LOMBARD, ILLINOIS — Getting more get freight off highways and onto railcars may be as simple as forming stronger partnerships with the trucking industry and the nation’s short line rail carriers, railroad executives said during an industry conference in January.

The weak freight market may be a window to win new business especially as trucking companies are seeking low-cost, emissions-reducing options and fighting to retain customers, executives said during the Midwest Association of Rail Shippers Winter Meeting.

Leaders of Union Pacific, Norfolk Southern and CSX shared optimistic outlooks for intermodal growth in 2024, pointing to efficiency, safety and reliability improvements as critical priorities for their businesses and customers.

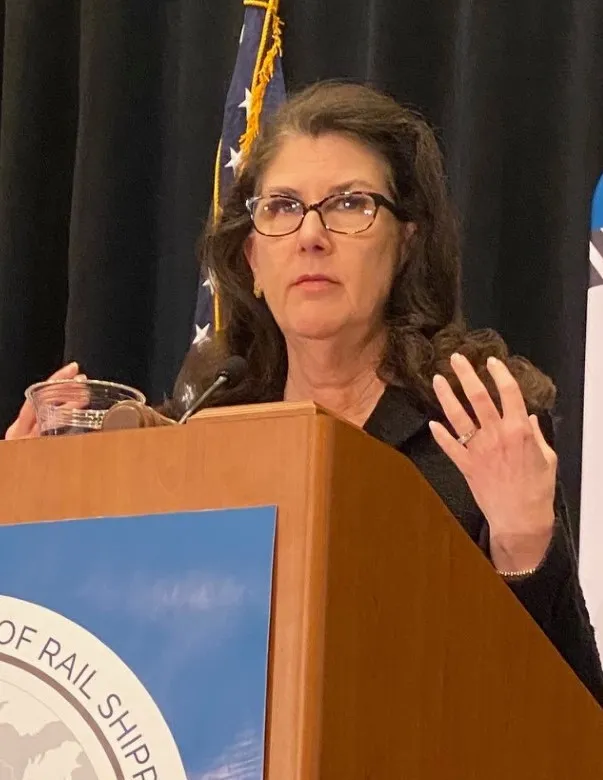

Boosting network efficiency is a key step in convincing shippers to shift their freight to intermodal, Union Pacific President Beth Whited acknowledged to conference attendees. The railroad has invested and secured grants to improve its performance.

Trucking is the real competition, Whited said, but railroads have an opportunity “to make the pie bigger for all railroads.” As an example, she highlighted Union Pacific’s recently launched on-dock service at Port Houston, which allows intermodal containers to be offloaded from ships directly to railcars as well as its cross-border service Falcon Premium.

Similarly, Brian Alexander, COO of Hub Group, a trucking partner of the railroad, expressed optimism about the Falcon Premium in an earnings call.

“We have gained confidence in the stability of that and the consistency of it,” Alexander said.

Whited said the railroad’s expanded services can help businesses, adding that “as the economy stabilizes and grows, we’re excited to be part of it with the intermodal service offerings that we have.”

Norfolk Southern focuses on safety, reliability

Safety has been a priority for Norfolk Southern in the wake of last year’s train derailment in East Palestine Ohio, President and CEO Alan Shaw said during the conference.

The railroad faced headwinds following the incident, he said, but it drove internal changes which have led to heightened safety and improved network performance.

“As we moved through the year, we promised to make a [safe] world even safer,” Shaw said. He said the railroad’s main line accident rate overall was down over 40% in 2023, which contributed to Norfolk Southern’s intermodal segment closing the year with its best service performance in over six years.

Shaw agreed with other executives’ assessment that service will help railroads win business from trucking. There are signs bulk products including metals are poised for a recovery, he said.

“They’re optimistic,” Shaw said, referring to raw metals shippers. “And I know that as we provide our metals customers a better service product and increased velocity of our equipment … they’re going to present us with more business.”

Manufacturing investment in the Southeast, particularly around EVs and automotive, also presents opportunities for intermodal growth, Shaw said.

“We serve nine of the top 10 states for doing business, and we see a lot of investments in manufacturing,” he said. “There are a lot of good things that are driving opportunities for growth.”

CSX sees opportunities in chemicals

CSX President and CEO Joe Hinrichs believes a targeted focus on hauling chemicals can secure more intermodal business for his railroad.

Hinrichs said “chemicals as a whole is our largest customer base.” Chemical hauling represents more than $900 million in revenues for the railroad, he said.

CSX has an inside track to shift loads off the road and onto tanker cars. The railroad in 2021 acquired bulk liquid chemical hauler Quality Carriers, which operates 100 terminals served by 2,500 drivers.

Acquiring Quality Carriers also provided CSX with better insight into the trucking industry, he said.

“What an opportunity to grow your motor business, provide a safer experience for everybody in the community, but also provide cost reductions through an intermodal product,” Hinrichs said.