Manufacturing activity trended slightly upward in September thanks to an uptick in demand and production, as companies hope for better economic days ahead.

While the industry remains in economic contraction amid slower orders and rising prices, manufacturers are beginning to plan for improved working conditions, slowly ramping back hiring and production, according to two purchasing managers’ indices.

The Institute for Supply Management’s Purchasing Managers’ Index registered 49% in September, up 1.4 percentage points from August. A reading of 50.0% or lower indicates the industry is in economic contraction.

The growth in activity was due in part to a rise in production, with a positive reading of 52.5%, up 2.5 percentage points from August. Employment also rose to a reading of 51.2%, up from 48.5% last month.

And while new orders remained in contraction at 49.2%, it was an improvement over August's 46.8% reading.

"We remain in the trough, and headline PMI indicates a very similar performance in September compared to August," said Timothy Fiore, chair of the Institute for Supply Management’s Manufacturing Business Survey Committee, on a call with reporters Monday.

On hiring, Fiore highlighted a shift in strategy for many companies to manage headcount, moving from the layoffs seen earlier in the year to a reliance on attrition and hiring freezes.

"Companies are still saying they're taking a slower approach here to getting headcount down, which can only mean that they're more optimistic about the moderate term," Fiore said.

The S&P Global PMI index registered similar results, with a reading of 49.8 in September, up from 47.9 last month. Like ISM, the S&P index highlighted a return to hiring and output growth as companies look to increase capacity.

At the same time, optimism among manufacturers regarding future output growth hit its highest mark since April 2022, as companies hope for further acceleration in future demand.

"Manufacturers’ expectations of future output have jumped to their highest for nearly one and a half years, supply conditions continue to improve, and the rate of order book decline has moderated considerably in recent months, in part due to fewer producers and customers reporting deliberate cost-focused inventory reduction policies," Chris Williamson, chief business economist at S&P Global Market Intelligence, said in a statement.

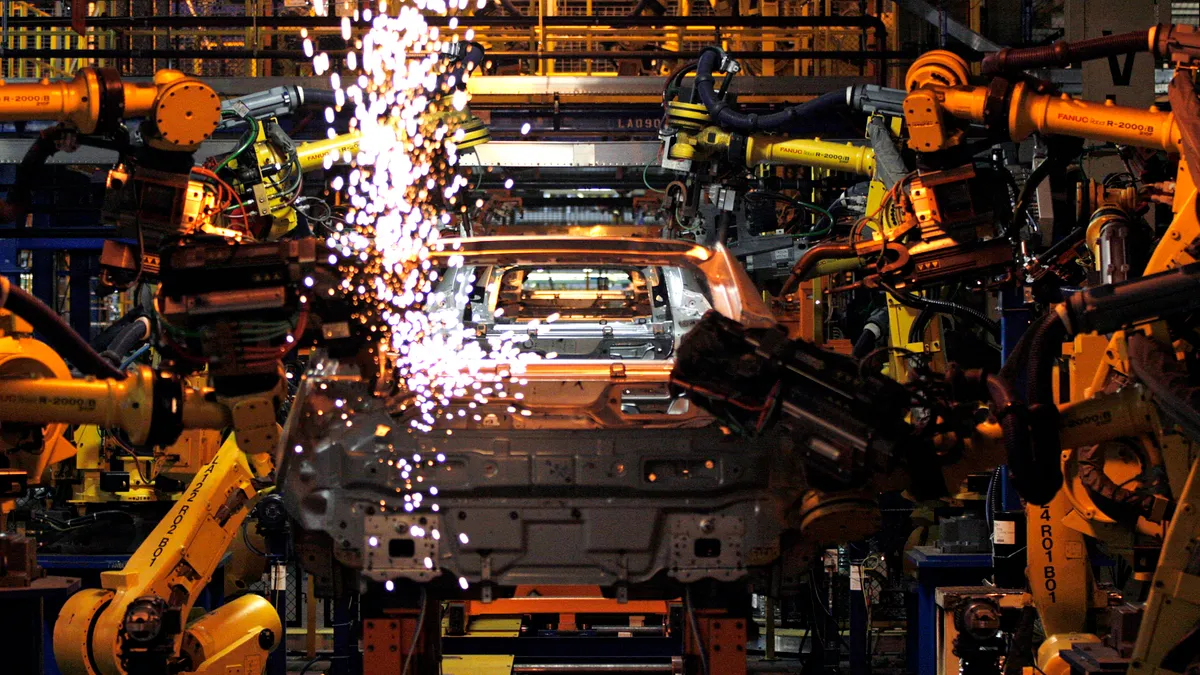

Still, anxieties in the industry remain as the United Auto Workers' strike continues and its impacts ripple throughout the manufacturing industry. Fiore noted that 8% of PMI survey respondents said they were concerned about the strike and its impact on manufacturing.

While transportation equipment makes up roughly 13% of national manufacturing output, according to Fiore, the effects of the strike could reach many sectors, including electronics and other suppliers.

"At this point people were definitely concerned," Fiore said. "The fact that it's slowly developing and they're continuing the dialogue and negotiations is a positive thing."

This story was first published in our sister publication, Manufacturing Dive. Sign up here.