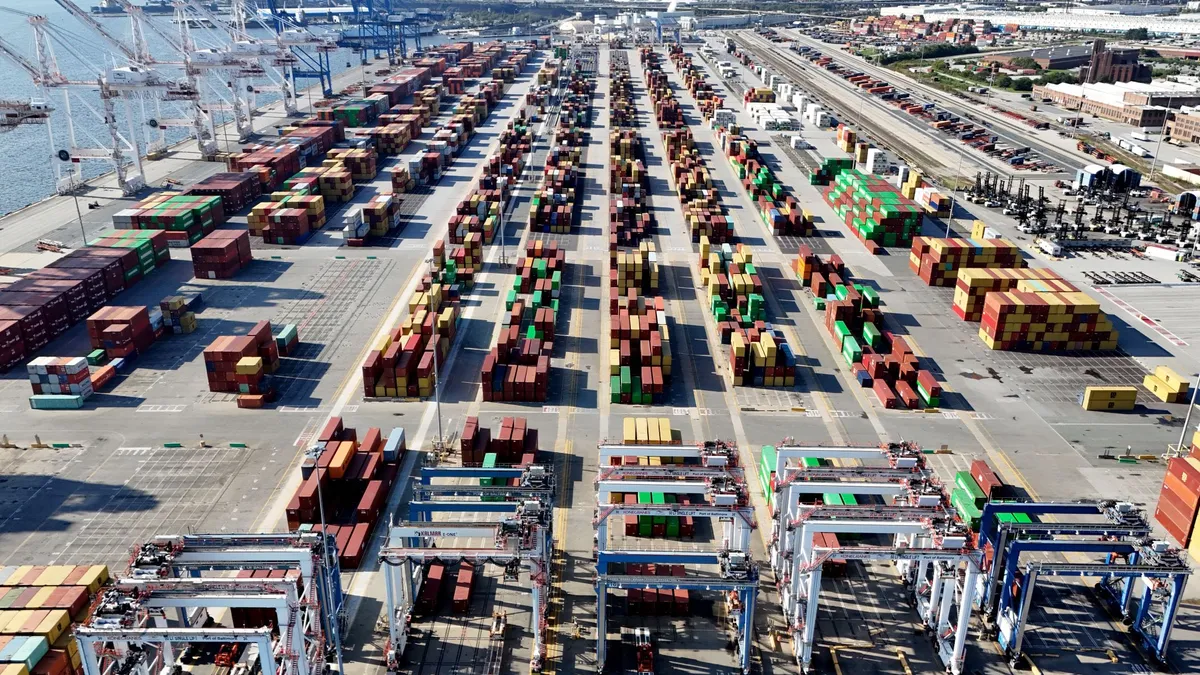

Trade groups are calling for a quick resolution to ongoing East and Gulf Coast port labor talks before workers' contracts expire on Jan. 15.

The Shippers Coalition and Retail Industry Leaders Association this week issued separate statements expressing concern over the potential for another port disruption if a deal is not reached by that deadline. The groups said a strike would jeopardize the U.S. economy by delaying shipments, increasing costs and creating supply shortages.

The letters come as the International Longshoremen's Association and United States Maritime Alliance were scheduled to continue negotiations after a long hiatus. Discussions between the two sides were previously halted in November over a disagreement on automation.

However, a person familiar with the negotiations on Friday told Supply Chain Dive contract discussions were slated to restart on Tuesday. In addition, media reports this week suggested the parties were preparing to resume talks, with CNBC and The Wall Street Journal reporting on meetings on Sunday and Tuesday, respectively.

When asked to confirm the status of negotiations on Tuesday, USMX declined to comment, while the ILA said it has no updates.

Trade groups are concerned about the potential for another strike at East and Gulf Coast ports, as the contract extension established as part of a tentative deal last fall is just over a week away. The last time the contract expired, on Sept. 30, a three-day strike followed on Oct. 1.

“Paralyzing these critical global commerce gateways will lead to shipment delays, increased costs, and potential supply shortages that could impact multiple sectors of the economy. And the longer a work stoppage goes on, the more consumers will feel the ripple effects,” the RILA said in a press release.

The Shippers Coalition urged both parties to consider a contract extension if an agreement is not reached by the deadline to avoid long-term consequences for retailers and consumers.

Simultaneously, the timing of these negotiations come at a critical time when retailers and manufacturers replenish post-holiday inventory and prepare for network pressure from the Lunar New Year, John Donigian, senior director of supply chain strategy at Moody’s, said in an emailed statement.

“A disruption now could ripple through key sectors like retail, automotive, electronics, and agriculture, driving up costs, delaying production, and impacting inventory levels,” Donigian said.

If the two parties do not reach a resolution by the deadline, the labor dispute could run in parallel to the beginning of the next Trump administration, adding complexity to the situation.

“If a deal is not made by the time Trump takes office, Trump will have to balance his campaign promises of protecting the American worker with traditional Republican policies which, as history has shown, are oftentimes less favorable to unions involved in port strikes,” Greg Speier, transportation industry group partner at Reed Smith, said in an email to Supply Chain Dive.

Last month, Trump expressed support for the ILA’s stance against automation in its discussions with USMX following a meeting with union leadership.

“Overall, Trump’s looming inauguration will hopefully push the parties to reach an agreement before January 15 and before the nation has to suffer the consequences of any prolonged strike,” Speier said. “If not, pressure may build from within Republican circles for Trump to take action by invoking the Taft-Hartley Act before too much harm is done.”