Editor’s note: This story is part of a series on the de minimis rule’s supply chain impact and its uncertain future. Read the previous story here.

If you’re an e-commerce retailer looking to save on cost, the de minimis exception could be right for you.

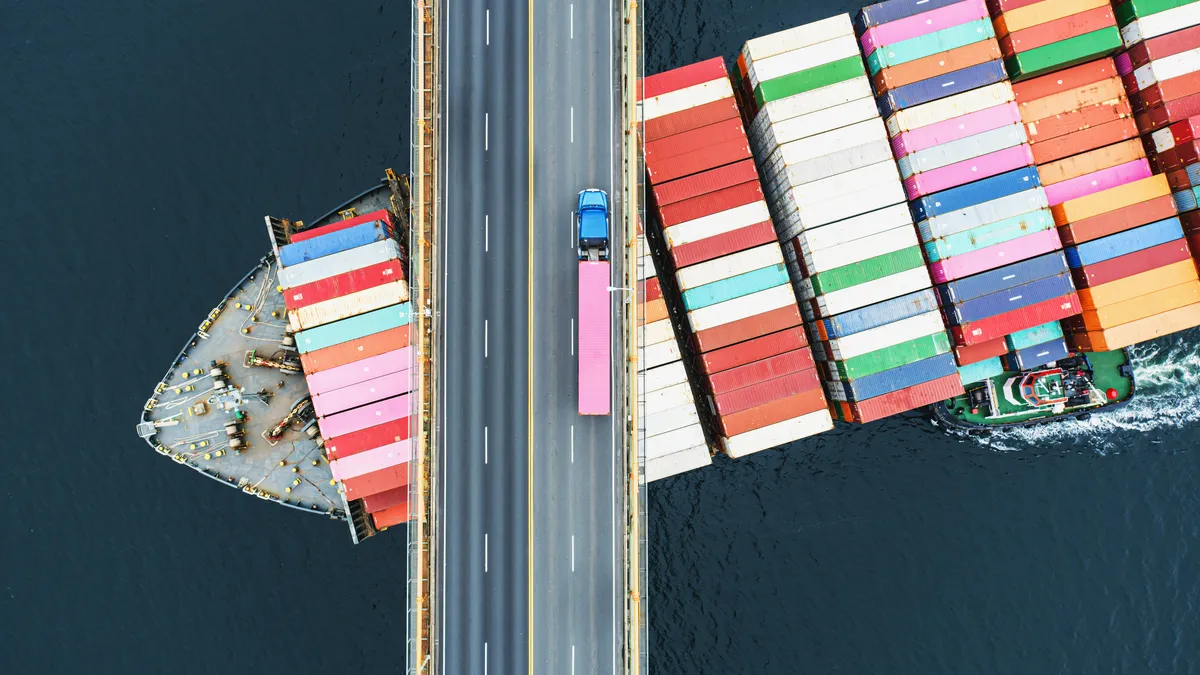

The niche customs provision is an increasingly popular tool in retailers’ fulfillment playbook, despite recent changes to enforcement and concerns about its future. If used correctly, companies can leverage de minimis to ship goods from foreign countries directly to consumers, while saving time and costs, experts told Supply Chain Dive.

However, the strategy is not a good fit for every e-commerce retailer: An effective de minimis strategy depends highly on a company’s product type and supply chain set-up, and may take significant customs expertise to assess. So how do you know if your supply chain is properly set up?

Here are some of the top questions logistics consultants and executives said they consider when helping shippers evaluate whether de minimis is the right fit for their supply chain.

1. What is your average order size?

Companies that ship goods directly to consumers are the best fit for this strategy, in part due to their typical order size.

“De minimis shipments are more common in the parcel and e-commerce industries,” Miguel Perez, senior director of cross-border operations and solutions at TA Services, a freight brokerage, said in an email.

The customs provision limits duty-free shipments to an $800 limit per person, per day. While that is a sizable limit for many e-commerce goods — consider how many T-shirts, water bottles, or beauty products a single person could buy for $800 — firms with high-value products may find the provision less useful.

As an example, ShipBob uses the provision to fulfill its merchants’ direct-to-consumer shipments from places like Tijuana, Mexico. A ShipBob spokesperson told Supply Chain Dive its clients use the provision to ship orders valued between $60 and $100, on average — far below the upper limit.

By contrast, companies like Ford may not benefit as much from a de minimis exception, due to the average size of their orders, Linda Bravo, a U.S. customs broker at Sunset Transportation, told Supply Chain Dive.

“Ford is an importer of record, and they're going to buy a huge amount. It's commercial,” said Bravo. “They're not going to buy for a person, right? They're going to buy for their plant, or they're going to buy goods to send to their plant in Detroit. So they’re huge shipments going for assembly.”

2. How is your product classified by customs?

The type of product being imported into the United States also matters, as not every e-commerce shipment may qualify for optimal savings under de minimis provisions.

“So the first thing is classification,” said Maggie Barnett, CEO at LVK Logistics, a 3PL specializing in de minimis fulfillment. “This can get really difficult.”

Barnett used several examples to explain why customs classification can quickly become a headache for shippers not versed in customs law. A shoe with a rubber sole could be assessed for tariffs differently than one with a leather sole, changing the potential cost-savings involved in the strategy. Similarly, products coming from different manufacturers could add further complexity to the analysis.

“That's just step one. Is the juice worth the squeeze?” Barnett said. “Am I gonna save 30% or am I gonna save 5%, but I have all this hassle and all this risk? And that’s where we usually weed out a lot of people.”

Imports of low-value packages has surged since 2015

3. What is your inventory mix?

Shippers should also look closely at their cash, mix of suppliers and sales channels, Barnett recommended.

She said a brand that does both direct-to-consumer and B2B orders may have different needs than one that mostly sells on marketplaces, in terms of how much and how frequently they need to import inventory. If a brand sells 50% of its product to Walmart, for example, they may need to bring large containers into the U.S. anyway.

“Is it worth splitting these shipments up from the jump?” Barnett suggested asking.

Ultimately, most brands want to minimize split shipments, she added, but if trying to leverage de minimis could result in extra touches, the strategy may not be a fit.

“If you get that mix wrong, then you're shuttling stuff from Vancouver down to fulfill a B2B order,” Barnett said.

4. Where is your customer?

Finally, if all the other factors align, several experts said shippers often also have to consider where their customers are when assessing how to set up their logistics network for de minimis shipments.

Shipping from Canada, for example, may a great choice for shippers who may want to service consumers in both the U.S. and Canada. Meanwhile, companies who ship from Mexico are often looking primarily to save on fulfillment costs, without serving the in-country market.

A customer's location may also define which de minimis hub to use in Mexico or Canada.

Shippers looking to reach the U.S. West Coast may choose Vancouver, Canada, or Tijuana, Mexico, as their cross-border hub. Meanwhile, shippers looking to service the East Coast may send products directly to Toronto, Canada, or use air freight as part of their logistics solution.

“There's so much density in the northeast, so something coming in from Vietnam — you can just air it in. Especially if it’s lightweight, drop it in Toronto, and take care of most of the needs,” Barnett said.

For shippers who have their de minimis hub in Mexico, air freight is also an important piece of the puzzle, said Steve Givens, managing director of fulfillment optimization at ShipWare.

Givens said clients he has worked with have sent packages from San Diego — across the border from Tijuana — to the East Coast on passenger planes, for speed.

“That eliminates a significant amount of the transit time,” Givens said.