3M is familiar with pivoting its supply chain for global health emergencies. The manufacturer developed surge capacity during the SARS outbreak in the early 2000s — and two decades later, that buffer enabled it to quickly accelerate production of high-priority SKUs during the COVID-19 pandemic.

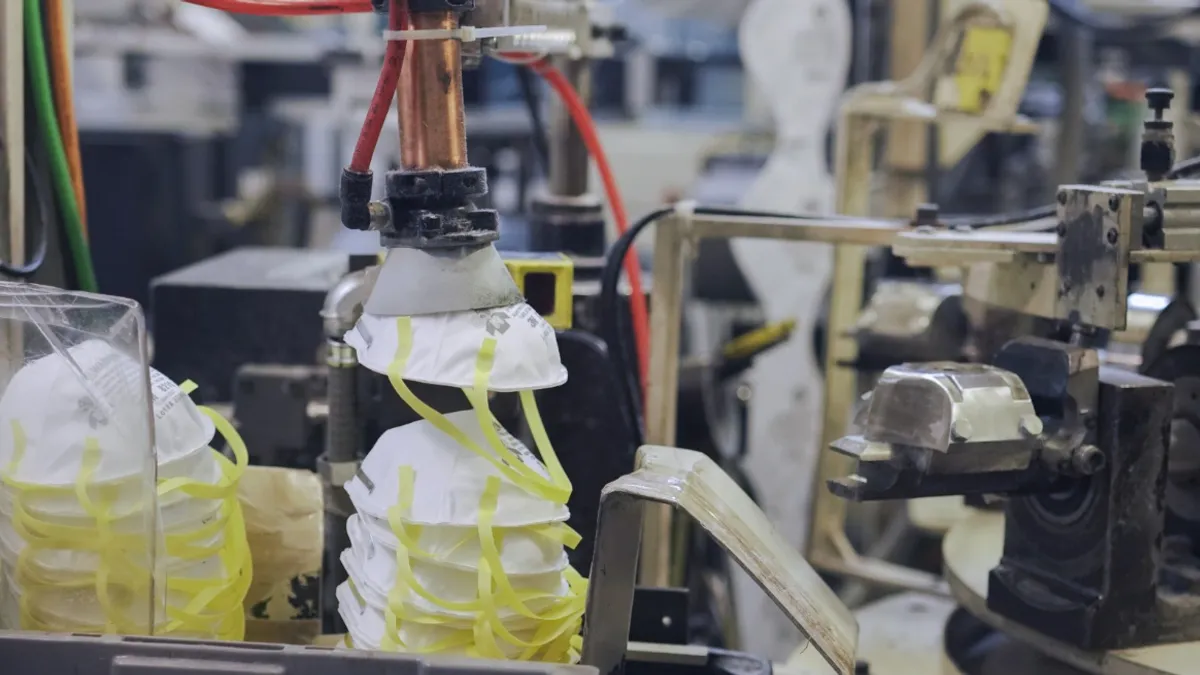

The manufacturer began ramping up production of N95 respirators in January, from 22 million per month pre-pandemic to 26 million.

By June, 3M was making 50 million respirators per month. It added two new respirator lines at a Wisconsin plant in Q3. It dropped non-critical SKUs and refitted production lines for critical supplies, according to Kaitlyn DeSpiegler, global transportation specialist at 3M, speaking at FourKites' visibility conference in September.

Monthly production in the U.S. will reach 95 million by the end of 2020, a 3M spokesperson said. "3M is making more respirators than ever before."

3M's journey through the pandemic as a supplier of critical items has not been perfect. The overall supply still falls short of demand. The company has also had to fight off counterfeit products. And critics say the manufacturer is too reliant on China for supplies.

But as far as leadership through crisis and supply chain risk management go, experts agree 3M has excelled in producing and distributing supplies in a time of unprecedented demand, earning it the Supplier of the Year award.

A supply chain ready to go

3M's plants were churning out personal protective equipment, but to distribute the critical supplies, "we saw a need to accelerate our real-time visibility," DeSpiegler said.

The supplier was already working with FourKites although not for all shipments and distribution channels. 3M put its critical shipments on the FourKites system to get real-time data in one place, which allows 3M to keep less buffer stock on hand, said Subodha Kumar, professor of marketing and supply chain management at Temple University. Getting parcel tracking live took less than one week.

"Your uncertainty is much less," Kumar said. "You exactly know where the item is." That data translates into aligning inventory orders closely with demand, allowing the lean operations and balance sheets many supply chains strive to achieve.

Planning in a pandemic

The manufacturer transitioned from sales and operations planning to integrated business planning about three years ago, according to Mike Burkett, a vice president and distinguished analyst for the Gartner Supply Chain team. 3M is on Gartner's Supply Chain Top 25 list for 2020.

The planning transition helped 3M combat siloed operational issues, Burkett said. And it helped 3M exchange data with suppliers and customers to better match supply and demand.

"You can't possibly plan for every scenario out there," DeSpiegler said. "I don't think any of us really imagined that in 2020, we'd be seeing the worst pandemic that we've seen globally for over 100 years. What you can do, though, is you can be proactive."

Being proactive stems from having visibility on the ground, she said.

This is exactly how 3M responded when customers didn't yet know what they'd need ahead of the pandemic, said Anshu Prasad, CEO of Leaf Logistics. "3M sent their representatives to the customers to understand realities on the ground, triage, and become part of the solution," Prasad said.

Lessons in agility

3M acknowledged demand for its critical SKUs continues to outpace supply, despite preparations and supply chain adjustments. "The demand for personal protective equipment is beyond what any one company can meet," the spokesperson said, adding that healthcare industry demand is up to 40 times above pre-pandemic levels.

3M is a global company with suppliers and manufacturing in many countries, including China. "As Americans, we would all have liked for them to scale production of respirators more quickly. But these extended, complex, global supply chains made that harder to coordinate," Prasad said.

A more robust domestic sourcing base may have reduced lead times, but it's not a guarantee given the widespread disruption of the pandemic.

3M's response does prove the value of real-time data and agility. Forecasting based on historical models was rendered ineffective during the pandemic, with real-time data proving more valuable. And demand shifted quickly at the consumer level, amplified up the supply chain via the bullwhip effect and requiring suppliers to adjust on the fly.

"This is a wake-up call," Kumar said. "Cost reduction is good, but we have lost a lot of flexibility in our supply chains."

Read more

Read more