Editor's note: This article is the latest in a series that looks into the ways supply chains, warehouses and manufacturing facilities are investing in technology. Here's the previous story.

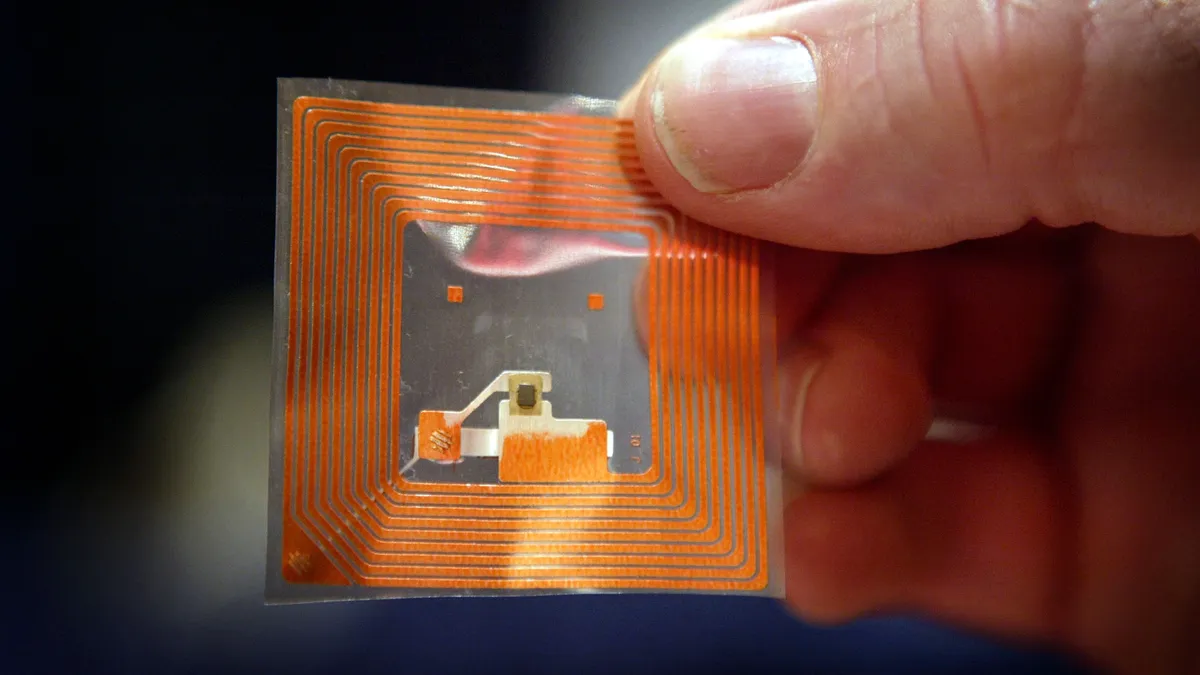

The proliferation of cheap RFID tags and Wi-Fi-enabled machines and devices means IoT is more present than ever in the supply chain. That presence lets warehouse managers and supply chain professionals know where an item physically is, or if a piece of machinery has slowed down. But it's just the start of what a connected supply chain can do.

In "Innovation Driven Resilience," the 2021 MHI Annual Industry Report, MHI and Deloitte surveyed more than 1,000 supply chain professionals worldwide about innovation investments in the supply chain. They found 27% of respondents use industrial IoT today, and 46% predict they'll use it in five years.

Cheap RFID tags have brought down the cost of connecting items, which means more items are connected. MHI and Deloitte found that 52% of companies are increasing or substantially increasing their investment in sensors and automatic identification. Of the respondents, 42% said they use sensors and automatic identification today, and 27% plan to adopt the tech in one to two years.

Tags will get even cheaper with the proliferation of Bluetooth tags, said Robert Schmid, chief futurist at Deloitte. They don't require batteries and instead draw power from radio frequency energy. He said that's probably two to three years away.

Data insights in a stovepipe

Right now, IoT is being used to know "where stuff is," Schmid said. Cloud adoption "gives people continuous access and ability to see the system."

This capability has been especially useful to manufacturers to find equipment, in which sensors help identify an item's location quickly.

IoT capabilities can also connect items, devices and machinery to a network, and give updates, "whether that's material going through the warehouse or supply chain machinery if it's doing its job and if it's up to throughput," said Jeff Christensen, vice president of product for Seegrid.

"Data lakes, without the right tools in place, just become data swamps."

Dwaine Plauche

Product marketing manager at Aspen Technology

The status and/or location of items, devices and machinery is helpful to warehouse managers and supply chain professionals, but those insights are limited if they're kept in a "separate and stovepipe way," said Christensen. "Devices are connected that then communicate their own status, as opposed to really being integrated with lots of others," he said.

If devices are integrated, their statuses are more cohesive and help with end-to-end goods flow, he said.

Previous investment in IoT devices "sets us up for the promise of what really connected IoT means," said Christensen. "But we're not quite fulfilling that promise yet."

The tech investment hangover

Integrating devices will require investment in technologies that not only collect data from all those connected devices and items, but figures out what to do with it.

"Data lakes, without the right tools in place, just become data swamps," said Dwaine Plauche, product marketing manager in AIoT at Aspen Technology. "All this data and all this investment capturing data is going nowhere without the ability to capitalize on this data."

He added that pharmaceutical companies and refiners are already ahead of the curve when it comes to integration via IoT, in part because they're both heavily regulated, and refiners also typically have low margins.

Connected systems will become more crucial if regulations on things like emissions become more widespread across industries.

"To do that really requires a data foundation," he said.

For mid-sized companies, the biggest hurdle to maximizing the capabilities of IoT is the need to spend in other areas of technology that, right now, have clear cut use cases. According to Deloitte's 2021 Middle Market Technology Trend Report, 28% of respondents from smaller companies with revenue of up to $500 million say that cloud applications will have the most significant impact on their organizations tin the next 12 months.

"COVID happened, so investment in digital ramped up," Schmid said, adding that smaller companies aren't spending on technologies like IoT, which could put them behind in terms of technology and in deeper technology debt.

Those mid- to small-sized companies that are already feeling a tech spend hangover but still want to move into more connected IoT across their operations should start small with two or three obvious use cases, and scale from there.

"What's going to happen is you're going to see benefits that you didn't expect," Schmid said. Even if the results are slightly unexpected, he said "keep an open mind to what else comes in."

This story was first published in our Operations Weekly newsletter. Sign up here.