Dive Brief:

- Cardboard boxes and wood pallets saw heightened demand in Q2, according to Thomas, as buyers continue to encounter challenges sourcing shipping equipment.

- Packaging ranked fourth among product types by sourcing volume for the quarter, behind adhesives, medical supplies and steel. Corrugated cartons had one of the largest QoQ sourcing increases at 358%, according to Thomas' quarterly report on sourcing activity.

- "The challenges that we’re having in the supply chain right now show just how far we’re stretched for certain components," Thomas Chief Marketing Officer Shawn Fitzgerald said during a presentation on Q2 activity.

Dive Insight:

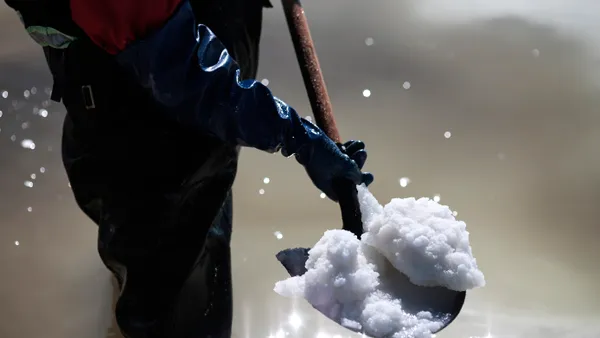

Supply-demand imbalances have been prevalent in many facets of the supply chain since the COVID-19 pandemic gripped the world. This trend also affects shipping supplies, with prices climbing for corrugated boxes and wood pallets amid tight supply, according to the Institute for Supply Management's June manufacturing report.

The Bureau of Labor Statistics' Producer Price Index for corrugated and solid fiber box manufacturing climbed to 375.3 in June, up from 342.0 in June 2020. The index for wood container and pallet manufacturing rose to 208.5 in June, versus 155.1 the year before. Both are record highs.

Companies are still clamoring for these pricier materials as they try to keep pace with heightened consumer spending, particularly for e-commerce orders that call for cardboard packaging. International Paper CFO Tim Nicholls said on the company's Q1 earnings call that containerboard inventories are low across all regions.

"E-commerce, again grew at a strong double-digit pace in the first quarter, and we believe the majority of the accelerated consumer adoption in this channel is permanent," Nicholls said.

Corrugated packaging manufacturer WestRock raised prices across all paper grades and saw North American box shipments increase 5.5% YoY, Ward Dickson, executive vice president and CFO, said on the company's Q2 earnings call.

Pallet costs, meanwhile, were up 400% in May due in part to strong demand and lumber costs, the United Fresh Produce Association said in an emailed notice.

Thomas didn't provide data on growth in wood pallet sourcing specifically, but CEO Tony Uphoff said wood pallets ranked No. 4 and No. 10 for items sourced from California and Pennsylvania, respectively.

In his own New Jersey neighborhood, Fitzgerald saw a truck patrolling the streets picking up any wood pallet the driver could find.

"They're out collecting those up because they can’t find them anywhere else right now," Fitzgerald said. "There are definitely challenges in finding every manner of components."