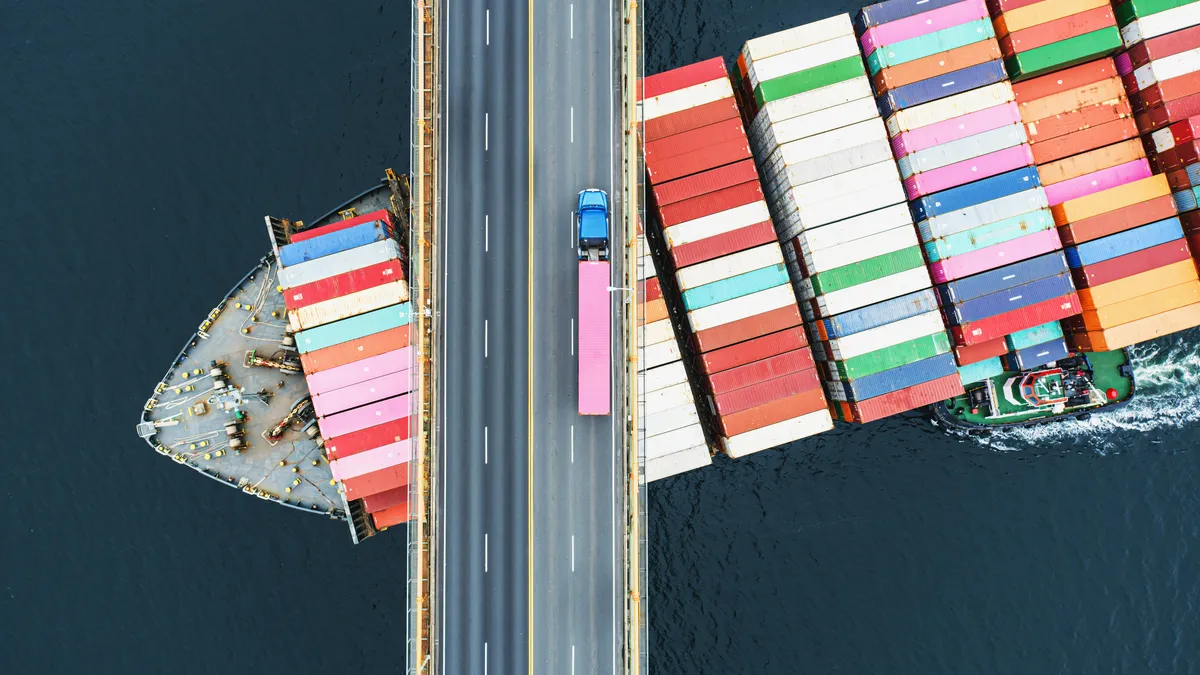

As automakers continue to struggle with logistics delays for newly produced vehicles, railroads say they are working to fix the issues, while car haulers see a business opportunity.

Automakers say industry-wide rail car shortages are limiting their ability to send new vehicles to dealerships. GM and Ford executives called out the problem, which has plagued railroads since the pandemic, on recent earnings calls. It is hampering business as production is recovering because of improvements in the flow of vital components elsewhere in the supply chain, they said.

“We’re generally seeing constraints around freight,” Ford CFO John Lawler said in a July 27 earnings call, noting the transport issues were driving up costs at a time when inflationary pressures are already hurting the automaker’s bottom line.

Railroads and trucking companies are now investing in more equipment and looking for operational efficiencies that could hasten new vehicle deliveries. After all, the carriers project auto builds will only continue to grow, and further raise the need for transportation.

How railroads are trying to speed vehicle deliveries

Norfolk Southern and CSX Transportation are adding workers, acquiring more double-deck transport railcars, and implementing network efficiencies to hasten new vehicle deliveries, the companies said in emails to Supply Chain Dive.

“With the rest of the industry, we are seeing some issues with availability of auto railcars,” Norfolk Southern spokesperson Connor Spielmaker wrote in an email.

Norfolk Southern has purchased 900 auto railcars this year and is expecting 500 more in 2024, Spielmaker said. The railroad, which moved 738,000 vehicles out of Detroit in 2022, has also opened five new repair shops to expedite maintenance of railcars.

CSX is following a similar approach. CSX said in an email it has added resources to accommodate rising vehicle production.

The Jacksonville, Florida-based railroad has added a “significant number of bi-level rail cars this year to support increased production forecasts from the automotive manufacturers.” CSX also pointed to a 6% YoY increase in its frontline workforce, and said it has improved recycle times of its bi-level car fleet by two days or 18% year-to-date.

“Over the last few years a multitude of supply chain challenges resulted in significant variability in automotive production and distribution,” CSX said in a statement. “Against this backdrop, CSX has been working hard to add resources and equipment to support our customers.”

A growth opportunity for auto haulers

While rail carriers move nearly 75% of the new cars and light trucks purchased in the U.S. annually, according to the Association of American Railroads, car haulers also play a role in the segment.

Cox Automotive, a provider of automotive services including transport brokerage, said in its Q2 Used Vehicle Value Index call it is targeting the segment for growth opportunities given the need for increased transport. The company, which also monitors U.S. new vehicle inventory, said domestic dealerships' new vehicle stock have increased 80% YoY in July.

“We’re also starting to move some new car inventory and ramping up our consumer delivery capabilities and see this as a major growth area,” Cox Automotive VP of Logistics Joe Kichler said during the call. Cox is investing in more technology to accommodate deliveries of vehicles sold online.

“Consumers also are used to the Amazon tracking experience, which requires major investments,” Kichler said.

Kichler said the company’s Central Dispatch business unit, which manages its digital load board, is on pace to move more than 13 million vehicles this year.

However, auto carriers also remain wary of whether economic conditions and rising borrowing costs could slow sales in the future, according to Cox Automotive’s June Dealer Sentiment Index. Still logistics providers are pressing on with their investments as automakers seem intent on building and selling more vehicles.

“[As] long as we see demand continuing to be as strong as it is for our vehicles, we think we're going to continue to perform,” GM EVP and CFO Paul Jacobsen said during the company's Q2 earnings call.