The sneaker resale market was booming before the coronavirus spread globally. During the pandemic, though, the second-hand market took off as people at home took stock of their belongings and start cashing in.

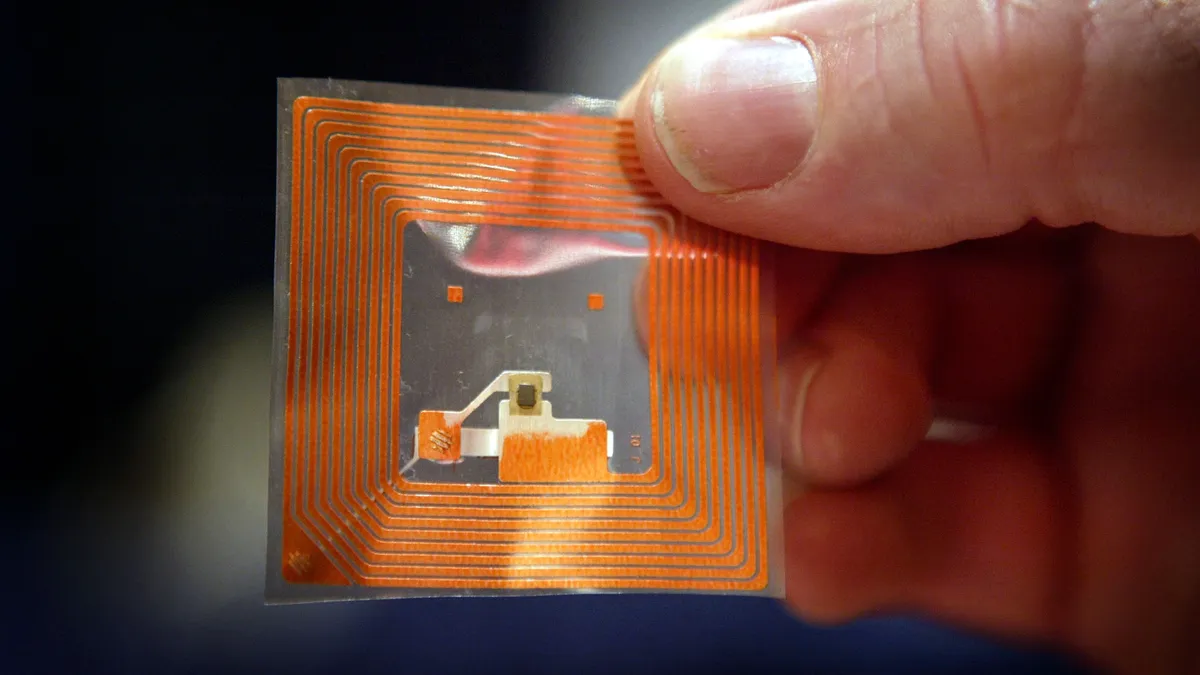

That brought about concerns of authenticity for brand-name items. Ensuring product legitimacy is one reason Adidas signed on to Avery Dennison's new atma.io platform, which can verify provenance using RFID and other sensors, said Max Winograd, vice president of connected products at Avery Dennison.

Adidas uses the platform for its Infinite Play program, initially piloted in the U.K., that allows consumers to return some branded items for Adidas credit. Adidas then resells or recycles the products. The company announced it will launch Infinite Play in the U.S. later in 2021 as part of its sustainability program and its plans to grow the direct-to-consumer business.

The goal is for DTC to encompass half of overall sales by 2025, potentially doubling Adidas' current e-commerce business. Digital transformation and an omnichannel strategy are big parts of that plan, which means using RFID to manage inventory.

Supply chain traceability increased in importance during the pandemic, as e-commerce grew. Companies began investing in visibility solutions for their complete supply chain, instead of just in one area, said Gayle Meyer, vice president of global marketing and communications at Impinj, which makes the silicon chips in the finished RFID tags.

"COVID has made the pain points that existed before [the pandemic] more painful. There have always been supply chain disruptions, but not necessarily at the same scale," she said.

RFID adoption grows

The investment in visibility solutions drove growth in Avery Dennison's smart label business which rose 9% in 2020, with most of that growth in the apparel space.

In the company's February earnings call, President and CEO Mitch Butier said Avery Dennison expected 15%-20% long-term growth from expanding RFID into a broader intelligent label platform. The increased RFID adoption momentum is due to migrations to e-commerce. RFID drives labor efficiency and improves product availability, he said, as it is easier for employees to know what products are on hand without having to manually search.

While Butier said the current RFID business brings in more than $500 million annually, the global RFID market is around $10.7 billion this year, according to Research and Markets, a number expected to grow to $17.4 billion by 2026. The firm bases that estimated growth on additional RFID installations in manufacturing to improve productivity as a result of the pandemic, healthcare organization use to deter COVID-19 spread, the increasing cost-effectiveness of RFID and high returns on investments.

RFID: Apparel's staple for in-stocks, fulfillment, returns

Apparel was the first industry to widely adopt RFID to solve inventory visibility issues, said Meyer. The industry uses it throughout the supply chain, from goods manufacturing to store distribution. Items can be pulled for e-commerce at any point along the way.

"Anywhere a transaction happens, there's visibility using RFID," Meyer said. With RFID, retailers can see how many SKUs are in stock according to item characteristics like size and color. The information can be fed through to the website for consumer use, too.

Apparel retailers like Scotch & Soda were looking into RFID before the pandemic as a way to improve stock accuracy. The goal is better visibility, replenishment and sales across channels.

"If you promise to have something, you have to keep up your promise, and that availability is provided by technology," said Rik Kok, Scotch & Soda's global director of procurement and real estate.

RFID will eventually help the retailer choose between store and warehouse fulfillment for each order, as well. If the system sees a store close to the customer stocks the item, it can fulfill through that store rather than a more distant distribution center.

"Stores are becoming more like microfulfillment centers rather than just buying or trying on products."

Max Winograd

Vice president of connected products at Avery Dennison

Kok said he has seen RFID prove itself with other fashion retailers. While each company's key performance indicators differ, some found it helpful in increasing sales, focusing on the customer journey, or showing stock availability.

The pandemic accelerated the use of buy online, pick up in store. Accuracy is imperative for these orders, and RFID helps with that. "Stores are becoming more like microfulfillment centers rather than just buying or trying on products," said Winograd.

Inside a store, retailers can automate their inventory counts. That drives up the accuracy and brings efficiencies into the inventory process. Stores then know the size and color of every item inside, making in-store fulfillment easier, and allowing accurate information to be shared on the retailer's website.

In-store RFID benefits, by the numbers

- 99% inventory accuracy

- 60%-80% stockout reduction

- 2%-12% sales lift

- 10% shrink reduction

Source: Avery Dennison

Companies are also tracking items for returns. Adidas uses digital triggers, such as 2D barcodes, RFID or NFC tags, on the 1.2 billion products it makes annually, according to Winograd. By assigning a unique digital identification to each item, and even each box (in the case of sneakers), the product's lifespan can be tracked from manufacturing to the consumer (or from consumer to consumer, if the product is later traded in or resold).

Adidas is trying to keep its usable products in circulation through Infinite Play. "Rather than throwing away old items, it's more of an effort to extend their life," Winograd said.

The atma.io platform marries item-level information with a unique digital identification, which can authenticate the items consumers want to sell back to Adidas, or presumably consumers can use it if selling items to other buyers.

Nike recently announced a takeback program as well, for sneakers covered under the 60-day wear test. The brand will refurbish the sneakers to resell, donate or recycle. Nike also uses RFID tracking for its sneakers.

The growing business cases for RFID

Adidas places digital triggers on each shoe and box — all of which can be tracked through the atma.io platform.

Winograd likens the atma.io system to an eye chart, allowing visibility to the lowest level of the chart, while traditionally companies only have access to the SKU-level visibility at the top of the chart.

That creates business value, he said. Brands and retailers can provide consumers with more information about the products, their journey and their provenance. A consumer might scan the sensor on the product inside the brand's mobile app to see care information, learn how to recycle it, or to verify the product is authentic.

Inventory accuracy is another benefit, as RFID accuracy is 93% to 99%. Brands and manufacturers can see an increase in productivity and touchless operations when using RFID, making inventory management more efficient.

Meyer said companies are adopting RFID to solve their largest pain point, which in many cases is tracking pallets. That ensures the company knows where the pallets are when they move on and off the truck.

RFID tags can be used on an item or unit level, in addition to a pallet level, or via a parent/child tracking relationship.

Businesses are also interested in using tagging and tracking to indicate the overall health of their supply chain. Managing just-in-time models were difficult during the pandemic.

"You need visibility so those running the system know where the slow-downs are, so they can figure out how to fix them," Meyer said.

"Anywhere a transaction happens, there's visibility using RFID."

Gayle Meyer

Vice president of global marketing and communications at Impinj

Meyer said another reason for greater RFID adoption is the lower cost of technology. When Impinj' RAIN RFID technology was introduced around 12 years ago, tags cost about 15 cents, she said. For mass adoption, retailers said the price needed to be around 5 cents. "That's roughly where we are today," Meyer said.

Decreasing costs had an impact in Scotch & Soda's decision to move forward with RFID, with total system costs falling 60% to 70% over the past four or five years, Kok said.

However, it's not just the tag cost companies are considering, Meyer said. "The cost of not having visibility is so great. There' an opportunity cost that starts to negate the cost of the tag."

This story was updated to clarify the types of digital triggers Adidas uses.

This story was first published in our weekly newsletter, Supply Chain Dive: Operations. Sign up here.