This is a contributed op-ed written by Katherine Barrios, chief marketing officer at Xeneta. Opinions are the author's own.

There is no doubt that the global supply chain is badly stressed. Import volumes into the European Union are strong, and American import numbers set records monthly.

TEU volumes at the Port of Rotterdam have returned to 2019's pre-pandemic levels, as TEU throughput has increased 7.8% in the first nine months of 2021. Similar to the stimulus payments that fueled consumer spending in the U.S., EU consumer spending is fueling the demand backing the import boom. And, similar to the U.S., the EU import boom is clogging ports and congesting the supply chain.

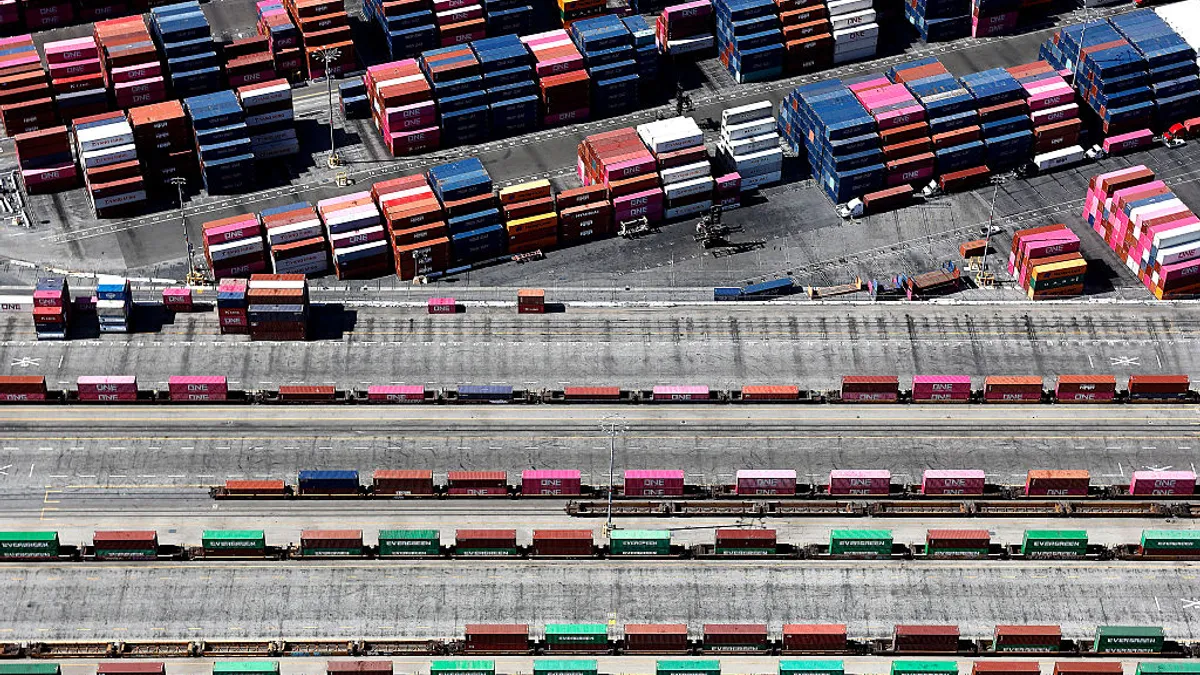

While imports at the Port of Los Angeles were down 6% August 2021 YoY, the Port of Long Beach imports were up 11.7% in the same time period. For both, total TEU's processed were up 10.8% and 11.3% respectively YoY.

The rise in ocean freights is often mentioned in these "what is wrong with the supply chain" discussions, and Xeneta's ocean freight rates reveal that, while rates are up drastically, so are the surcharges applied by the carriers.

Rates for 40-foot dry boxes have jumped during the pandemic

| Lane | Rates on Dec. 31, 2019 | Rates on Nov. 5, 2021 |

|---|---|---|

| Shanghai-Los Angeles/Long Beach | $1,360 | $7,198 + up to $ 3,500 surcharge |

| Shanghai-Rotterdam | $1,633 | $13,521 + up to $ 4,000 surcharge |

| Shanghai-U.S. Main East Coast | $2,500 | $9,491 + up to $ 8,000 surcharge |

SOURCE: Xeneta

In these challenging times, the extraordinary circumstances in international trade have pushed a few capable players to take extraordinary measurements to keep their supply chains somewhat intact. Everyone is watching to see if they can succeed.

What's a shipper to do?

A few of the much larger shippers have chartered dry bulk cargo vessels and begun moving their cargo break bulk, as cargo was moved in pre-container days.

The Home Depot, Ikea, Walmart, Target, Costco and Coca Cola (which recently chartered three bulk tankers to ship 60,000 megatons of product to Shanghai) announced in recent quarters their move into dry bulk in an effort to keep their inventory flowing and shelves stocked prior to the holiday season.

While sellers of pricey electronic goods and fancy items such as Peloton have the ability to raise prices if they ship via air cargo, Walmart, Costco and Target sell low- or medium-priced retail items that historically were price-sensitive.

However, price-sensitivity is immaterial if the store shelves are empty and your cargo is moving slowly on an Evergreen vessel or one of the other six box carriers with a sub-20% reliability rating.

The problem in a shipping world dominated by 24,000 TEU mega-maxes is that moving cargo break bulk is a lost art, or at least requires a skill-set not typically available in a logistical department today.

Price-sensitivity is immaterial if the store shelves are empty and your cargo is moving slowly on an Evergreen vessel or one of the other six box carriers with a sub-20% reliability rating.

Chartering a vessel, collecting the cargo at the load port, dealing with stevedores, making progress payments during the voyage, unloading at the discharge port (more stevedores), moving the cargo to a myriad of final destinations, damaged goods and insurance claims — it's a far different world than calling one's contracted carrier or one's forwarder and have them handle each shipment.

Moving 500-1000 or more containers to the port to meet a specific vessel takes considerable local expertise, plus a dedicated warehouse and/or staging area. Dealing with stevedores and trying to coordinate rail-truck shipments for that same cargo on the receiving end could easily be equally frustrating.

This sort of on-the-job training can prove to be exceptionally expensive.

Some cargo is more easily shipped by break bulk than others. Sugar, coffee, rice, cotton, cocoa, and dry chemicals and fertilizers are products that can be packed in supersacks and transported break bulk. Supersacks can carry up to one metric ton of cargo, have large slings so to be moved by forklift and can be double-stacked.

Although 80% of refined sugar was shipped via container pre-pandemic, that figure has dropped to some 60% as break bulk has become a more viable option, Paulo Roberto de Souza, CEO of the world's largest sugar trader, Alvean Sugar SL, told Reuters recently.

The losses from theft will also be expensive. Shippers worldwide rejoiced when containers were introduced, as the locked boxes virtually single-handedly stopped theft. But with Walmart, Target, The Home Depot, et al shipping boxed goods on pallets, their loss-prevention departments may need additional staffing.

The problem in a shipping world dominated by 24,000 TEU mega-maxes is that moving cargo break bulk is a lost art, or at least requires a skill-set not typically available in a logistical department today.

Shipping via break bulk is doable for large, well-capitalized companies who have the financial ability to meet the different payment requirements of vessel chartering, as well as find the chartering and logistical expertise needed. But there is no guarantee that all the effort and energy needed to successfully ship by break bulk will return freight costs less than today's skyrocketing rates box rates and infuriating reliability issues.

Since Dec. 31, 2019, the Baltic Dry Index has risen from 839 to a high of 5,458 on Oct. 27, 2021. That index, found on the London-based Baltic Exchange, measures the cost of chartering the break-bulk vessels.

The C-Suite needs to be aware of this sort of volatility in the charter market, and the fact that chartering vessels adds to the logistical portside issues at shipping and receiving ports.

Editor's note: This story was first published in our Logistics Weekly newsletter. Sign up here.