Being prepared for potential service disruptions is part of Scott Shannon’s job.

As a VP with C.H. Robinson Worldwide’s North American Transportation Division, he oversees the brokerage’s operations in Canada where it manages more than 650,000 cross border shipments annually.

So when Shannon learned in May that Canadian railroad workers authorized a strike, he recognized the crippling impact it could have on freight movement, and immediately began contingency planning. The plan wasn't needed at the time — the Canadian government halted it to assess the public impact of a strike — but Shannon is keeping contingencies ready in case disruption eventually comes.

While no strike is imminent, the prospects of a work stoppage by Canada’s nearly 10,000 union railroad workers has plagued logistics managers, like Shannon, for months. On July 12, the Canadian government announced it would release a decision by Aug. 9 on whether a work stoppage by the Teamsters Canada Rail Conference would impact residents’ health and safety. If it’s determined there is no safety risk to citizens, represented workers are positioned to legally strike 72 hours after the government announces its decision.

The union, Teamsters Canada Rail Conference, has said it is prepared to strike unless it gets a new labor deal to replace its contract that expired Dec. 31, 2023. Here's what such a strike would mean for supply chains, according to several logistics experts.

How would a rail strike in Canada affect supply chains?

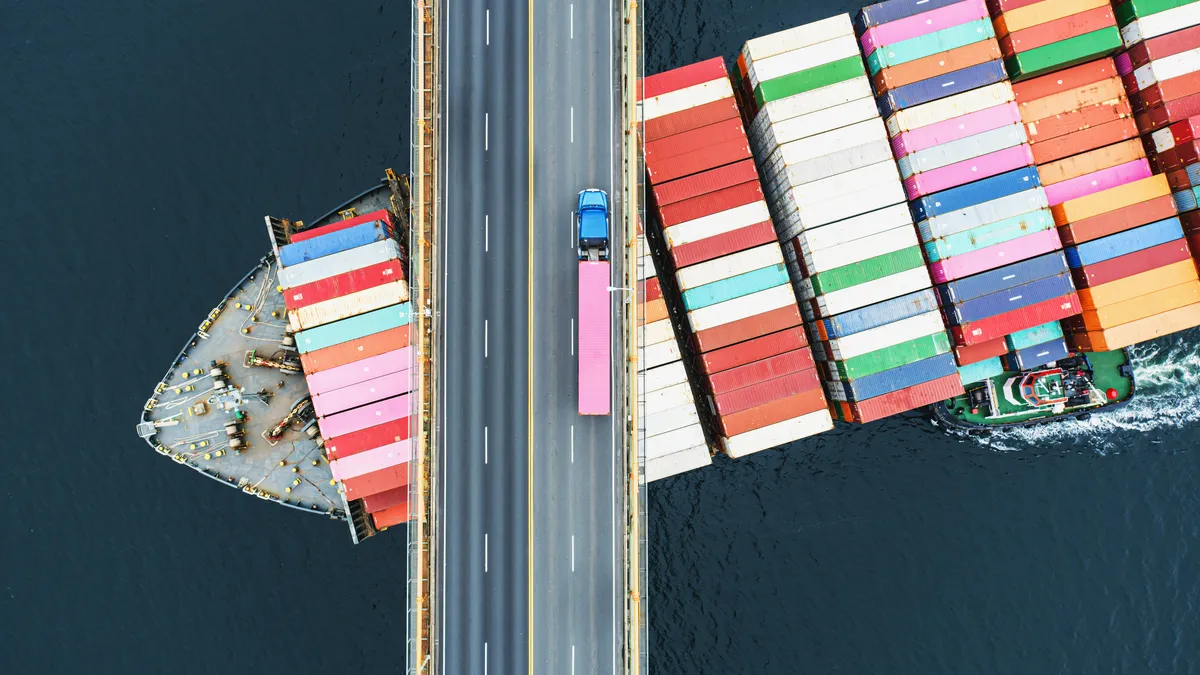

Every day of a strike would have the potential to ripple into further supply chain disruptions, as railroads are critical links for maritime, trucking and cross-border freight shipments, experts said.

More than 900,000 metric tons of goods move daily on Canada’s railways, according to the Railway Association of Canada. A work stoppage would impact the movement of $1 billion in goods daily.

Lawrence Gross, president of Gross Transportation Consulting, said Canada’s western ports would be among the first impacted by a strike as a substantial percentage of containers arriving in Vancouver and Prince Rupert move inland on railroads.

A strike lasting more than a day or two would take weeks for Canada’s railroad network to recover, Gross said.

Similarly, Shannon said cross-border freight shipments between the U.S. and Canada are heavily dependent on railroads, and could be quickly affected.

The situation is complicated by the historic nature of the talks: the Teamsters union is negotiating, for the first time, separately yet simultaneously with Canada's two major railroads, Canadian National Railway and Canadian Pacific Kansas City.

In prior years, if a strike occurred at one railroad, freight could be shifted to the other, Shannon said.

“If workers at both railroads strike, it could paralyze the ports and trucking rates could spike because a whole lot of freight would have to find another way to travel,” Shannon said.

The ripple effect of a strike would impact industries dependent on raw materials and minerals as well as agriculture and food products that depend on railroads for distribution. A total of $380 billion dollars in goods were transported by Canada’s railroads in 2022, Canada’s railway association reports.

Marc Brazeau, president and CEO of the Railway Association of Canada, said in a website post to members in May that the impact of a strike would be extensive.

“Not only would Canada’s two Class 1s be idled, there would be deep impacts on trucking, transloading, warehousing, and port operations,” he wrote.

What can shippers do to mitigate service disruption?

Preparation is the best way to stave off problems that could arise if Canadian railroad workers strike, experts say. Many brokerages and logistics companies have been making contingencies in recent weeks.

Logistics giant Maersk has been reviewing contingency actions, per a May customer notice. The actions include exploring truck options for cargo transport within and across Canada in the event of a work stoppage.

Paul Brashier, VP of Global Supply Chain at ITS Logistics, said the industry continued preparing for shipping delays even after the initial strike was postponed.

Brashier said in ITS Logistics May Port Rail Ramp Index that railroad strikes in Canada would negatively impact ramps in the U.S. Midwest and Toronto, as a majority of those containers enter North America through Canadian ports.

“The best operational plan to avoid these challenges is to terminate imports at the port of entry and use dray off, transload, and one-way trucking to get freight into DC networks,” he said.

If a strike occurs, Brashier said the main strategy would be to route freight to different entry points in North America.

ITS Logistics has established plans to dray off from the ports of Prince Rupert, Vancouver and Montreal, then cross dock and use domestic truckload one way to get freight delivered to its final destinations throughout North America. Many shippers are also choosing to book shipments to West Coast U.S. ports to avoid Canada, he said.

“It is a very fluid situation and we continue to monitor daily until a resolution is reached,” Brashier said.

Shannon said shippers have been seeking over-the-road options in recent weeks. A typical freight train carries the equivalent of 300 truckloads so trucks will fill up fast, he said.

This likely will cause a spike in trucking spot market rates, Shannon said. Shippers must recognize and be prepared to pay a premium should Canada’s railroad workers strike.

“So as a rule of thumb, we know that changing modes from intermodal to truckload, from truckload to expedited, or from expedited to air comes at a premium of 10-20%,” Shannon said. “In the event of a strike, we advise customers to ship only the most critical freight while we hold back less urgent shipments until more favorable conditions prevail.”