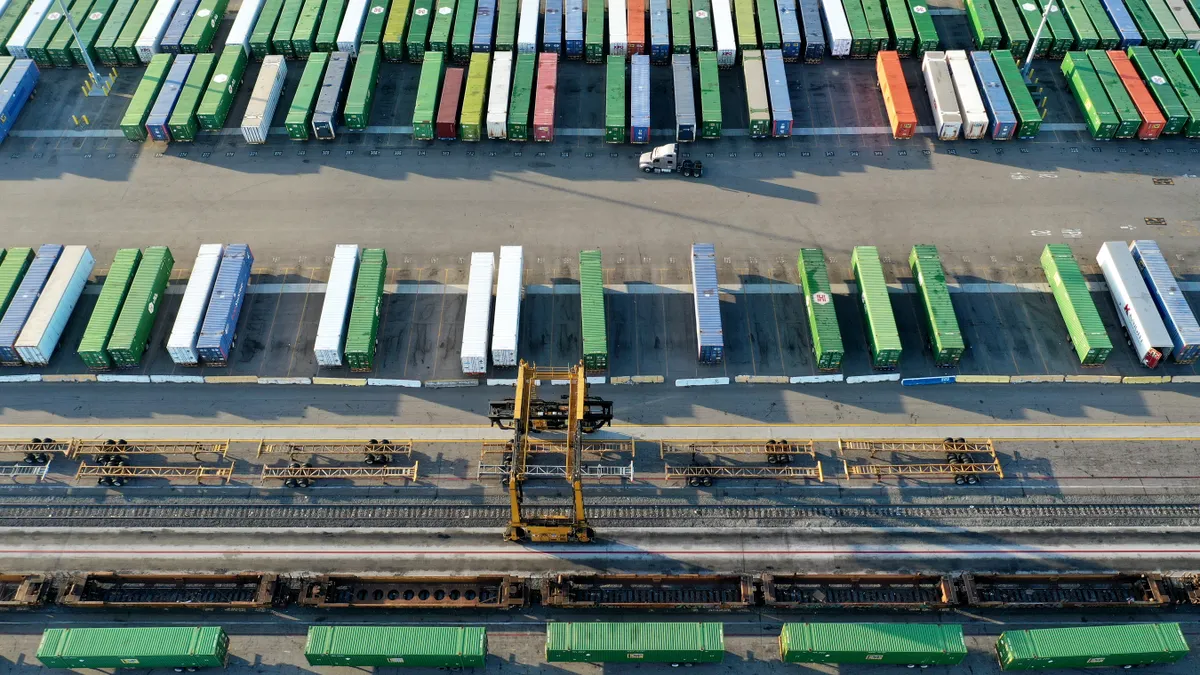

- Norfolk Southern and Union Pacific both saw total volume decline 4%, with the latter reporting a 15% drop in intermodal. Meanwhile, intermodal volumes remained flat at CSX as a rise in shippers utilizing East Coast ports was offset by a decline in domestic volume.

- All three railroads said a rise in omicron cases hurt network fluidity and velocity. Average daily cases at CSX, for example, increased by several 100 employees since early November and "are approaching prior peak levels," Jamie Boychuk, executive vice president of operations, said in an earnings call.

Dive Insight:

Staffing challenges due to the fast-spreading omicron variant add to labor constraints that were already affecting rail service.

Norfolk Southern had been working to widen its hiring pool as part of a plan to add capacity and improve service, but "our improvements have been sporadic as COVID related absences have more than doubled from where they were in December," COO Cindy Sanborn told analysts.

Union Pacific was caught off guard not only by the rise in coronavirus cases, but also by the disruptions that came with giving workers time off to get vaccinated before federal regulators withdrew the rule Jan. 26.

"What we did not plan for was a vaccine mandate where we have to give people time off to get vaccinated and waves where we had hundreds of UP employees unavailable to us on any given day because of quarantine," said CEO Lance Fritz. "And I look at that and I think shame on us. That's a risk factor that we did not adequately plan for."

Cumulative volume across railroads declined 4.5% the first three weeks of 2022 compared to the same time last year, according to the Association of American Railroads. Meanwhile, the number of intermodal units online was down 15.7%.

Staffing challenges at railroads have translated into disrupted service, some shippers say. Chemical manufacturers reported that labor constraints in the rail industry impacted customer deliveries and led to "missed switches or increased hold time at interchanges" in a January survey from the American Chemistry Council.

Still, railroads forecast demand for service to remain high in 2022 as they expect more shippers to rely on rail to avoid high trucking prices. Norfolk Southern Chief Marketing Officer Ed Elkins said "elevated consumer activity and tight truck capacity" helped drive intermodal revenue in Q4.

Tight trucking capacity due to equipment and labor shortages has sent prices soaring, which railroads see as an opportunity to get new customers in the future.

"You've seen our primary competition, truck rates are up significantly, and we're....working with customers on opportunities for them to convert more freight over to rail," said Kevin Boone, executive vice president of sales and marketing at CSX. "In this high inflation market, they're looking for ways that they can save on their transportation costs and rail is almost every time the most economical solution for them."