Scope 3 emissions have come into the spotlight as shippers set sustainability goals. The extended supply chain is often the largest contributor to emissions yet the toughest scope to tackle, as it requires third-party involvement and supplier engagement.

The most recent supply chain report from CDP noted that just "37% of suppliers are taking action and engaging with their own suppliers, down from 39% in 2019."

But CDP also estimated that more than 1,000 companies are now working to reduce scope 3 emissions, and 94% of companies with science-based targets include details on how they'll accomplish it.

The growing level of shipper interest, along with pressure from the public and regulators, is driving carriers to invest in greener delivery options.

FedEx, for example, recently said it plans to achieve carbon-neutral operations, globally, by 2040. In testimony on Capitol Hill weeks after this announcement, FedEx CEO Fred Smith said the decision was based on the increasing economic viability of sustainable solutions and concern about carbon pollution.

"Our customers are increasingly focused on this issue. They want to do business with transportation providers that are environmentally responsible," Smith said. "But we also — as a commercial enterprise — have to produce for our shareowners."

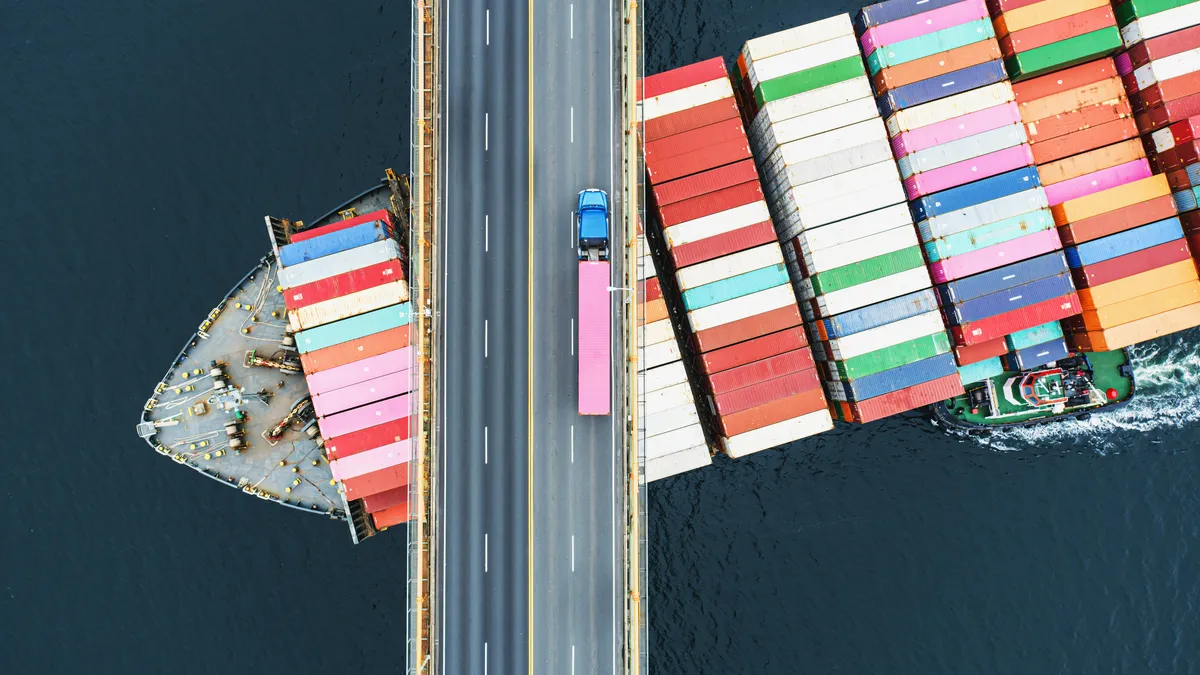

Carriers across the supply chain — from ocean, to air, to rail, to road — are investing in green technologies and tools to reduce emissions and boost sustainability.

Ocean: LNG-powered container ships

Last year, a set of regulations took effect in the global ocean shipping industry. The International Maritime Organization's sulfur regulations, referred to as IMO 2020, limited the sulfur emissions from ships to 0.5% mass by mass, down from 3.5%.

Since then, carriers have found ways to comply, including the addition of scrubbers and the adoption of new fuel types. One of the fuels gaining traction is liquefied natural gas.

This year, CMA CGM CEO Rodolphe Saadé announced the carrier was dedicating six LNG-powered ships to a trade lane that calls on the U.S.

"Maybe LNG is not the technology of the future," Saadé said. "Maybe there will be technologies that are far better than an LNG — maybe. But today, what is important is not so much to criticize LNG, but to take action. And that is why we feel that LNG is the way to go. It is the best technology available for today."

The stats that CMA CGM shares on the fuel and ships are indeed encouraging: 99% less in sulfur dioxide, a 91% drop in in particulate matter emissions, 92% less nitrogen oxide emissions and 20% less CO2 than traditional fuels, according to the carrier.

But as Saadé alluded to in his plea to not criticize LNG, the fuel has plenty of critics.

A report released last year by The International Council on Clean Transportation provided a particularly bleak outlook for the use of LNG. The ICCT report found that LNG can indeed result in a 15% reduction in greenhouse gases over its lifecycle. But this assumes a high-pressure injection dual fuel is used and the upstream-methane emissions are well controlled.

"However, the [well controlled upstream-methane emissions] might prove difficult as more LNG production shifts to shale gas, and given recent evidence that upstream methane leakage could be higher than previously expected," the report reads. "Additionally, only 90 of the more than 750 LNG-fueled ships in service or on order use [high-pressure injection dual fuel] engines."

A spokesperson for CMA CGM said the goal is to move beyond fossil fuel.

"While the shipping industry’s ultimate goal is to deploy non-fossil fuel options, the requisite renewable energy technology is not yet available and may not be for some time," the spokesperson said. "Rather than wait for the perfect solution, we are taking steps today to improve our emissions rates by offering alternative solutions, including LNG."

One of these non-fossil fuel powered ship ideas might seem like a step backward in terms of maritime technology: windpower. The Swedish shipbuilding company Wallenius Marine has developed the concept ship Oceanbird, a wind-powered automobile carrier that can carry 7,000 vehicles. The ship could be in service as early as 2024, one of the company's executives told Reuters last year.

Air: Sustainable aviation fuel

Logistics companies and airlines have been making a number of announcements around sustainable aviation fuel in recent months. Kuehne+Nagel and American Airlines in March announced plans to invest in 11 million liters of sustainable aviation fuel.

"Over the past two to three years, the demand has really started to rise" for sustainable aviation fuel, said Maxime Molenaar, a program manager at SkyNRG.

Sustainable aviation fuel can be made using a variety of different sources including plants, used cooking oil and solid waste. It is very similar to traditional fuel, and the two can be mixed without any changes to engines, according to the International Air Transport Association.

Molenaar said airlines are starting to feel the pressure from customers to provide a lower-emission option, and companies want to reduce their scope 3 emissions from business travel and airfreight.

The fuels "are considered to be a critical lever for decarbonizing aviation," according to draft guidance for the airline industry released by the Science Based Targets Initiative at the end of last year.

Right now, SAF is still "a very small percentage" of the jet fuel in use, but producers are working to build supply to meet demand, Molenaar said.

"There is a lot of production capacity that is being planned right now," she said.

In an attempt to show demand to help build up supply, SkyNRG has started the Board Now program, which tracks sustainable fuel volumes and enters them into the nearest airport's system.

"You don't have to produce fuels on one side and then ship them around the world to be able to put it into the literal plane of the cargo owner, because from an emissions management perspective that would be really inefficient," Molenaar said.

The program allows corporations to claim the reduction of the SAF even though their cargo won't be flying with SAF onboard.

SAF will mean a reduction in emissions, not the elimination of them. While some are working toward electric air travel, it is likely decades away, according to Molenaar.

A report released last year on SAF by the Department of Energy reached a similar conclusion.

"Unlike light-duty vehicles, the low energy density of even the best batteries severely limits opportunities for electrification," the DOE noted. "While many are working on electrification, efforts are for smaller aircraft and airlines will have no alternative for some time but to use SAF to operate in a GHG-emission-constrained future."

Rail: Battery-powered trains

The rail industry frequently touts the sustainability of its freight mode (even if the industry has a track record of funding climate change denialism).

"If 25% of the truck traffic moving at least 750 miles went by rail instead, annual greenhouse gas emissions would fall by approximately 13.1 million tons," The Association of American Railroads said on a fact sheet last year.

BMW told Supply Chain Dive that reducing emissions was one of the goals for switching from truck to rail for moving cargo from the Port of Charleston to its plant in Greer, South Carolina. Intermodal companies have also started taking a similar approach. Schneider made an increase in intermodal use a core part of its sustainability plan, noting it has about one-third of the carbon footprint of trucking alone.

BNSF and Wabtec are piloting a battery-powered train that could improve the industry's carbon footprint even more.

The investments also make financial sense for the railroads, Tim Bader, the senior business communications leader at Wabtec, said in an interview.

"If you're saving fuel, you're also saving money and you're reducing carbon at the same time," Bader said.

Wabtec's electric locomotive doesn't have any engine, but the entire back end is a giant battery that provides power. It has already hauled freight with BNSF in a three-month pilot that ended in March on a route between Stockton, California, and Barstow, California. Trains are propelled using multiple locomotives, and the pilot used one battery-powered locomotive and two powered by a traditional engine.

Bader said Wabtec plans to start selling its technology to railroads "in the near future," but didn't provide an exact timeline for when that might happen. And railroads can run their locomotives for "well over two decades," he said. So transitioning the entire fleet likely won't happen in the near future.

Road: Route optimization

Route-optimization software is not yet ubiquitous in the trucking industry, said Neil Menzies, a managing director at L.E.K. Consulting. But for fleets that have invested in the technology, cost savings is the biggest motivation. Less carbon is an added bonus.

"It just follows on naturally that, if you decrease the amount of miles, you decrease the amount of fuel burned and, therefore, the carbon. The incentives are perfectly aligned with respect to saving costs and being greener," Menzies said.

Routing technology optimizes long-haul and short-haul operations. It can help over-the-road drivers reduce deadheading, and it can help reduce last-mile inefficiencies, especially when paired with software that enables communication with a consumer, Menzies said. Efficient routing can also help navigate delivery windows and cut down on idling.

And there's no shortage of routing technology vendors on the market. From SkyBitz, to KeepTrucking, to Samsara, to Omnitrax — numerous options at various price points offer different suites of functionalities.

"In general, these solutions as a category are pretty high [return on investment]. But it depends on the individual set of circumstances around your particular business," Menzies said.

Truck: Alternative fuels

The trucking industry knows the supply chain is moving toward a more sustainable future, which means, eventually, the diesel truck will go out of style — or become a violation of state regulation.

Battery-electric vehicles, fuel-cell-electric vehicles and vehicles that run on renewable fuels are perhaps the most talked about alternatives.

Large truck-makers are developing BEVs and FCEVs, betting on their eventual ubiquity at the hands of governmental and societal pressures. Each type of technology, though, has its obstacles.

For BEVs, the challenge is batteries. So far, the BEVs participating in pilots are completing short, regional hauls. Smaller batteries take less time and energy to charge, and they’re lighter.

Tesla boss Elon Musk has been saying for at least a year that the OEM's inability to scale battery production is the only thing holding back the development of the Tesla Semi. That vehicle is projected to have a 300-mile range.

Hydrogen is viewed as the solution for longer hauls, though Musk recently said the use of hydrogen to power vehicles is "just crazy, basically" and "not realistic" to keep in liquid form.

Multiple OEMs are betting on hydrogen, though. Cummins and Navistar announced last November they would produce a Class 8 hydrogen truck that Werner would test for regional hauls in California.

While batteries are the sticking point for BEVs, electric passenger cars have led the way in developing charging infrastructure. Infrastructure is the biggest obstacle for FCEVs. Setting up a national system of hydrogen fueling stations is a large undertaking that will likely require an extended timeline.

But, truckers have options already on the market. Energy company Neste said late last December that more than 1,000 customers in North America were using its My Renewable Diesel offering. Neste calls renewable diesel a "drop-in" replacement, as it is compatible with all diesel engines. The company said the fuel cuts greenhouse gas emissions by up to 80%, compared to petroleum diesel.

UPS began converting trucks to renewable natural gas in 2013. Last September, Wegmans announced it had added a 19th compressed natura gas truck to its fleet. Clean Energy Fuels announced this week it had agreed to provide RNG to Amazon at dozens of stations in 15 states. The deal also involves Amazon taking ownership of nearly 20% of the fuel company's common stock ― a move that underscores the retailer's interest in the space.