At an investor's conference last December, Norfolk Southern CEO Alan Shaw made a somewhat surprising announcement for the rail industry: The company would look beyond short-term profits to rebuild service and invest in customer relations.

Following nearly three years of declining service and contentious negotiations with labor that nearly boiled over into a nationwide strike, railroads have been working to remake their image in the public and private sphere. Shortly after Norfolk Southern's investor day, other major railroads including CSX and BNSF made similar promises to invest in infrastructure and workers.

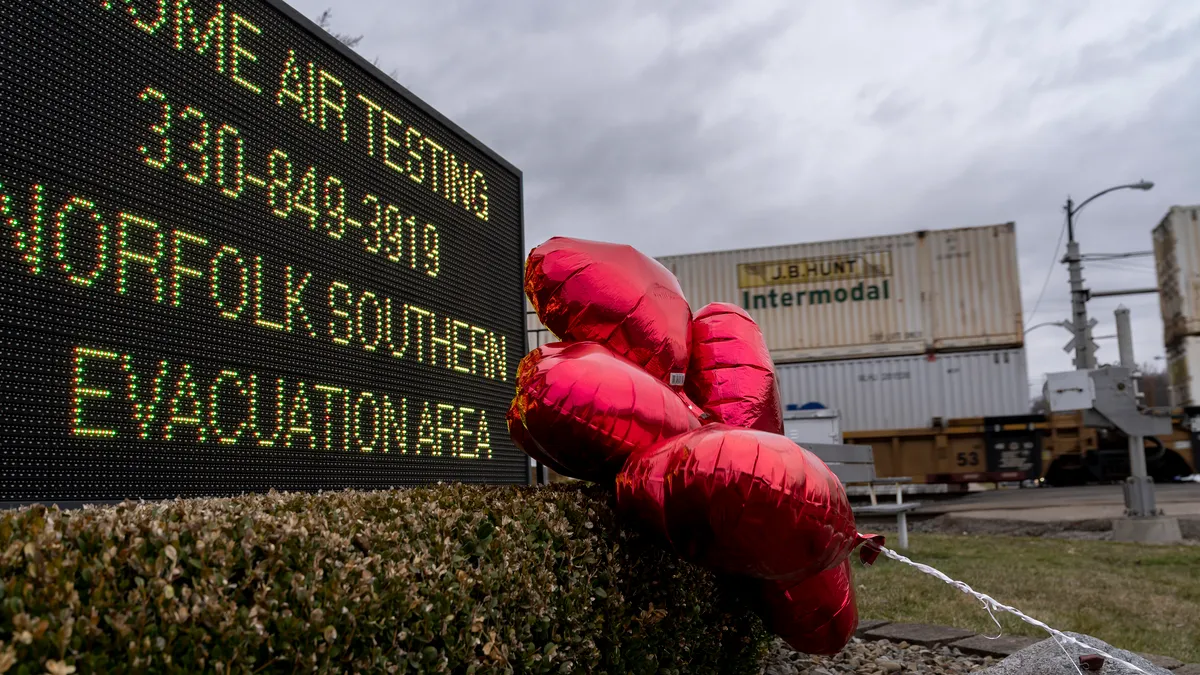

Those announcements, however, were quickly overshadowed in early February when a Norfolk Southern train carrying hazardous materials derailed in East Palestine, Ohio. While no injuries or deaths have been associated with the incident so far, half of the town's roughly 5,000 residents were forced to evacuate so officials could release and burn toxic vinyl chemicals as a safety precaution.

Railroads are now engaged in another political firestorm with the prospect of more regulatory oversight. As a result of the derailment, Senate President Chuck Schumer called on the National Transportation Safety Board to expand its investigation into Norfolk Southern to include the safety practices of all Class I carriers.

"In the eyes of the public, the railroads went from bad service to being bad bosses, to now being dangerous within 12 months," said Anthony Hatch, owner of transportation consulting firm ABH Consulting. "Railroads will pay a price – all of them, not just Norfolk Southern."

Can rail still win back customers?

Reports of chickens at risk of starving from poor rail service and workers not receiving paid sick days have tainted the impression of railroads over the past year. The high-profile derailment added fuel to the fire just as many carriers were pushing to improve their public image.

Railroads have shaken up their C-Suites in recent months, and the four largest U.S. railroads have also struck agreements with local unions to add paid sick leave days. Norfolk Southern, BNSF and CSX also made pledges to invest in technology, customer service and infrastructure as they look to win back lost customers.

"If you can't service your customers well and reliably, all the cost control in the world won't deliver a healthy growing business," Joe Hinrichs, who became CEO of CSX in September, told investors during an earnings call late January.

Adriene Bailey, a partner of consultancy firm Oliver Wyman's Transportation practice, said that the derailment adds to the recent "snowball effect of negativity" around railroads. But she doesn't expect this to be a "pivot" point for the industry – for many shippers, rail remains the cheapest, safest and most fuel-efficient option.

Ultimately, the quality of service will determine whether rail can capture market share away from trucking going forward.

"Shippers want to do more with rail. But it is mind-numbingly difficult to do business with railroads at times," she said. "So there's a journey that railroads need to undertake to get themselves to a place where shippers are willing to invest in doing more business with them."

Although shippers aren't expected to radically change their relationship with railroads, Bailey still called the overwhelming public blowback against railroads "troublesome."

"In the long run, the railroads are our best transportation option – for safety reasons and for environmental reasons," she said. "And if we clobber the railroads out of a knee jerk reaction, we will be robbing ourselves and future generations the right to have a very energy efficient, low emissions way of moving freight around this continent."

What tightened oversight means for the industry

A bipartisan bill introduced earlier this month and endorsed by President Joe Biden would increase fines around safety violations, require trains to be operated with two-man crews and compel railroads to add more track monitoring equipment.

More broadly, however, the derailment is likely to create more skepticism around railroads' technological investments, which carriers have said are critical to advance plans around efficiency and service improvements.

Railroads have remained at odds with labor unions and the Federal Railroad Administration over the use of advanced technology – namely automated track inspections and a cruise-control system known as Trip Optimizer. While carriers say these technologies can enhance safety and operational efficiencies, unions argue that the reliability of these systems are unproven and that they will become a means for railroads to cut workers and maximize profits.

Workers are open to new technology when it enhances safety and assists railroaders in their day-to-day work, said Greg Regan, president of the Transportation Trades Department, which represents a coalition of unions within the transportation industry. But railroads have tried to justify automation as a reason to eliminate in-person inspections or cut an additional crew member from the locomotive.

"I think the number one focus should be using this technology to empower our workers to do their job better," Regan said. "Instead of jumping to use this technology to replace the workers."

The FRA has already limited the expansion of these technologies despite reports from railroads of safety improvements. A federal judge last Wednesday sided with BNSF that the agency's denial of an automated track inspection pilot expansion was "arbitrary and capricious," saying the decision was "especially glaring in the face of the agency's statutory mandate to prioritize safety."

The FRA could take even more of a hardline stance in light of the derailment, said Hatch of ABH consulting, saying the derailment gives the agency "more wind at its back" to oppose technological expansion.

"It doesn't eliminate, but it certainly delays the future of technological advancement," Hatch said. "It prevents railroads from becoming more efficient, more consistent or more resilient. That's not the direction shippers want their carriers to go."