North American railways have suddenly become hotter, and it has nothing to do with the summer heat.

Drama is ensuing over proposals for one of two major Canadian railways to acquire Kansas City Southern. Stakeholders across the supply chain are watching the situation unfold — especially shippers, who are trying to determine whether and how a cross-border acquisition by either entity could affect their movement of goods.

At the moment, Canadian National has the upper hand. In May, KCS agreed to be acquired by CN in a deal valued at $33 billion, and KCS' shareholders are voting on an aspect of the deal on Aug. 19.

But it was Canadian Pacific that first proposed to acquire KCS for $29 billion in March. Despite having agreed to that acquisition first, KCS backed out after receiving a higher, unsolicited bid from CN. While it originally refused to enter what it called a "bidding war," CP submitted a new $31 billion bid this month. On Thursday, Kansas City Southern rejected that offer, asking its shareholders to approve the CN deal instead.

Any deal would require review and approval by the federal Surface Transportation Board. Should either proposal be denied, the other railroad could still acquire KCS, but an STB conclusion is not expected until the second half of 2022.

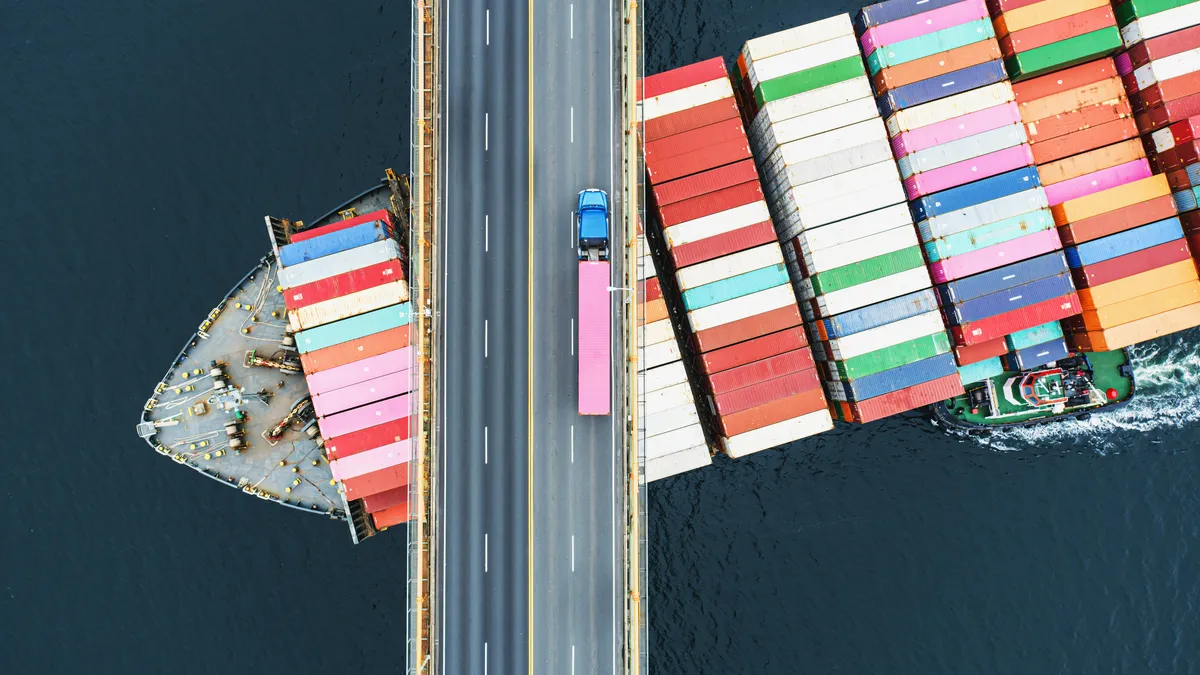

Either way, the consolidation would create the first railway stretching the continent from Canada to Mexico: In addition to reaching U.S. markets, KCS dips into Mexico, and both CP and CN span Canada.

"This proposed deal, no matter who wins it, strengthens that existing idea of creating, in all likelihood, a better service product," said Tony Hatch, an analyst with ABH Consulting.

A rail deal to connect North America

Cross-border trade already occurs by rail, but connecting more of North America on one line and providing access to all of the Gulf, East and West coasts opens untapped opportunities for shippers.

Regardless of which railroad acquires KCS, shippers would get "additional reach for their products [and] additional single-line movements of their goods," said Todd Tranausky, vice president of Rail & Intermodal at FTR.

The additional reach could align with existing logistics strategies focused on shifting product routes. Optimal ports of entry and the flow of goods traffic change as the world changes. For example, the pandemic, recent trade tensions with China and expanding business relationships in Southeast Asia have forced changes in established supply chains.

"Part of the reason that Canadian railroads are developing and strengthening their eastern port access … is because of the possibility of the Suez Canal growing as global supply chains move around based on economic and political events," Hatch said.

The single-line movement could better link Canadian crude oil and petroleum products with Southern U.S. refineries, as well as grain from the Canadian provinces and U.S. Midwest down to Mexico.

"Business to and from Mexico is one of biggest growth markets in the North American rail world," Hatch said.

A connected railroad could bring more traffic

The automotive and auto parts industries frequently ship from production facilities in Mexico to the U.S., namely the auto stronghold in the Midwest. A deal with either Canadian railroad would strengthen that link, Hatch said.

A longer continuous railway could provide more entry points for international intermodal shipments, which also could influence material shipments to the manufacturing-rich Midwest. In particular, Chicago, a main North American transportation hub and the busiest railroad hub in the U.S., could see changes from a cross-border deal such as increased traffic or potential alterations to some supply chains and routes.

"I would watch intermodal shipments," Tranausky said. "If you can get right from the Port of Lazaro Cardenas to Chicago, then you can compete with Southern California ports in a way you can't today because you only get as far as Kansas City and then have to drayage to Chicago."

But increased freight traffic to Chicago could also pose a problem for supply chains: congestion. The recent surge in intermodal traffic to Chicago led two railroads, Union Pacific and BNSF, to limit their operations in the region in July because containers were not moving out of the rail yards as fast as they were coming in. That's due in part to limited supplies of chassis and drayage providers.

The potential traffic increase in the Chicago area and through the rest of Illinois has prompted numerous communities, regional associations and transportation authorities to write letters to the STB either in opposition of the deal, requesting the public release of merger-related information or a thorough and transparent STB investigation before making a decision.

Shippers worry about a new wave of consolidation

KCS' acquisition proposal is widely considered to be a landmark event and likely a precedent-setting case because it is the first time Class I railways have tried to combine since the STB issued revised antitrust regulations in 2001. The rules enhanced applicants' responsibility to prove that the consolidation would boost competition as necessary to offset negative transaction effects like service disruptions.

The STB already ruled that the 2001 regulations would apply to a KCS merger with CN, but one with CP would be exempt.

"If the board allows the CN-KCS transaction to go through under the new rules, it's essentially creating a road map of how other transactions would be viewed and adjudicated," Tranausky said. "I would argue that it opens up pandora's box a little bit, and we ought to be very careful about doing that."

Stakeholders worry that merger approval could create a domino effect that leads to further consolidation within the industry, especially if the CN deal is approved as it would make it nearly double the size of CP. Watching its biggest rival grow even bigger could push CP to seek M&A with another Class I railroad.

This idea of widespread consolidation raises a lot of red flags for shippers.

"One worry in the back of shippers' minds … is will this lead to a final round merger involving the U.S. big four?" Hatch said. "That is something almost nobody wants to see, including the big four railroads themselves."

Some shippers question whether either deal ultimately can — or should — pass the sniff test.

"The merger is probably a good thing overall for transportation, but not necessarily for shippers. The fewer the players, the fewer the options for shippers, especially the smaller ones," said Tom Knippel, vice president, commercial industrial at SA Recycling, a scrap metal recycler that ships products on rail.

Shippers may hold more weight in the M&A approval process than they realize. The STB tends to rely heavily on stakeholder input when making decisions, and shippers can make their opinions known to the STB either individually or through shippers' associations.

"There's going to be a lot of scrutiny in terms of how this deal is pro-competition," Tranausky said. "That's going to come down to shippers weighing in — looking at their supply chains and their routing guide and saying, 'Is this a good deal for us or is this not?' And then making their voices heard."