Dive Brief:

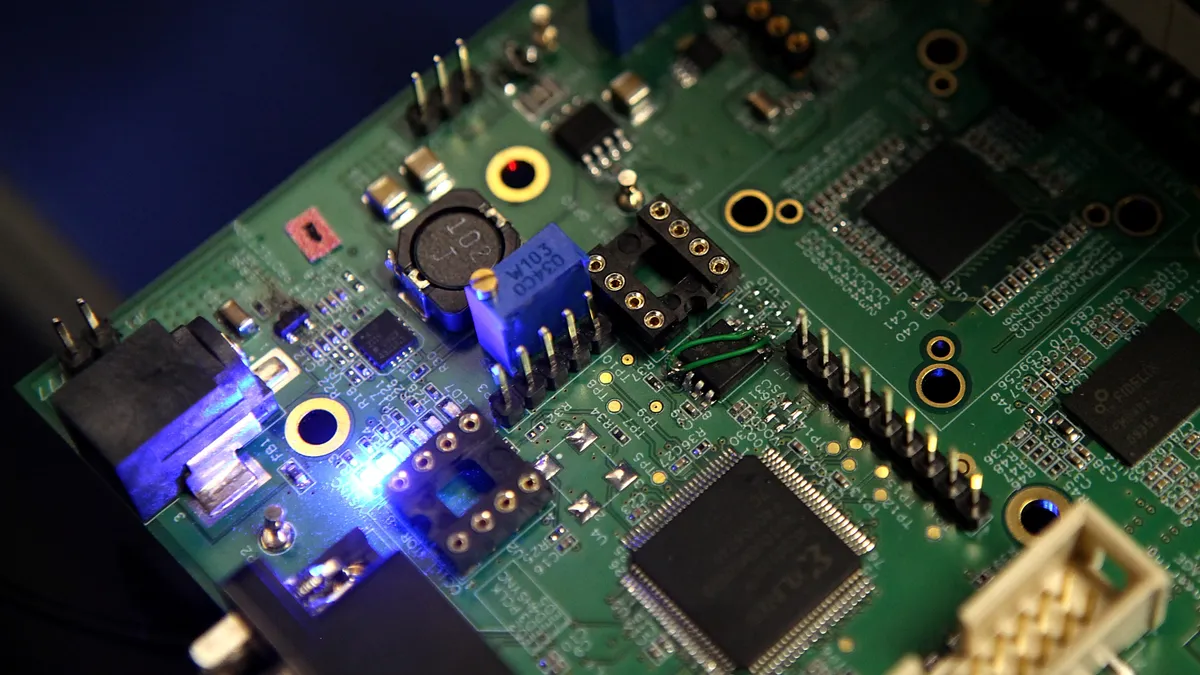

- Semiconductor producers don't expect shortages to improve in the near term as soaring demand and a backlog of orders constrains supply.

- Taiwan Semiconductor Manufacturing Company CEO C.C. Wei told investors Jan. 13 it expects "capacity to remain tight throughout 2022." Demand for silicon-based computer chips has skyrocketed as businesses shift to 5G and high-performance computing, said Wei.

- Semiconductor supplier Broadcom saw its order backlog grow to $14.9 billion at the end of 2021, up 15% from the prior year. "As of right now, we're pretty much booked all the way through '22 and even beyond '22 into '23," CEO Hock Tan said in an earnings call last month.

Dive Insight:

Increasing use of chips in everything from automobiles to appliances means more businesses across industries are competing for limited supply. Suppliers are working furiously to ramp up production, announcing plans for new factories and billions of dollars worth of capital expenditures.

Intel announced Friday it will invest at least $20 billion in two chip factories in Ohio, with production set to come online in 2025 according to a release.

TSMC, a supplier of Apple, is moving forward with factories in Arizona and Taiwan. In 2022, the company plans to help grow its supply by spending between $40 billion and $44 billion in capital expenditures. The majority of the budget will go toward "advanced process technologies, including 2-nanometer, 3-nanometer, 5-nanometer and 7-nanometer" semiconductors, according to CFO Wendell Huang.

But with many suppliers' planned capacity projects not expected to be operational until 2023 at the earliest, chip supply will likely remain limited throughout this year, according to a Deloitte industry outlook.

"We expect shortages and supply chain issues to remain front and center for the first half of the year, hopefully easing by the back half, but with longer lead times for some components stretching into 2023, possibly well into 2023," the report said.

Still, supply constraints may not be as dire as they were over the past two years, which Deloitte said resulted in revenue misses of more than $500 billion worldwide for suppliers and customers. Capital investments made before the pandemic are set to become operational this year, and the report expects capacity for 200-mm and 300-mm wafers to rise by more than 10% in 2022.

Major investments in long-term capacity also show that chip suppliers don't think demand will go away any time soon. Computer chips are becoming more common in retail products and are increasingly essential for companies' plans to invest in technology that can make their own supply chains more efficient. The semiconductor industry sold 1.05 trillion chips through November 2021, the sector's highest-ever annual total according to the Semiconductor Industry Association.

"As we embark upon the 5G era, an intelligent and more connected world will fuel a massive requirement for computation power and propel greater need for energy-efficient computing, which demand greater use of leading-edge technologies," said Wei.