Editor's note: This article is part of a series that looks into the ways supply chains, warehouses and manufacturing facilities are investing in technology. Here's the previous story.

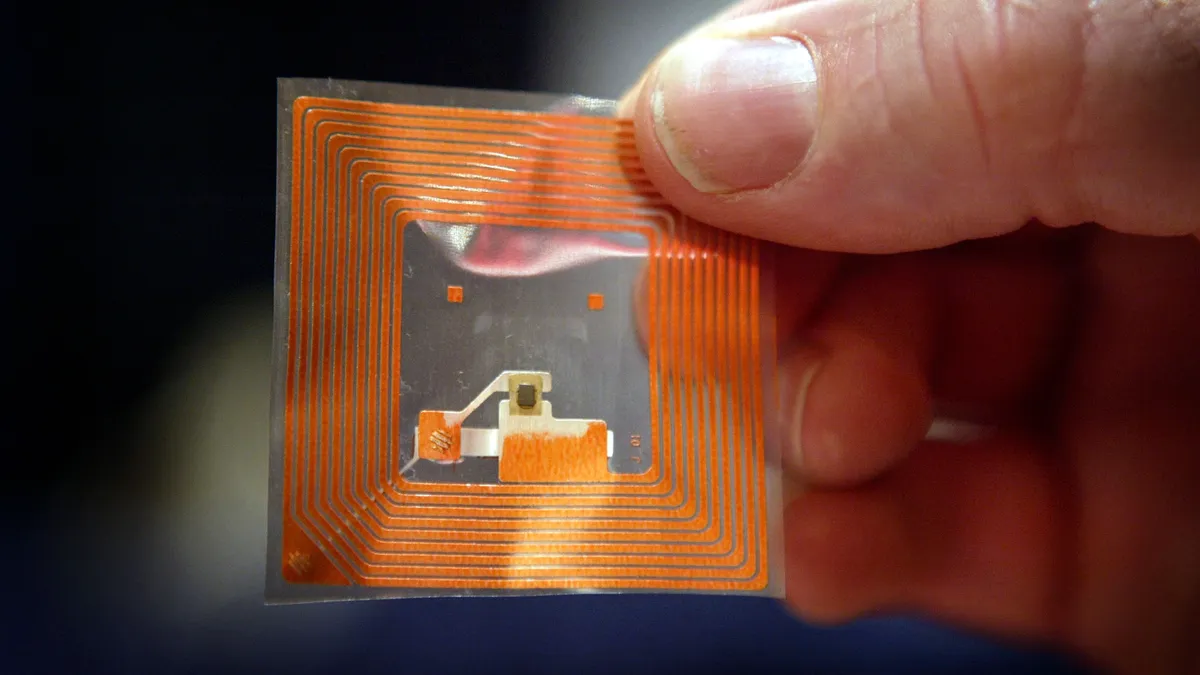

Sensors and automatic identification have already transformed supply chains. RFID tags and scanners, barcodes, QR codes, and handheld or fixed position scanners and imagers generate real-time data that can improve supply chain visibility. They also can enable drones and autonomous mobile robots to bring more automated technologies into warehouses.

The technology has "come a long way," said Chris Riemann, managing director of supply chain and network operations at Deloitte.

Enterprises continue to invest these technologies as they push closer toward realizing the concept of the automated warehouse, especially in the face of an unprecedented labor shortage.

In "Innovation Driven Resilience," the 2021 MHI Annual Industry Report, MHI and Deloitte surveyed more than 1,000 supply chain professionals worldwide about innovation investments in the supply chain. They found that 52% of companies are increasing or substantially increasing their investment in sensors and automatic identification. Of the respondents, 42% said they use sensors and automatic identification today, and 27% plan to adopt the tech in one to two years.

That pervasiveness has been pushed along by two factors, said Riemann: The technology is better and cheaper.

Cheaper, advanced tags give a full inventory view

When Riemann first saw RFID tags 20 years ago, "there was a huge amount of hype but the technology and the physics weren't there, and certainly the price point wasn't there."

He posited then that tags would need to cost about 5 cents each for the technology to become ubiquitous. He wasn't far off — some tags at the low end of the market are 10 cents each, according to Airfinder.

More advanced and cheaper tags have enabled all sorts of capabilities in warehouses and retail settings. The tags let retailers know exactly what inventory is in which stores, and where. That has given them more selling options.

"If a customer goes online and [inventory] says I have this product, just kidding, we really don't, that's a big issue."

Chris Riemann

Managing Director of Supply Chain and Network Operations at Deloitte

If a retailer, for example, knows what is in a specific store, it can allow a customer to order that item, select buy online, pick up in store and have the item there when the customer arrives.

"If a customer goes online and [inventory] says I have this product, just kidding, we really don't, that's a big issue," said Riemann, especially if the customer finds this out when they've already traveled to the retail location. A mistake like that could lose that store a customer for life.

Sensors and automatic identification have also helped enterprises track shrink by letting them know "exactly where that product is in any point in time. It's important if that product does end up on the black or gray market," he said.

If items turn up at flea markets or on eBay, a retailer could interrogate the RFID tag and identify where it went missing, Riemann said, and find problem spots in its supply chain, whether that's a supplier siphoning off some inventory to sell, or employees buying items at the store on discount, then selling them online.

Data processing gets a speed boost

Kyle Bermel, chief operating officer of Metalcraft, said cameras have also gotten better and faster at processing for collection of data.

RFID tags themselves are more sensitive and "integrated circuits that power the RFID tag have become better performing, which allows you to create smaller layers," he said. This had pushed costs down, he added, until recent supply chain issues nudged them back up.

Bermel anticipates the wider use of dual frequency RFID tags, meaning that warehouses can use ultra-high frequency capabilities on a tag and reader for far field reads, but also that anyone with a smartphone could access the tag via near field communication.

Bermel said there are almost endless possibilities for that kind of technology.

"You can see what the temperature is or what it has been in the past" by tapping the tag with a smartphone, he said. A company could also take such a tagged item to a promotional event and allow potential customers to tap the tag with their own phone to learn more about it.

Visioning robots are next

Adrian Kumar, DHL Supply Chain's vice president of solutions design, said DHL first deployed Locus Robotics AMRs in 2017. In 2020, DHL expanded that partnership.

Already, AMRs have improved in that time, particularly when it comes to enabling better vision. AMRs can "see longer distances, they can pick up more things," he said, adding that "because the sensors have come down in price, they can put more sensors on the robot, and it just becomes that much smarter."

Kumar predicts that the better sensors become, and the more that can be put on AMRs as sensors become cheaper still, the more often robots will be able to work alongside humans instead of each staying in their own spaces.

Sensor innovation could also outgrow the need for robots to rely on things like magnetic strips "to tell them how to get from point A to B," he said.

"Forget about RFID. Forget about putting tags or barcodes on products. Why can't machines be able to ID products?" Riemann said. "I go to a supermarket and I go to the shelf and I see cornflakes and I pick cornflakes. It's intuitive to me. It's not intuitive for machines yet."

This story was first published in our weekly newsletter, Supply Chain Dive: Operations. Sign up here.