Manufacturers who use resins for everything from plastic straws to industrial pipes, car parts and heart valves are facing higher prices and increased supply chain hiccups that could persist for years. And the pandemic is only partly to blame.

Dwindling resin supplies have driven up prices for virgin resins between 30% and 50% this year alone, according to the consulting firm AlixPartners. One of the biggest drivers of spiking resin prices this year has been the winter storm that essentially shut down Texas for part of February.

It took several weeks for resin producers in Texas and Louisiana to begin coming back online, and even now many are operating under force majeure procedures. As a result, demand for resins is far outstripping supplies, leaving manufacturers scrambling for polyethylene, PVC, nylon, epoxy and more.

Resin prices surge

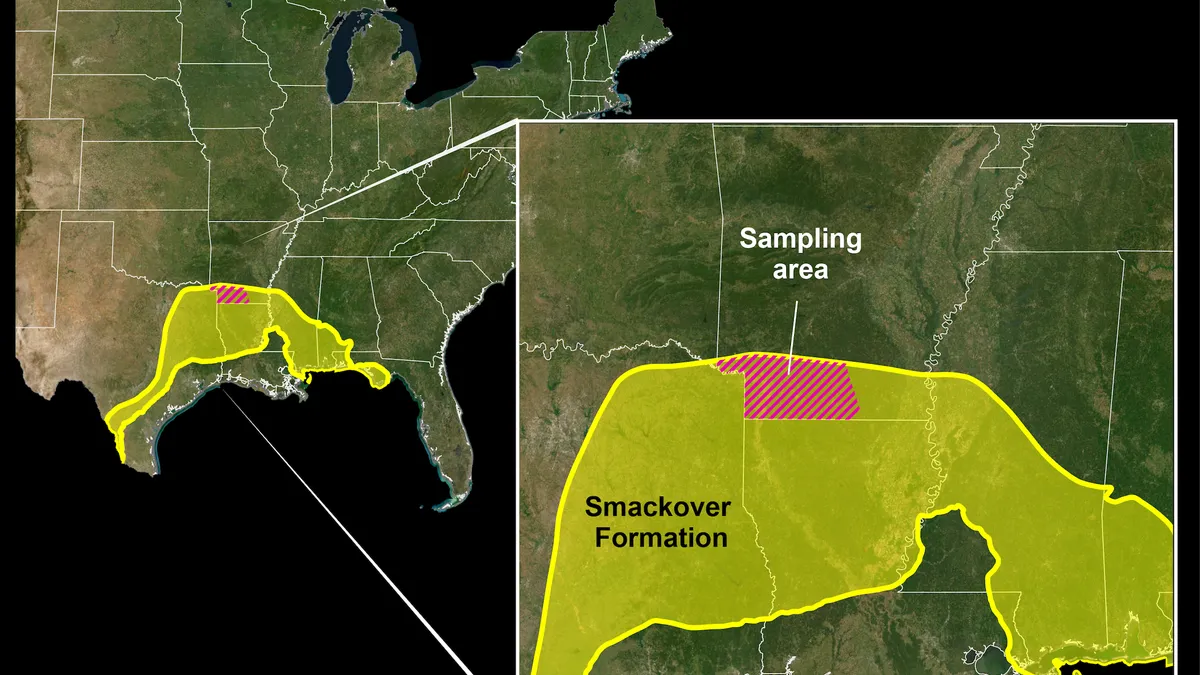

Texas is home to 85% of the U.S. polyethylene production, and polyethylene is the most used plastic in the world. The shortages that resulted from the winter storm have been exacerbated by a busy gulf hurricane season.

"In a hurricane season, there is no room for errors for manufacturers," said Sudeep Suman, a director at AlixPartners.

All of this comes on top of an ongoing pandemic that continues to slow down factories amid sharp increases in demand for everything from medical grade resins and personal protective equipment to plastic silverware and delivery bags.

A domino effect on resin supplies

As it stands now, more than 60% of manufacturers are reporting resin shortages, according to survey data from AlixPartners. It expects the problem could persist for up to three years until production capacity catches up with demand. Some relief could begin to emerge as early as the end of this year, Suman said, but even then, other threats are perpetually on the horizon.

Because resins are a byproduct of petroleum refining processes, anything that causes a decline in refining activity or the demand for fuel can set off a domino effect that makes resins harder and more expensive to find.

Storms could knock out refinery capacity at almost anytime, for example. Refineries in southern Louisiana idled their plants as Hurricane Ida barreled toward the state and its petrochemical hub. On Monday, a day after the Category 4 hurricane made landfall, S&P Global estimated 2.2 million barrels per day of refining capacity was offline.

The rising popularity of electric vehicles and pressures of climate change could have domino effects that result in lower petroleum production and a decline in the resins created as byproducts of that production. Political pressure to move away from oil drilling could also cause hiccups for resin manufacturers and those who rely on them.

"Disruption cycles are replacing economic cycles," Suman said. "Disruption is the new normal. Resin is the new semiconductor."

When only resin will do

Manufacturers in need of resins now have few options or alternatives. Some producers may be able to substitute recycled resin. Their savings, however, could be limited. Even reground resin prices are up between 30% and 40%, Suman said.

Manufacturers of food grade products have specific requirements that limit their flexibility to substitute components. Industrial manufacturers on the other hand, have an increased variety of options though any process changes could bring increased production costs or performance issues.

When specific resins are the only option, treating supply chain disruptions as the new status quo is key, Suman said. That could mean planning further ahead, paying more for storage and holding greater volumes of inventory in warehouses.

Ferriot, an Ohio company whose specialties include injection molding and resin selection, recommends its customers approve multiple resins for use in their products so they have options when shortages arise.

"This affects anybody that makes plastic parts — everything from consumer goods to industrial products," said Liz Lipply, manager of customer service and marketing at Ferriot.

"Disruption is the new normal. Resin is the new semiconductor."

Sudeep Suman

Director at AlixPartners

Lipply expects resin supply issues to persist into next year.

"It's really controlled by the manufacturers and their raw materials availability to make the resin," she said.

While the pandemic caused severe shortages in commodity resins like polyethylene, manufacturers using engineered resins were largely spared until this year, she said.

Now, however, estimated deliveries for many types of resins have stretched from a month at most into several months at best. Ferriot recommends customers invest in developing relationships with suppliers and not just planning ahead but also planning for whatever other disruptions could emerge.

In the meantime, manufacturers may have to make some tough decisions about how to deal with increased materials costs.

"The name of the game is figuring out where you can pass on costs," Suman said.

This story was first published in our weekly newsletter, Supply Chain Dive: Procurement. Sign up here.