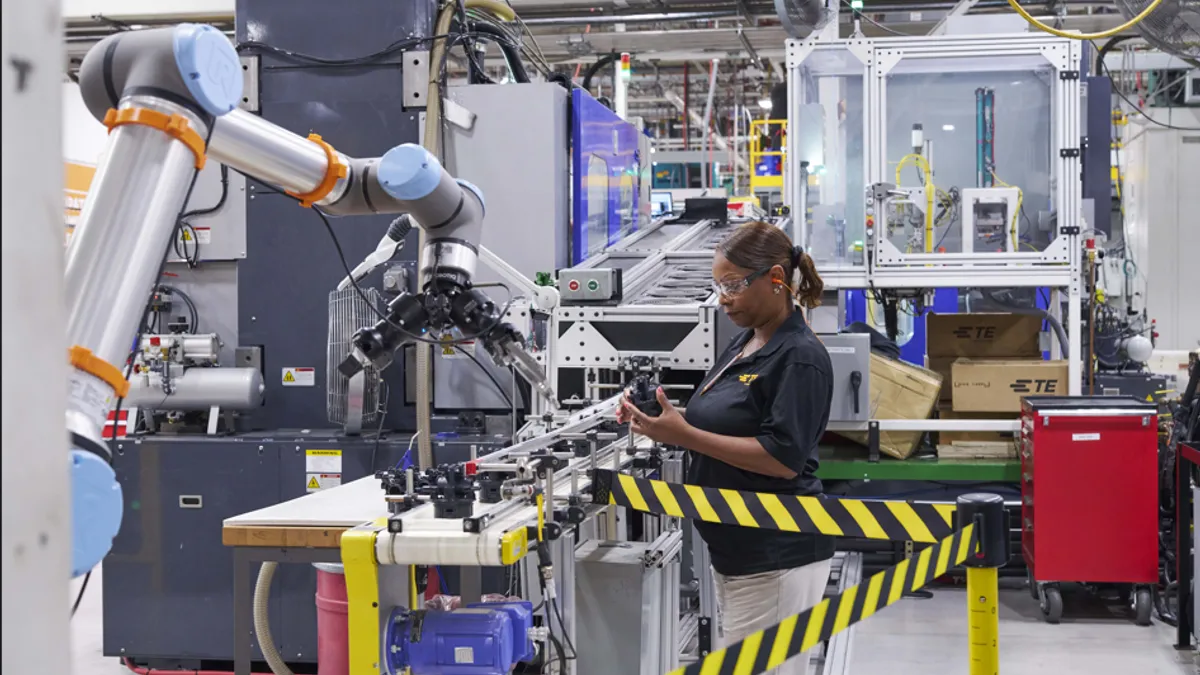

Three centuries after much of the western world underwent an industrial revolution, we’re now seeing another revolution in industry. This time, rather than agrarian societies giving way to manufacturing ones, digital tools are taking manufacturing to the next level of efficiency.

Industry 4.0, as some call this wave of new technology, is breeding the "smart" facility, where systems are interconnected, networks span supply chains and machines learn from past and real-time data.

"Everything is much more connected, networked, integrated," Patrick Van den Bossche, partner at A.T. Kearney, told Supply Chain Dive. "That's not just within the four walls of any manufacturing plant, but it's also with suppliers and customers."

One of the first steps to building a smart manufacturing plant is gathering the technology tools needed to digitally transform manufacturing.

This is where the procurement department comes into play. As PwC said in a report, Industry 4.0 can’t happen without Procurement 4.0.

Buy the right sensor, or risk the Christmas lights problem

In most companies, the IT department, not procurement, handles software and hardware purchases. As smart manufacturing facilities grow, however, the responsibility for acquiring sensors will start to fall into the hands of procurement professionals.

"Certain items, such as intelligent sensors, communicating actuators, and associated controllers and software, will be sourced much more frequently than before," PwC said in the report.

Sourcing new technologies will require purchasing managers to have an understanding of the tools and their functions, so they can make informed decisions when working with existing and new suppliers. In the era of Procurement 4.0, procurement leaders must "stay up to speed on all the new players" and the smart facility trends, Van den Bossche said.

"If you miss the boat ... you're going to end up with a device or piece of software that may require you to update your ERP."

Alex Manders

Principal Consultant, ISG

The process of procuring technology isn’t too different from buying other goods, Alex Manders, principal consultant at ISG, a technology research and advisory firm, told Supply Chain Dive. But it’s not as straightforward as simply buying a sensor. With machines and parts interconnected with one another, purchasing managers have the added responsibility of thinking about how new parts will integrate with existing systems.

"In some cases, not all smart devices will integrate with an ERP system," Manders said. "If you miss the boat on that, then you're going to end up with a device or piece of software that may require you to update your ERP."

Van den Bossche calls it the Christmas lights situation — one bulb goes out, and the whole string turns dark. A faulty or incompatible device can cause this kind of ripple effect throughout a plant.

On the other hand, the outage could be the result of an external factor, such as a cyberattack. "How do you secure all these devices?" Manders said. "Anything that's now being plugged into the supply chain — how do you control all of that?"

Once a concern mainly for IT or security departments, it’s another factor procurement leaders have to keep top of mind when making sourcing decisions, and may require additional software purchases to secure networks.

Services a boon to suppliers and customers

Having the hardware and software in place will start to generate data that can later be connected to an Internet of Things (IoT) platform or used for artificial intelligence and machine learning. But the raw data on its own isn’t all that useful.

"A lot of the companies that come up with these very nifty sensor kits will also try and sell you on the services side of the business," Van den Bossche said.

The suppliers can then take the data gathered from the sensors, store them in the cloud, process and analyze them and produce a report with the findings. "You don’t necessarily have to go through the headache of doing that yourself," he said.

As a supplier, General Electric (GE) found more value in offering services to its customers. It transformed its model to "Power by the Hour," in which it sells engines based on operating time rather than a fixed rate. In other words, customers only pay for the time the engine is in use. GE also offers aftermarket and maintenance services.

This model can be a boon to both the vendor and customer. GE sees greater profits by offering services after the initial engine sale. But GE also has an incentive to keep engines up and running — the more uptime, the more money. For the customer, that’s value added in reliability, even if it comes as a greater cost up front.

The ‘mental leap’ for procurement

Balancing quality and reliability with cost, Van den Bossche said, is the biggest challenge for procurement in Industry 4.0.

Most decisions on sourcing parts historically have revolved around the specs of a product, such as how many pieces can the machine make per minute and at what force, and what product can be purchased at the lowest cost.

But with interconnectivity, reliability becomes a crucial part of evaluating a product, he said. "It's not just ‘does this product meet the specs?’ but also, ‘to what extent is it going to able to help us generate the business results that we expect from that?’ Costing use and delivering business results is not quite the same, so there's a little bit of a mental leap that needs to be made there."

Industry 4.0 is even fundamentally changing how procurement executives go about forming relationships with their vendors.

"A reflex that a lot of procurement folks have is to go for a longer term relationship," Van den Bossche said. "That's not quite possible just yet."

Smart manufacturing and IoT platforms are still relatively new, so established Tier 1 suppliers don’t necessarily exist. Many of the suppliers making sensors and offering analytics services are emerging players and startups.

"A reflex that a lot of procurement folks have is to go for a longer term relationship. That's not quite possible just yet."

Patrick Van den Bossche

Partner, A.T. Kearney

Technology innovation tends to move much more quickly than regulation. When regulation eventually catches up and starts setting baselines or requirements for sensors and IoT systems, the number of suppliers in the space could dwindle, as many are put out of business.

In "this particular landscape of suppliers, a lot of them have a lot of promise but may not be around," Van den Bossche said.

Procurement 5.0?

History repeats itself, as we’ve seen with now the fourth industrial revolution coming about, so logic tells us there’s bound to be Industry 5.0 sometime in the future. What exactly that will look like is unclear, but what’s certain is it will require another shift in the purchasing department to accommodate the next wave of technology.

One possibility is the proliferation of 3D printing to create parts and hardware in smart facilities. Instead of purchasing a sensor, for example, a manufacturer may be able to 3D print that sensor in house, eliminating the need for procurement to source sensors from external suppliers.

What it does mean for sourcing managers is adding a whole new series of parts to the list, including the 3D printers themselves, the associated parts and the raw materials for printing parts.

"There's still a job for procurement," Van den Bossche said.